New federal data show that the number of small bank loans to business has fallen to the lowest point in more than a decade, cutting the flow of money to a sector that's usually a job-creation powerhouse.

"It's usually the smaller business that is more able to bounce back and take advantage of different opportunities faster than a middle-market company," said Linda O'Connell, manager of small business research at Barlow Research Associates, a Minneapolis market research firm that focuses on the financial industries. "We haven't seen that."

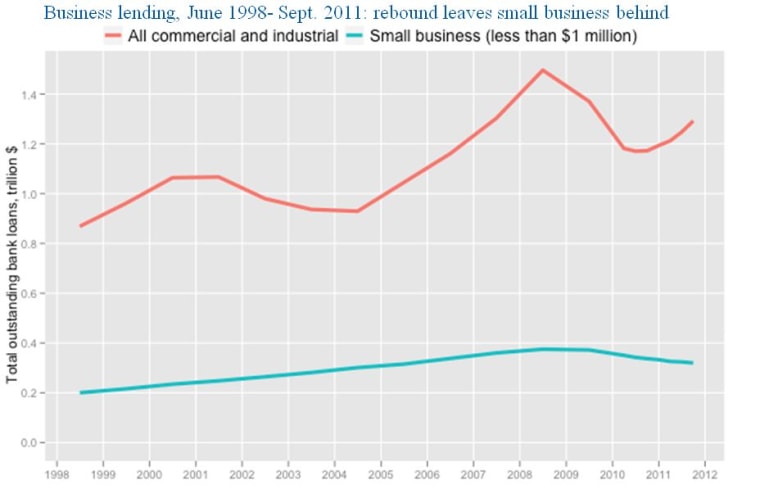

An analysis of recently released Federal Deposit Insurance Corp. data by the Investigative Reporting Workshop shows that overall commercial and industrial lending by banks has increased for five straight quarters, but small loans to business of $1 million or less have been shrinking consistently since June 2008. As of Sept. 30, total outstanding loan volume was down 14.7 percent from its peak.

BankTracker: Search for your bank by name or location

The reduction of bank credit has had an even bigger impact on small business than it would on large business, which can borrow money through corporate bonds and "commercial paper." In contrast, small businesses rely almost exclusively on credit provided from banks.

The current situation stands in stark contrast to the recession at the start of the decade, following the dot-com bust. Even though commercial lending dropped severely, small business lending kept chugging upward. In this recession, the number of individual small business loans has fallen even further. Banks reported having just 1.5 million of those loans outstanding on Sept. 30, the smallest number since 1999, according to the FDIC data. Bank regulators define small business lending as loans of $1 million or less, regardless of the size of the business.

The numbers are especially troubling because businesses with fewer than 500 employees created 65 percent of the jobs between 1993 and 2009, according to the Small Business Administration. But in a November survey conducted by the National Federation of Independent Businesses, a small business advocacy group, only 7 percent said the next three months would be a "good time to expand."

There are many reasons that mom-and-pop businesses have been hit harder than international behemoths, economists say. Local businesses — especially service providers — can't easily tap overseas markets, though small-scale manufacturing firms that can have done slightly better. And construction, which has traditionally driven the local recovery, is expected to linger in the doldrums for years, as it has since the real-estate bubble popped. Finally, the sheer length of the country's economic woes has left small businesses with fewer reserves and hardly ready to jump back up, were conditions to start looking up.

Even successful businesses find it hard to get credit

With annual growth of around 40 percent, David Ehreth's six-person sauerkraut and pickle business in Healdsburg, Calif., had a different problem — he couldn't grow his "Alexander Valley Gourmet" and "Sonoma Brinery" brands fast enough without new machinery. "Everything we were doing, we were doing by hand," he said.

Ehreth's hardly a standard food entrepreneur. He started brining pickles full-time about six years ago, following a lucrative three-decade career in the technology sector. As a tech executive, Ehreth had overseen "hundreds of millions" in sales and peppers his conversation with phrases like "credit facility."

He had reason to be optimistic about borrowing. "I am an individual of relatively high net worth with no debt of any sort. ... When I approached the banks we had about four years' worth of track record of steady growth of about 40 percent year over year."

None of that mattered to the banks, though. "I was just flatly turned down without any discussion," he said. "Just about everyone I know in the food industry has given up on banks."

Instead, Ehreth and his crew kept working by hand, even though that slowed their growth. Finally, he decided to sell a vacation home, even though the price he got for it wasn't great. The investment in his business, he reasoned, was a sound one.

Banks' unwillingness to lend was especially galling to Ehreth because jobs he would create — small-scale, blue-collar manufacturing that's unlikely to go overseas — is the kind of job that's most needed. "For those who are college educated, for those who have engineering degrees, there's plenty of work. But for those who were working in factories, who saw their jobs sent overseas, people like myself create opportunities."

Bank profits reach four-year high

Though small business has suffered, bank results continued to improve in the third quarter of this year. Profits rose to $35.3 billion, the best in more than four years. Most of the improvement came because troubled loans continue to decline. Meanwhile, lending rose for the third straight quarter, though it remains well below pre-recession levels, mostly because of real estate lending remains very sluggish. The number of banks with troubled assets greater than their capital and reserves also declined.

The small-scale, business lending slowdown is all the more remarkable given the federal government's exceptional efforts at reversing it. The 2009 stimulus bill and 2010 Small Business Jobs Act cut fees and included "credit enhancements" that pumped up the Small Business Administration's loan guarantee rate.

The last three months of 2010 was the biggest quarter in the agency's history in terms of total new loan guarantee volume, said spokesman Mike Stamler. Many of those loans are for amounts greater than $1 million, and don't show up in FDIC's statistics. Yet bank lending during the SBA's biggest quarter ever still declined.

The jobs bill set aside $30 billion to buy preferred stock in midsize banks, with those that actually increased small business lending eligible to lower the dividend rate paid back to the government. But just $4 billion of that money was actually lent out.

"The lending program through the federal government certainly didn't do a whole lot. We've heard from many banks that we've talked to that they have enough money to lend, it's just that there aren't enough borrowers out there," said Holly Wade, a senior policy analyst for the NFIB, the small business group.

Bankers say lending standards aren't the issue, and point to research that backs them up. In 2011, 17 percent of businesses with sales between $100,000 and $10 million applied for additional credit, but of those, only 22 percent were denied, according to Barlow Research surveys.

Overall, the number of businesses that haven't sought credit because they don't think they'll get it has been rising. In 2010, 15 percent of the small businesses that didn't apply for credit did so because they thought they wouldn't succeed, according to NFIB surveys. And 24 percent of small businesses that did seek additional credit reduced the amount they sought for fear of being turned down.

"The longer it goes on, the worse the financial condition for those that are just hanging on becomes, so they become less credit-worthy," said Robert Seiwert, director of the American Bankers Association's Center for Commercial Lending and Business Banking.

"Are credit standards tighter today than they were two years ago? Absolutely. But they should be because we're operating in a different economic climate," said the ABA's Seiwert. "The business that was viable in the past may not be viable in the future."

That’s hardly consolation to upstart entrepreneurs trying to launch. Michael Marquess, chief beer officer of Mother Road Brewing Co., in Flagstaff, Ariz., spent six months trying to get financing to open his brewery and taproom. “Borrowing has changed dramatically in the past five years from easy lending to extreme process,” he wrote in an e-mail.

“We had the plans in with the city. The contractor was on board. Everything was just waiting on that funding,” he said. But his SBA loan application for less than $300,000 fell apart, he said, because plans for a small craft brewery didn’t match up to numbers loan examiners expected for an established beer manufacturer.

Marquess’ story turned out well, though, thanks to the persistent bankers at the National Bank of Arizona, who he said helped him cobble together another application that was finally approved in June. Mother Road Brewing Co. opened last month and now has four employees. “We sold our first pallet of beer two weeks ago,” he said.

Some of the information in this story came from interviews with members of American Public Media's Public Insight Network, which the Investigative Reporting Workshop joined earlier this year.