What made Milwaukee burn?

The rioting and civil unrest that followed Saturday's fatal shooting by police of a black suspect has cast fresh attention on one of the most segregated cities in America.

A barbwire bramble of factors are contributing to tensions throughout the city, especially in the community of Sherman Park, the mainly black neighborhood where the victim, Sylville Smith, was shot.

But at the heart of the issue is the fact that — like other American cities that have been the site of recent racial protests — it's not easy to borrow in Milwaukee if you're black.

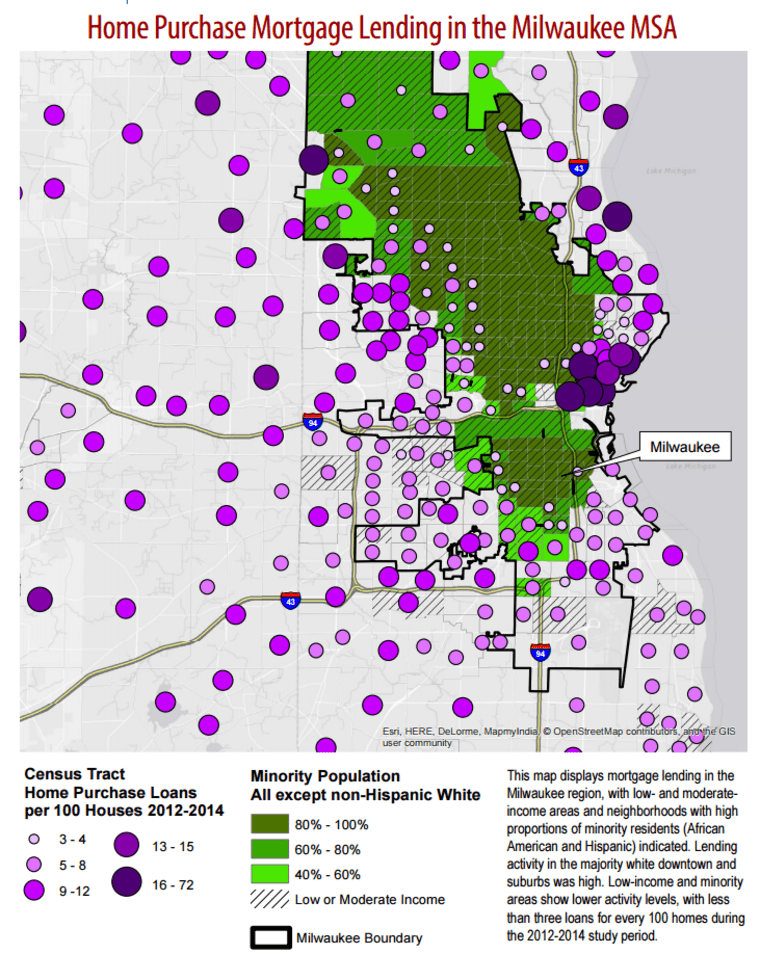

In the Milwaukee Metropolitan Statistical Area, whites represent 70 percent of the population, and received 81 percent of all mortgage lending, according to a recent study. Meanwhile, African-Americans represent 16 percent of the population — but only 4 percent of the loans.

The July 2016 study by the National Community Reinvestment Coalition overlaid census data and bank-reported mortgage data. It found that while median income was the first predictor for whether a home loan would be made, race was the second.

The whiter a neighborhood, the more loans it got. And vice versa.

"For areas with higher percentage of whites, race became an important factor in our analysis, showing landscapes of divestment," said NCRC researcher Bruce Mitchell.

Whites have historically benefited from government-backed programs like the Federal Housing Administration and the GI Bill. Though open to all, the GI bill was administered locally and for instance in New York and New Jersey out of 67,000 mortgages only 100 went to non-whites. While both programs brought down the cost of home ownership, blacks were steered away from white neighborhoods, shunted into rentals and the arms of predatory lenders, said University of Iowa history professor Colin Gordon, who has studied segregation in St. Louis, Missouri.

The methods have ranged from overt — such as the FHA-created "redlining" maps that effectively blocked off entire minority areas to lending — to more subtle. Redlining was made illegal in the 70's but advocates say discriminatory practices continue.

In an undercover investigation by the National Fair Housing Alliance, a non-profit that works to end discrimination in housing, minority and white borrowers sent to real estate companies across the country had divergent home-buying experiences.

Despite being as qualified as — or better qualified than — their fellow white mystery shoppers, blacks and Latinos were consistently shown fewer properties, an average of five properties per test versus eight. They were made to go through more hurdles, like more frequently being required to provide a loan pre-approval letter, and not informed about programs that would have made it easier to purchase a home, such as lower closing costs or mortgage rates available through an affiliates.

And all groups were steered towards neighborhoods that reflected the color of their skin, at a rate of 87 percent, said the study, funded in part by the Department of Housing and Urban Development.

"When banks decide they're not going to make home mortgages in certain communities, they're deciding it's going to be mainly rentals and it's going to have a deleterious effect," said NCRC president John Taylor. "It's a self-fulfilling prophecy on part of the banks. That's redlining"

Fair housing advocates say this creates cities split along racial lines that limit economic opportunity and sow the seeds of distrust and misunderstanding. Even violence.

“You have the attitude of some police officers that you don’t belong in this neighborhood," said Shanna Smith, president of the National Fair Housing Alliance. "The police's stereotype and bias is what causes the violence in the segregated communities."

In response, Milwaukee Police Department spokesman Timothy Gauerke said the force was highly involved in local community organizations and block watches and has "positive daily contact with citizens of all races."

"Those in disadvantaged neighborhoods are often asking for increased police presence to help ensure their safety and security. We continue to engage in community oriented policing and our officers are trained in fair and impartial policing and put it into practice every day," said Gauerke.

But the neighborhoods those officers are patrolling are suffering from a lack of investment.

A map produced by the study shows the divide in Milwaukee in further detail. The minority-concentrated neighborhoods in darker green received virtually no loans, as represented by the purple circles, during the 2012-2014 period studied.

Banks say they just look at the numbers.

On average, African-Americans have lower credit scores. Less than one quarter of blacks have scores in the prime range, while more than 65 percent of non-Hispanic whites do, according to a 2008 Federal Reserve study.

The only three things the computers care about are a buyer's debt-to-income ratio, credit history, and collateral, he said.

And though that calculus includes an estimate of a home's value generated by a human appraiser, "the appraiser is looking at the value of the property today," and not estimating a neighborhood's expected rise or decline in property values, said Fratantoni.

The group has also cautioned against the use of statistical models to draw conclusions about race and lending.

"Don't confuse correlation and causation," said Mortgage Bankers Association spokesman Ali Ahmad.

"Dalmatians are more likely to be run over by fire engines than any other kind of dog," he said by way of example.

But, according to the consumer advocacy group's use of regression analysis, a technique that teases out the relationship between multiple sets of variables, the researchers found race also played a factor in lending decisions in Baltimore, St. Louis, and Minneapolis — all cities where raw videos of police arrests and shootings of black suspects have sparked national protest.

In low-income areas of Baltimore where minorities are just 10-19 percent of the population, 72 percent of the mortgage applications were approved. But in areas in the same income bracket where minorities were over 80 percent of the population, only 59 percent of applicants got loans. In St. Louis, similar patterns: 64 percent in the first group were approved, as compared to 37 percent in the second. Less of a disparity was found in Minneapolis, with 69 percent versus 56 percent.

Similar cities of recent unrest, like Baton Rouge, Chicago, and Dallas, have also been the subject of studies that found patterns of bias in home lending.

Segregation creates a vicious circle, said Gordon, the history professor. It pushes down property values, and studies have shown it's associated with increased crime and violence.

Among the predominantly white communities "It creates the perception that African-Americans are a threat, or at least a threat to property values," he said. "They see African-Americans not as citizens, but as interlopers, as invaders."