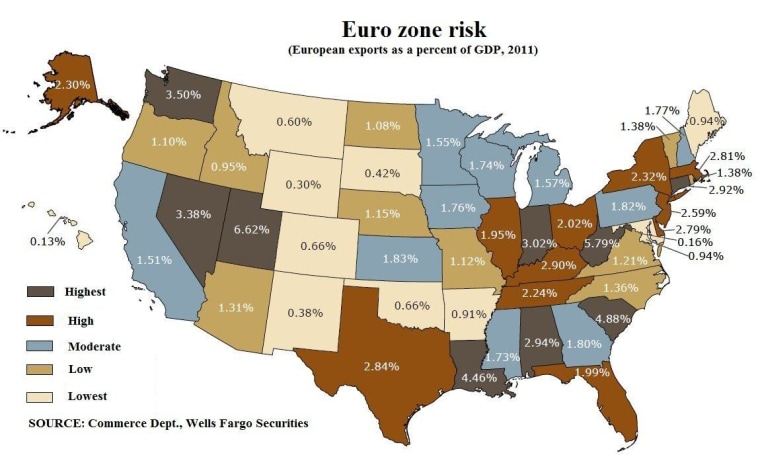

The European meltdown is weighing heavily on the U.S. economy, with states that rely heavily on exports most at risk from the deepening crisis overseas.

An analysis by Wells Fargo estimates that Utah and West Virginia economies face the biggest risk from the problems in the eurozone, while many Western states including Wyoming and Colorado are unlikely to see much impact.

“The impact of the eurozone recession on each state varies considerably with the mix of goods and services produced and exported,” Wells Fargo economist Mark Vitner said in the analysis.

The European and U.S. economies are linked through numerous ties. The most direct — and most easily tracked — impact centers on a trade relationship that is "the largest and most complex in the world," according to the Office of the U.S. Trade Representative. Those ties generate trade flows of about $3.6 billion a day and account for more than 7 million jobs.

But that money flows unevenly within the U.S., leaving some state economies more vulnerable than others. States with the highest risk of slowing exports are those heavily concentrated in transportation equipment, commodities and chemicals, according to Vitner's analysis.

Those include South Carolina, where more than 250 transportation-related companies employ more than 32,000 workers. Vitner estimates the slowdown in exports over the last year has shaved roughly 1.4 percent off the state’s GDP.

The drop in exports has been partly offset by continued investment in new plants, including a new Boeing aircraft factory. In Alabama, the fourth-biggest vehicle exporting state, weaker demand for cars and trucks is being offset by plans for expanded production by Mercedes-Benz, Honda and Hyundai.

The drop in transportation exports has also been offset by orders from the rest of the world, which has helped blunt the impact on states that rely heavily on aircraft manufacturing. But Washington state, where the aircraft industry makes up 71 percent of exports, remains vulnerable to a further slowdown. With nearly two-thirds of its exports coming from sales of aircraft and related equipment, Connecticut is also vulnerable.

States that rely heavily on exports of commodities face the greatest risk, according to Vitner. Those include Utah and Nevada, with large exports of gold and silver, and West Virginia, a major coal exporter. Slowing chemical exports have hit Louisiana hard. Louisiana’s exports to the eurozone fell 31 percent in the first five months of the year.

The European recession also hurts states that rely heavily on industries such as financial services and tourism.

“European visitors account for around 40 percent of all international visitors to the United States, and the volume of visitors has slowed noticeably over the past few months,” according to Vitner.

Top U.S. destinations include New York, Los Angeles, Miami, San Francisco, Las Vegas, Orlando, Fla., and Washington, D.C. The eurozone slowdown is hitting East Coast destinations the hardest, Vitner said.

The crisis also hurts the financial centers of New York, Chicago, Philadelphia and Boston. As of June 30, the six largest U.S. financial firms by assets had cut more than 18,000 jobs in the past year, or 1.6 percent of the total, according to The Wall Street Journal.

Eurozone woes add to existing troubles

The slowdown comes as states are already struggling with weaker economic growth and persistent pressure on state budgets. Last year, six states — Wyoming, Alabama, Mississippi, New Jersey, Maine and Hawaii — saw their economies shrink.

States with positive growth are still feeling the hangover from the 2007-09 recession, which cut deeply into revenues just as newly unemployed people turned to their services for help in large numbers. Other costs, including for healthcare and public employee pensions, are rising rapidly, forcing cuts in basic services such as law enforcement, schools and transportation.

The budget crunch shows no signs of easing, and states' current spending, taxation and budget practices cannot be sustained, according to an independent bipartisan committee.

As aging populations drive health care and pension costs higher, revenue from sales and gas taxes is shrinking, the group said in a report last week. Meanwhile, grants from the federal government, which provide about a third of state revenue, are likely to shrink, the report said.

The State Budget Crisis Task Force, headed by Volcker and former New York Lt. Gov. Richard Ravitch, studied six key states.

More money and business news:

- Dollar stores are shedding their cheap reputation

- Not yours, but some companies offer unlimited vacation

- Video: For first time, Canadians richer than Americans

- Sign up for our Business newsletter