American consumers would feel a pinch in their pocketbooks if Trump goes ahead with a 20 percent tariff on goods imported to the U.S. from Mexico.

“Mexico has taken advantage of the U.S. for long enough. Massive trade deficits & little help on the very weak border must change, NOW!,” Donald Trump Tweeted Friday morning.

But economists say a 20 percent tariff on goods coming into the country would translate to higher prices on everything from avocados to automobiles, and that hit could come quickly.

“All of these industries now keep pretty low levels of inventories. They produce to meet demand,” said Robert Scott, senior economist and director of trade and manufacturing policy research at the left-leaning Economic Policy Institute. “You would see this work through the pipeline very quickly — a matter of weeks or months at most.”

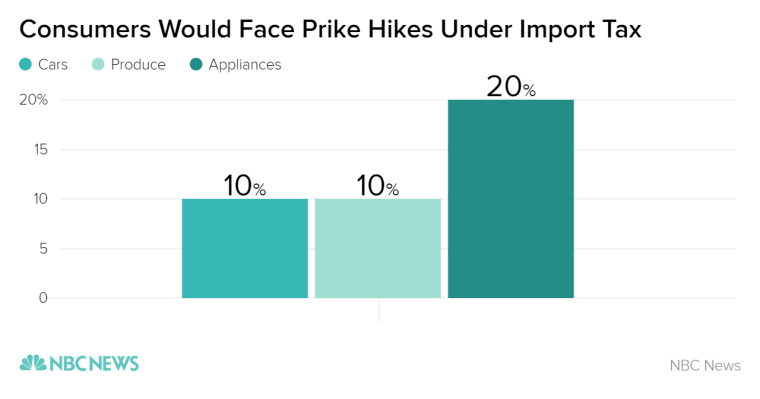

Vehicles: Expect to Pay 10 Percent More for Your Car

Trump has made cars his focus in the ongoing battle over Mexican imports, much to automakers’ chagrin. Far-flung and deeply entrenched, thanks to more than two decades of investment under NAFTA, supply chains mean that everything from steel to steering wheels could cross the border two or three times before a vehicle ever reaches a dealer’s lot.

“It is going to have a significant effect on auto producers,” Scott said. Even if the value of the peso continues to sink, and even if automakers are willing to absorb some of the higher costs, car buyers could be looking at sticker prices of up to 10 percent higher. “It not only affects the price of the finished vehicle but the parts that come from Mexico,” he said. “That’s when the law of unintended consequences could really kick in.”

Produce: A 10 Percent Hike on Your Avocados and Tomatoes

In 2015, the U.S. imported $9.1 billion of fresh fruit and vegetables from Mexico, and prices shoppers pay at the grocery store could rise by 10 percent or more, predicted Monica DeBolle, senior fellow at the Peterson Institute for International Economics.

The perishable nature of this import category makes it tougher to find replacement sources for it, and the ongoing drought in California has hurt harvests, so retailers have fewer options for alternative sources. A strike last fall that hit Mexican avocado producers caused shortages that triggered skyrocketing prices, with reports of a single avocado retailing for $3 or more in stores.

And that’s not even taking into account the produce we just don’t have the climate to grow domestically. “Consider the impact on American consumers of a 20 percent hike in the cost of foods such as bananas, mangoes and other products that we simply can not grow in the United States,” Tom Stenzel, president and CEO of the United Fresh Produce Association, said in a statement. “We urge President Trump to consider the unique nature of food and not place a new ‘food tax’ on American consumers.”

Appliances/Electronics: Your Fridge Could Cost At Least 20 Percent More

While people tend to think of China when they think of imported electronic devices, the reality is that we import a significant amount of machinery and gadgets from Mexico, as well.

Prices for items like cooktops and refrigerators could actually increase by a greater percentage than the tariff itself, DeBolle said. “It could be close to the 20 percent tariff. It could possibly be higher than that,” she said.

As with cars, the interconnected nature of supply chains means that there are innumerable raw materials and parts that can go back and forth across the border multiple times. “All the additional cross-border costs the company would bear and, likely, would pass along to the consumer,” she said. “It could be even higher than 20 percent, and 20 percent is already a lot.”

Medical: Higher Insurance Rates

In 2015, the U.S. imported $12 billion of optical and medical equipment from Mexico. The pain of a tariff would be spread more broadly in the case of this category, Scott said. Because consumers aren’t buying these products themselves, there’s less of an incentive for producers to hold the line on prices. Those higher prices, although initially paid by the healthcare industry in the U.S., eventually get passed along to us in the form of pricier health insurance.

Alcohol: The News Isn't Good

Brace yourself: Tequila would get pricier, as would Mexican beer.

“Products that have a pretty low elasticity with reference to prices — in other words, where consumers will buy anyway — will probably bear the full brunt of a 20 percent increase,” DeBolle said. And booze certainly falls into that category. “Alcoholic beverages tend to be very price inelastic,” she said. “These would likely go up by the same amount as the tariff.”