When it comes to meeting and managing their financial goals, millennials in creative and educational professions are shaping up to be even more committed to saving than millennials in the financial and engineering sectors.

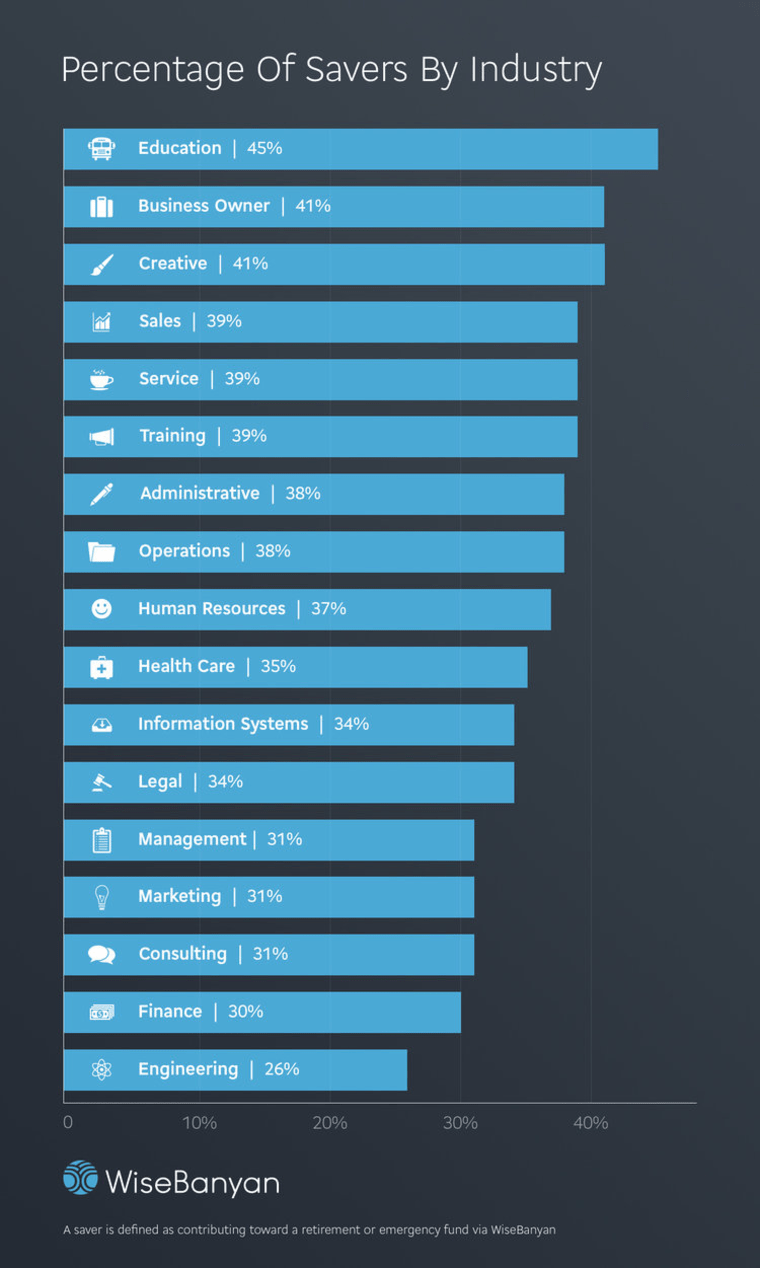

WiseBanyan, a financial advising and management startup focused on serving consumers who may be overlooked by traditional investment firms because they don’t make enough money, conducted a study to find which of its user types best handles financial goals. The New York-based company surveyed its 13,000 users (past and present) and found that those who marked their career field as “creative” were 35 percent more likely than finance professionals and 56 percent more likely than engineering professionals to have a retirement or emergency fund.

The majority of WiseBanyan’s users are millennials and “first time investors,” noted Vicki Zhou, CEO and co-founder of WiseBanyan. “The median age of our users is 30, and over 75 percent are 35 or younger,” said Zhou, adding that the company serves “a sizable cohort of students.”

WiseBanyan conducted the poll in order to get a clearer idea of people’s saving habits and how successfully they were meeting their own goals. The results came as “a bit of a surprise,” Zhou said, and one that reinforced WiseBanyan’s confidence in its mission to prove that anyone can get on track with their saving goals, no matter their profession or income.

“As long as you’re willing to create financial goals, you can achieve them,” said Zhou, adding that one of the most impressive aspects of these findings is that people are saving despite not making a great deal of money, and doing so more effectively than people in higher income categories.

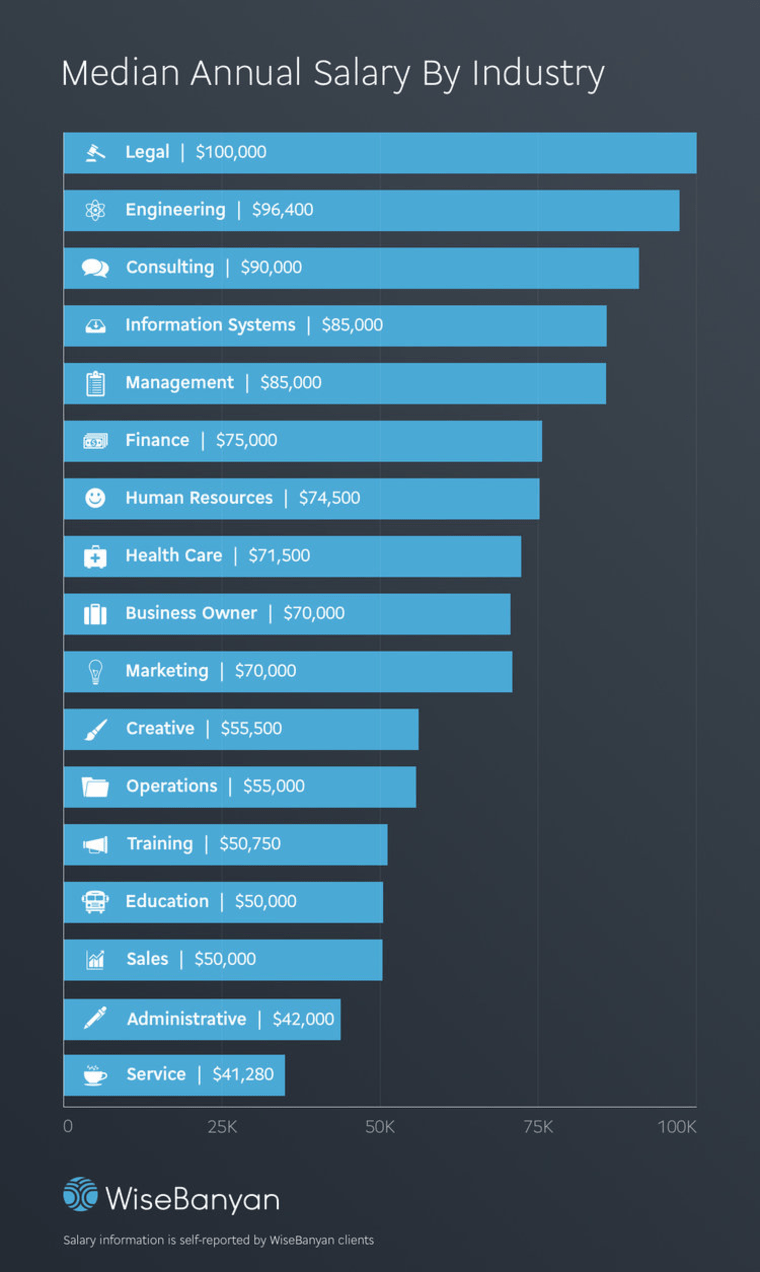

For example, 41 percent of the creatives consulted have a retirement or emergency fund. The median salary for this type of professional, WiseBanyan calculated, is $55,500. People working in the finance sector make an average of $75,000 per year, but as a group, they’re lagging behind creative, with 30 percent having set up an emergency or retirement fund.

The field of education has the most savers, with 45 percent possessing emergency and/or retirement savings — and they earn even less than creatives, with a median salary of $50,000.

“Across the board, creatives and educators are pulling ahead,” said Zhou. “But there was no group that we saw doing poorly per se; a lot of people are on track for their goals.”

Erin Lowry, founder of Broke Millennial, attributes these findings partly to the fact that engaging with money-related matters on one's smartphone is increasingly appealing to millennials.

“The gamification and easy access to financial information is making it so those who desire to get their money on track are able to without many barriers,” Lowry said. “Gamification and the use of apps is a great way to get people who may not normally be engaged with their money to at least put some of it on autopilot. Sure, you can — and should — do this by setting up your employer-matched 401(k), but that can feel intimidating to so many millennials who have never had to pick investments before.”

Lowry also thinks that millennials may be proving to be more aggressive savers than previous generations because of the prominent impact of student debt with which so many young people are living.

“I can't speak to us being more inclined to set [financial] goals, but rather our goals are different,” said Lowry, who at 26 years old, speaks from a millennial perspective. “Boomers and even, to a degree, Gen X didn't deal with student loans in quite the same way.”