Sometimes, you just need a few dollars between paychecks. About the only options for someone with bad credit is to borrow from a friend or family member or take out a high-interest payday loan. A new app-based service called Activehours offers another way. It gives you access to your pay as you earn it.

Users can get an advance on their next paycheck for hours they’ve already worked — up to $100 a day. And here’s the novel twist: there’s no interest and no fee required — unless you feel like paying for the service. Activehours is supported by what it calls “voluntary tips” from users.

“You decide what you want to pay, what you think is fair, and you could decide you don’t want to pay anything,” said Activehours founder Ram Palaniappan. “We have some people who tip consistently and we have some people who tip us every third, fourth or fifth transaction. So, we’re seeing some very interesting tipping patterns.”

While there are limits on how much can be requested during any single pay period, financial counselors asked about the service worried that consumers might overuse it and urged restraint.

Activehours works on both Android and iOS smartphones. It’s for hourly employees who have an electronic timecard system at work and use direct deposit.

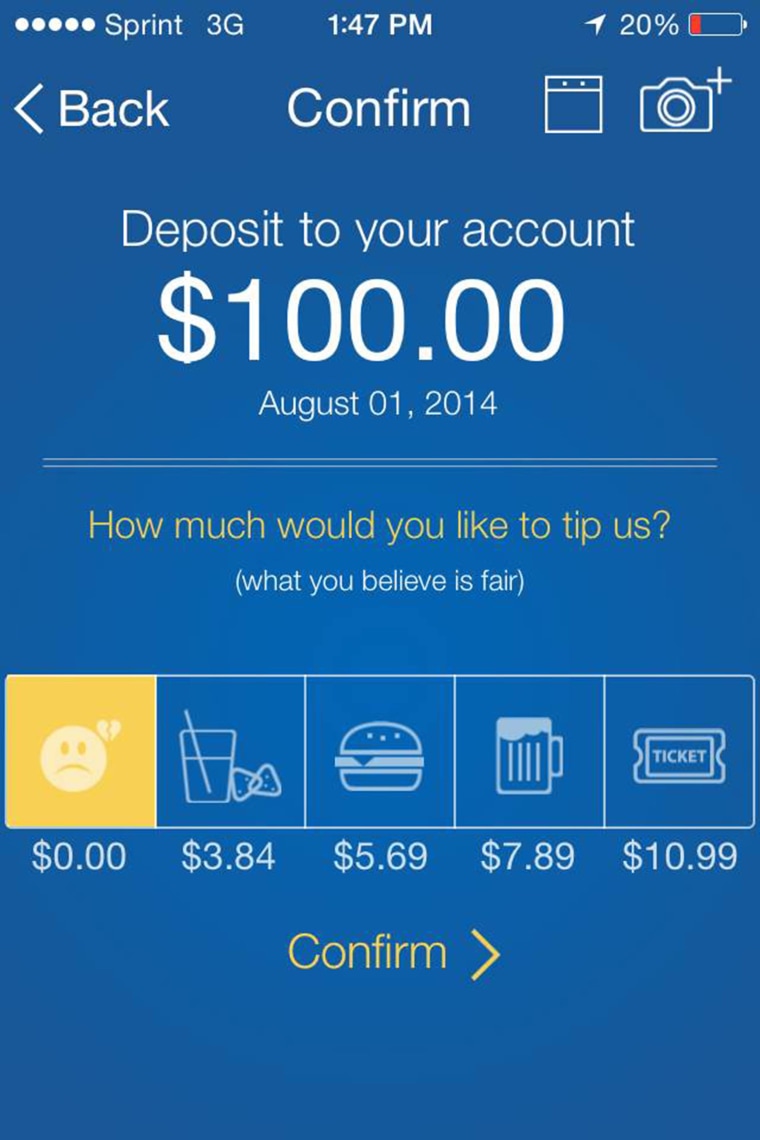

When you sign up, you provide Activehours with your bank account number. When you need money, you forward a screenshot of your timesheet to Activehours, decide how much you want deposited into your bank account and what, if any, tip to authorize. The app provides five suggested tips for every transaction. Zero is always the first option.

For example, on a $100 advance, the suggested tips are: zero, $3.84, $5.68, $7.89 and $10.99.

Make the request by 3 p.m. PT and the money you’ve borrowed will be in your bank account the next business day. On payday, Activehours withdraws that amount, plus your tip.

Your employer isn’t involved in these transactions and doesn’t have to approve them, so they don’t know you’re doing this.

‘Safety net’

Activehours wouldn’t say exactly how many people use the app. Palaniappan told CNBC it’s in the thousands.

Stephen Prentice, a 48-year-old IT support technician working in Dallas, found himself needing a few dollars before each payday. When he heard about Activehours, Prentice figured it was a scam – but he tried it and it worked. He didn’t mind paying a tip for what he thought was a great service.

He called Activehours “a blessing” that helped him get back in control of his finances and kept him from being evicted. Now he sees his account as a “safety net” that’s there if he ever needs it.

Christine Lombardo, 31, lives in New Bedford, Massachusetts, and has a part-time job with a local non-profit. She uses Activehours a couple of times a month. She says it has helped reduce the stress in her life.

“It’s so much easier than going to my payroll person and bothering them with my money issues. I can straighten it out myself,” Lombardo said. “I wish I was in a better financial situation, but for the emergencies that pop up, it definitely has its place. I can just do this. It’s quick and painless and I know I’m not going to get hit with crazy fees.”

Lombardo notes that she doesn’t always leave a tip, but tries to go with the middle suggestion whenever possible.

Use caution

CNBC spoke to a number of financial experts and credit counselors to get their take on Activehours. They all worried about the potential abuse of what is billed as a short-term solution for cash.

“Consumers need to closely evaluate all of their credit options, particularly when the repayment of that loan is due in full on the next payday,” said Tom Feltner, director of financial services at the Consumer Federation of America.

Gerri Detweiler, director of consumer protection at Credit.com, said using Activehours was probably better than taking out a payday loan, and it could help someone with a cash-flow problem avoid late fees, which could be much more expensive.

“But if you’re not careful and wind up doing this week after week, you run the risk of getting yourself into a worse financial situation,” Detweiler cautioned. “If this is not a short-term thing, you need to talk to a credit counselor and go over your household budget.”

If the problem is simply caused by when bills are due, Detweiler suggests trying to change the due date on credit card statements and utility bills. That might eliminate the long-term cash-flow problem.

Gail Cunningham, spokeswoman for the National Foundation for Credit Counseling, is also worried that a well-intentioned service could become a bad habit.

“Ten bucks feels cheap, and the person is so relieved to have the money that they are happy to be a big tipper,” she said. “It all sounds great — no fees, no interest charged, no mandatory payment on top of what’s borrowed — but this could snowball downhill quickly if the well-intended person, the one who thinks they’ll utilize it ‘just this once,’ continues to rely on this pay advance instead of probing to see what the real problem is and resolving it.”