Self-described “pharma bro” Martin Shkreli made headlines for raising the price of a drug for AIDS patients over 5,000 percent, but that's not why he's in court this week.

Instead he faces eight counts of wire and securities fraud related to his time as portfolio manager of two hedge funds, MSMB and MSMB Healthcare, and as founder and CEO of a pharmaceutical company Retrophin.

In day four of the Shkreli trial, prosecutors called the daughter of a well-known pharmaceuticals executive Sarah Hassan to the stand to talk about her $300,000 investment in MSMB.

She said she received emailed statements showing a solid profit for her money and that she felt "betrayed" when she was informed that there was no money left in the fund after Shkreli's decision to close it. After months of Shkreli dragging his feet, Hassan said she received $400,000 in cash and 58,000 shares of Retrophin stock that she later sold for $900,000.

During cross-examination, Shkreli's lawyer Benjamin Brafman pointed out the fine print in Hassan's investment agreement. "This is what you reviewed with your lawyer and signed," Brafman said.

"This is also conflicting with what I was told," Hassan responded.

Brafman acknowledged during opening arguments in Brooklyn federal court Wednesday that jurors may find Shkreli strange, but added that "Martin Shkreli is brilliant beyond words."

RELATED: Martin Shkreli Built Hedge Fund Empire on ‘Lies,’ Prosecutor Says at Trial Start

"Maybe he's just nuts, but that doesn't legally make him guilty," Brafman said.

Prosecutor G. Karthik Srinivasan said that while Shkreli may have convinced his investors that he was a "Wall Street genius," he was in reality "just a con man."

“Like a Ponzi scheme"

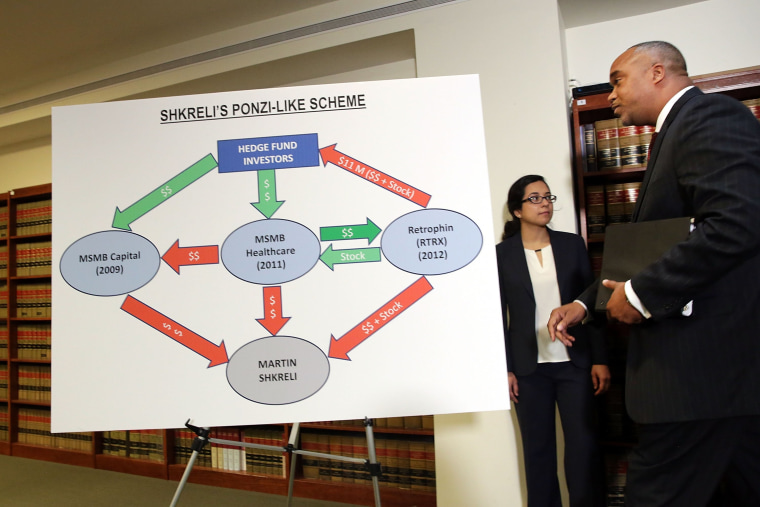

Shkreli is accused by the SEC of treating two hedge funds and a pharmaceutical company he helmed as his "personal piggy bank," said U.S. Attorney Robert Capers in 2015, running them “like a Ponzi scheme.”

In a classic Ponzi scheme, named after 1920's con artist Charles Ponzi, a fraudulent investment operator promises investors returns but instead uses funds from later investors to pay returns to earlier investors, misleading them into thinking that the fund has made solid returns.

Columbia Law Professor John Coffee said that Shkreli’s case is a "variant on the classic Ponzi scheme." Instead of using money from a single fund to pay investors back, said Coffee, he's accused of using money from his pharma company to pay back his hedge fund investors.

In the complaint filed by the Securities and Exchange Commission, Shkreli is accused of "widespread fraudulent conduct," "material misrepresentations and omissions to investors and prospective investors," and misappropriating over $1 million in funds from MSMB, MSMB Healthcare and Retrophin, among other charges.

RELATED: FBI Arrests Pharma CEO Martin Shkreli on Securities Fraud Charges

Between 2009 and 2011, he allegedly spent approximately $120,000 of investor funds from MSMB on food deliveries, medical expenses and other items that were not chargeable under the terms of MSMB’s limited partnership agreement.

Shkreli is also accused by the SEC of attempting to short 32 million shares without having the ability to do so.

When shorting a stock, or betting against it, an investor has to borrow shares in order to sell them and buy them back later.

Shkreli allegedly told a broker that he had access to 32 million shares, but did not have nearly enough. The broker had to buy shares on the open market to close the gap “at a loss of over $7 million,” according to the suit.

The broker took Shkreli and MSMB to arbitration in an attempt to recover some of the $7 million, and settled for just over $1.5 million, according to the suit. Between January and March of 2013, Shkreli allegedly took $900,000 from MSMB Healthcare to help cover the cost.

The complaint states that "Shkreli had no right to use MSMB Healthcare's investor funds to pay the settlement."

In September 2012, Shkreli told investors he was liquidating the funds, and used Retrophin funds to pay back investors, many of whom were disgruntled because Shkreli could not pay them back with cash from MSMB and MSMB Healthcare. The suit says "Shkreli did not disclose to Retrophin's Board that the true purpose of these consulting agreements was to settle potential claims against Shkreli."

Just "an overly optimistic person?"

While the prosecution may have a straightforward path to proving that Shkreli’s claims to his investors and others were not factual, they will also have to prove that it was his intent to defraud.

Coffee said that the defense may try to show that Shkreli "is an overly optimistic person who truly believed his own statements."

Shkreli has continued to grab attention with various antics since his arrest, flaunting large purchases on social media, offering $40,000 to a Princeton student who solved a mathematical proof and getting his Twitter account suspended after harassing a female journalist.

“This is a defendant who is beyond the control of his own attorney,” Coffee said. “We’re all going to sit back and see if this turns into a circus.”

Not on trial for drug prices -- but might as well be

Though Shkreli's fraud trial is unrelated to his history of raising drug prices, it's not far from the minds of prospective jurors, who repeatedly mentioned it during jury selection, slowing down the process.

One prospective juror said “I have total disdain for the man” while another prospective juror indicated that he wanted to punch Shkreli.

"I'm sorry, judge," the man who wanted to punch Shkreli said. "Is he stupid or crazy? I don't understand."

By the end of Monday and Tuesday, more than 300 prospective jurors were questioned before the judge was able to seat 12 jurors with six alternates.''

An NBC News request for comment from Martin Shrkeli was declined by a spokesperson for his lawyer Brafman.

Regulators filed the securities charges three months after the story of how he raised Daraprim's price up from $13.50 a pill stoked national outrage.

Congressional hearings followed 6 months after the story broke, in February of 2016. Today the price of the drug remains at $750 per pill.