Is insulin is the new EpiPen?

In the last eight years, the average price per milliliter of insulin has skyrocketed by over 200 percent. But there's one major difference. If you can't get an EpiPen, there's a chance you might die. If your body doesn't have insulin, you certainly will die.

"It feels like they're holding my kid ransom," said Tiffany Cara, whose son has diabetes.

Only three major companies make insulin in the U.S. and each has steadily ratcheted up prices, sometimes in lockstep. Since 2004, the manufacturer list price for insulin, known as wholesale acquisition cost, is up by triple digits. Novo Nordisk's insulin Novolog is up 381 percent, Eli Lilly's Humalog is up 380 percent and Sanofi's Lantus is up 400 percent, according to data from Truven Health Analytics.

That's sending some diabetic families into sticker shock.

Six-year-old Dorian Carra loves to play outside his Texas home and dress up as a super hero. Specifically, Captain America, the World War II version. His mom says her outgoing boy has "never met a stranger."

But four years ago he couldn't stay awake. He was breathing oddly. His parents brought his rag doll body to the E.R. Doctors said his blood sugar levels had spiked to 965 milligrams of glucose per deciliter of blood. A normal range is 80 to 140.

The diagnosis was type-1 diabetes. The prescription was insulin, every day, for the rest of his life.

Recently those treatment costs doubled after the Carra's health insurance company switched to cover another brand. Even though the brands are clinically the same, the new medicine isn't available in the dosages he needs, so they have to stick with the more expensive kind.

Tiffany Carra, a thirty-two-year-old IT field support analyst, says it now costs them $1,880 a year for insulin and supplies.

6 million Americans rely on insulin

Mostly Dorian keeps a brave face. He's able to set up his insulin supplies by himself. Sometimes his parents help him with the last step. Sometimes he cries. Sometimes he says he hates diabetes.

But without insulin Dorian's cells can't absorb the sugar they need to make energy and he can go into a life-threatening diabetic coma.

There an estimated 30 million Americans with diabetes. Most are what's known as type-2. Their body doesn't use insulin the right way and may end up with a prescription for it if lifestyle and diet changes aren't enough. But 10 percent of diabetics are type-1, like Dorian. Their immune system actually destroys the cells that release insulin, requiring a lifetime of daily treatment.

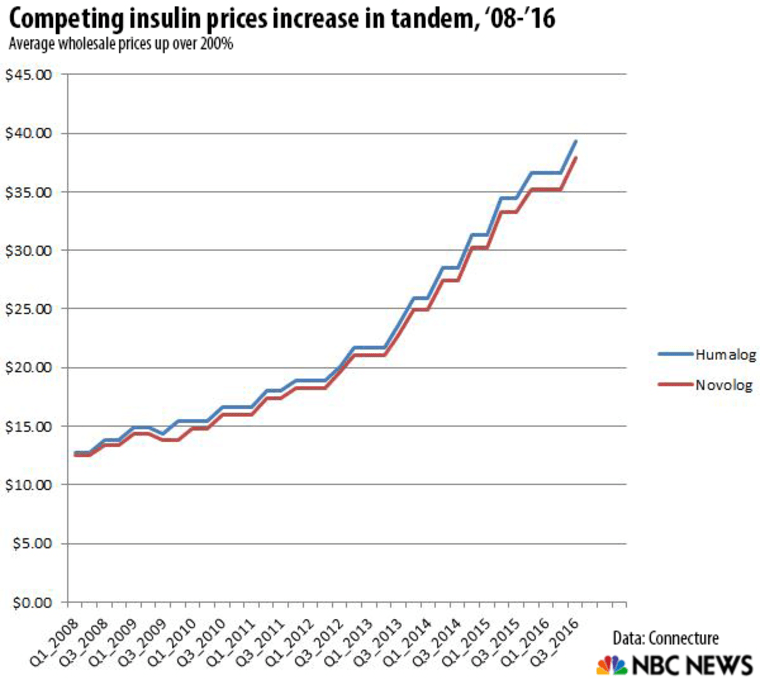

When Eli Lilly raised the average wholesale price of the Humalog Dorian was taking by 10 percent in the 4th quarter of 2013, so did Novo Nordisk with its competing insulin Novolog.

And when Novolog's prices went up by 8 percent in the third quarter of 2016, so did Humalog's.

Between the 3rd quarters of 2008 and 2016, the drugs saw 16 separate price moves. Of them, 10 were by the same amount and at the same time. The others differed by a few percentage points, or were delayed by a quarter.

Generic is no panacea

Another major factor: there is currently no generic for insulin.

And while Wal-Mart sells three different kinds of insulin for $25 a vial, these are older kinds that require the patient to follow strict snack and meal schedules. That's not as viable for families with diabetic children who prefer the flexibility of the newer – and more expensive -- generations of insulin.

Another factor tamping down competition is that it's hard and hugely costly to make a "generic" (technically a "biosimilar") version of insulin. The drug is not just synthesized chemicals, it's actually made by cells. Insulin used to be drawn from the pancreases of slaughtered animals. Nowadays it's coaxed from tweaked yeast or bacteria.

This December will be the first time that biosimilar insulin is set to hit the shelves, and others are in the works. The increased competition will offer much-needed, but modest, price relief.

A typical generic offers 85 percent savings off the name brand. But biosimilar insulins are only projected to save 11-15 percent, according to an analysis by the nonprofit RAND research corporation.

It can take $100 to $250 million for a drug company to develop and market a biosimilar drug, versus the $1 million to $4 million needed for a traditional generic.

The blame game

There's plenty of blame for rising pharmaceutical prices to go around with a complex health care machine responsible for getting a drug from the manufacturer to the patient.

In an argument that echoes the one used by Mylan to explain its over 400 percent price hikes on the EpiPen, drugmakers say pricing is multifaceted and driven up by middlemen. Novo Nordisk says it negotiates to increase access for its drugs and that most patients have co-pays that average between $1 to $1.40 per day.

"Price increases are necessary to support our mission to research and develop new medicines," the company said in a statement to NBC News.

Eli Lilly, makers of Humalog, said in a statement that "today's health care system works well for most people, but those enrolled in high-deductible insurance plans and managing chronic conditions face challenges in gaining reasonable access to treatments they need."

In a statement, Sanofi said it hasn't raised prices for Lantus since 2014 "because of efforts to remain included on formularies at a favorable tier which helps to reduce out of pocket costs to patients."

All drugmakers say they're working to make insulin more affordable, offering co-pay assistance programs for those with insurance, as well as patient assistance programs for those without insurance.

They also point the finger at pharmacy benefit managers (PBMs) for negotiating larger rebates for insurers, which they say forces them to raise prices.

Brian Henry, a spokesman for Express Scripts, one of the two largest PBMs in the country, said drug companies are responsible for setting the prices, and creating and managing the rebate program. He says they typically pass along 90 to 100 percent of the rebate to insurers.

Meanwhile, insurance carriers just say drug prices are out of control.

"Millions depend on insulin every day," said David Merritt, a spokesman for America’s Health Insurance Plans, an industry trade group. “Every cost increase by a drug company makes it that much harder for patients to access the treatments they need. We need to solve this pricing crisis now."

Price hike relief is on the way -- for payers.

Shares of insulin maker Novo Nordisk and drug wholesaler McKesson fell by double digits last week on news that aggressive rebate negotiations with PBMs are helping cut or flatten the prices insurers pay for insulin.

But don't expect to see that get passed down to a lower premium or cheaper insulin, especially for those without insurance or facing a high deductible.

"Most people with insurance are paying a co-pay, and even when a price changes, we don't see much movement on the co-pay side," said Novo Nordisk spokesman Ken Inchausti. "A patient exposed to list price is still going to be exposed to list price."

Another shot at savings

Ultimately, you should tell your doctor if you're having trouble paying for what you’re prescribed. There may be a more affordable alternative, so check with your insurance company to see if you qualify for patient assistance programs, and comparison shop on sites like GoodRX. Big box stores like Costco and Wal-Mart may also offer additional savings.

Even if you tell your doctor they may not know all the tricks. The Carras worked with drug comparison site Rx Savings Solutions and found two manufacturer coupons that cut their insulin costs by $600. Using them required that they start going to a different drugstore.

A small price to pay but one that reflects the complex network of hidden agreements that govern who gets the best access to insulin and at what cost.

"The only way for consumers to save money is to advocate for themselves," said Michael Rea, founder and CEO of Rx Savings Solutions. "You can manage cholesterol six different ways, and the difference can be $4 to $400. Consumers don't know that — and neither do their doctors."