After several years of dramatic growth, the adoption rate for mobile banking in the U.S. has slowed dramatically. Those who like to bank this way are doing it more often, but the industry is struggling to get more customers to go mobile.

A recent report from the Federal Reserve (Consumers and Mobile Financial Services 2015) found that 52 percent of smartphone owners with a bank account did at least one mobile banking transaction last year. That’s not much of an increase from the 51 percent reported in 2013.

Most of the people who did not bank this way (86 percent) said they believed their banking needs were being met without mobile banking.

But nearly two-thirds of those who did not use mobile banking cited security concerns, such as data interception, phone hacking or a lost/stolen phone.

“The security is likely there, and the bankers are putting a lot of effort into making sure that it’s a secure process, they just need to get that information out to the consumer.”

A new report from RateWatch, a banking data and analytics service, concluded that mobile banking will only increase if those security concerns are addressed. In a recent survey, RateWatch found that security was the number one reason people said they did not use mobile banking.

“The security is likely there, and the bankers are putting a lot of effort into making sure that it’s a secure process, they just need to get that information out to the consumer,” said RateWatch marketing manager Kimberly Myszkewicz. Is this security concern justified?

After two years of major data breaches and hack attacks, the American public is hyper-aware of cyber threats. The nation’s bankers realize this and tell NBC News they take this issue very seriously.

“Security is and will continue to be a primary concern with regard to mobile banking – just as it is for all aspects of the banking business,” said Nessa Feddis, vice president and senior counsel for the American Bankers Association.

What's riskier?

When it comes to security, is mobile banking any riskier than online banking?

“I would argue that mobile banking is safer right now,” said Al Pascual, director of fraud and security at Javelin Strategy & Research. “For online banking you have all of this malicious software that targets browsers and that’s a huge threat.”

Pascual told NBC News he expects criminals to focus more attention on mobile banking as it becomes more popular. But he points out that there will always be threats to every form of financial services technology. If you decide to download a mobile banking app, make sure you get it directly from your bank or credit union. Don’t search the app store – that could be dangerous.

“Since these apps are not developed by a trustworthy source – that is, your bank – they represent a real risk to the user who has no way of knowing what’s bad,” said Elias Manousos, CEO of the digital security firm RiskIQ.

In a study released earlier this year, RiskIQ looked at 350,000 Android mobile banking apps available at 90 different app stores and found that more than 40,000 (11 percent) of them contained malware.

Another 40,000 had dangerous permissions. Among other things, they could record audio, access contact lists, read text messages and capture device logs.

“It’s just another way for your identity to be stolen from a source that appears to be legitimate, but is really not,” Manousos told NBC News.

Other drawbacks

Security isn’t the only drawback

Internet banking and going to the branch are still the most preferred methods of banking, according to the latest survey by the American Bankers Association. Only 10 percent preferred using their mobile device.

Some say a lack of promotion is another significant reason why the growth of mobile banking has apparently stalled in the U.S.

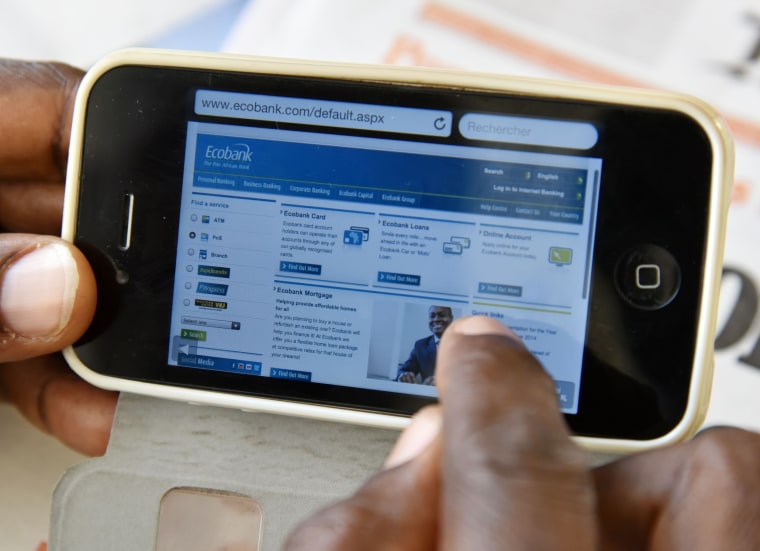

“In other parts of the world, especially emerging countries, banks are more aggressively marketing their mobile banking services,” said M.S. Krishnan, associate dean of global initiatives at the University of Michigan’s Ross School of Business. “Financial institutions in America have been slow in seeing the importance of this business channel.”

The nation’s bankers say the mobile platform is important. They believe it will continue to grow as young people, who live on their mobile devices, open financial accounts and expect instant access to their money anytime and anywhere.

For that to happen, financial institutions will need to up their game, providing apps that allow customers to do more. Right now, it can be a frustrating experience.

In a recent survey by the Mercator Advisory Group, 23 percent of those who used a mobile banking app said they frequently or always had a problem performing the banking functions they wanted to do. Among young adults, the target audience, 44 percent experienced a problem.

“People want mobile banking and they’re doing it more often, but they want more robust functionality and they want it to be easier to use,” said Karen Augustine, manager of primary data services at the Mercator Advisory Group. “If it’s done correctly, the mobile app is going to be more convenient and easier to use than accessing the bank via its website.”

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitter or visit The ConsumerMan website.