Secretary of Labor Tom Perez on Tuesday said he would initiate a "top-to-bottom" review of labor practices at disgraced bank Wells Fargo — coming as CEO John Stumpf agreed to forfeit $41 million over a brewing sales scandal.

Perez was responding to a letter from eight Democratic senators who had requested a probe into whether Wells Fargo — one of the nation's largest banks — had violated wage and working hour laws by failing to pay overtime to tellers and sales representatives who stayed late to meet sales quotas.

"We take the concerns raised in your letter very seriously," Perez told the lawmakers, whose action was spearheaded by Sen. Elizabeth Warren, D-Mass.

"Given the serious nature of the allegations, I have directed enforcement agencies within the department to conduct a top-to-bottom review of cases, complaints or violations concerning Wells Fargo over the last several years," Perez also wrote.

In their letter to the department on Friday, the senators detailed how Wells Fargo had "a management culture characterized by 'mental abuse,' being forced to work overtime 'for what felt like after-school detention' during the week and on weekends, and being 'severely chastised and embarrassed in front of 60-plus managers.'"

Wells Fargo said the bank aimed to make all employees "feel valued, rewarded and recognized" through "market competitive compensation, career-development opportunities, a broad array of benefits, and a strong offering of work-life programs."

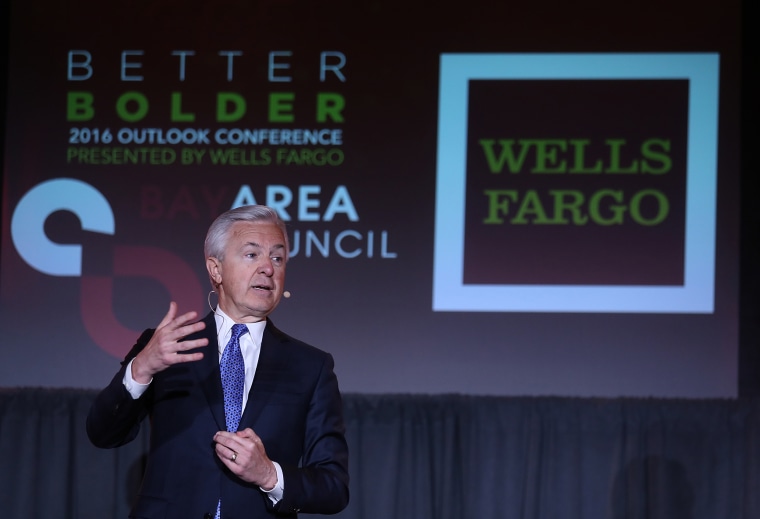

The probe of the embattled bank is underway as Stumpf has agreed to give up about $41 million in stock awards and his salary following a $185 million settlement with the Consumer Financial Protection Bureau, reported CNBC.

Wells Fargo employees were accused of opening fee-generating accounts without customers' authorization in order to meet the high sales goals. But the bank said it fired about 5,300 employees from January 2011 to March 2016 for engaging in the deceptive practice.

Also on Tuesday, Wells Fargo said it cut ties with its community banking division head, Carrie Tolstedt. She will not be given a severance package, according to CNBC.