They’ve tried dumping $2 trillion in cash into the financial system, slashed overnight interest rates to zero and made an unprecedented promise to keep rates low for at least another two years.

But as Federal Reserve Chairman Ben Bernanke and his central bank colleagues meet this week to ponder their next move, they’re still struggling to quicken the pace of the slowest economic recovery in generations.

Until recently, it appeared the Fed’s medicine was finally having the desired impact. Economic growth, as measured by gross domestic product, picked up to a healthy 3 percent annual rate in the last three months of 2011. Manufacturing, driven by a healthy pickup in new car sales, shifted into higher gear over the winter. The unemployment rate, stuck at 9.1 percent last summer, fell by a half percentage point.

But that growth may have been something of an illusion.

“It looks like a lot of the hiring that we were so enthusiastic about late last year was weather-related," said Yale economist Stephen Roach. “A little bit of a bloom is off the rose."

That view was echoed by the responses of 53 economists, fund managers, and investment strategists in the latest CNBC Fed Survey, released Tuesday. Several lackluster economic reports have moved market participants closer to the Fed’s view on the economy and the outlook for monetary policy.

The respondents downgraded their outlook for year-over-year GDP growth to 2.39 percent from 2.46 percent. They took nearly a quarter point off the outlook for growth in 2013 and now see GDP rising just 2.55 percent. As a result, they downgraded already muted expectations for the stock market, predicting the S&P 500 stock index will be basically flat through June and rise just 2.9 percent by year-end.

“Bernanke has been vindicated on the Fed's forecast, with growth now giving back some of the seasonal strength we saw earlier in the year,’’ said Diane Swonk of Mesirow Financial.

The survey echoed the belief, shared by the Fed’s own forecast, that the economy will continue to turn in a subpar performance at least through the rest of the year. Asked their opinion of Fed policy, 51 percent of respondents say it’s “just right,” up from 38 percent in March; only 36 percent believe it’s “too accommodative,” down from 53 percent in March.

Some Fed officials, including Bernanke, have recently acknowledged that the economy isn't growing rapidly enough to make a significant dent in the unemployment rate.

“If our economy were a Kentucky thoroughbred, I'd say we have moved from a walk to a trot, but we're far from a gallop," Cleveland Fed President Sandra Pianalto told a meeting of bank regulators last week in Lexington, Ky.

There are signs that sleek horse may be slowing down into a walk.

After each recession since World War II, housing has helped lead the subsequent recovery. But five years into the biggest housing bust since the Great Depression, another hoped-for spring revival in home sales is in doubt.

Following signs earlier this year that the market may have hit bottom, the National Association of Realtors said last week that sales of previously owned homes fell 2.6 percent last month to a seasonally adjusted annual rate of 4.5 million. That's well below the pace of about 6 million typically seen in a healthy economy.

"We are most certainly not set to declare that the housing recovery is over, but a strong start to the spring selling season is simply not in the data," said Dan Greenhaus, chief global strategist at BTIG in New York.

Consumer spending and retail sales perked up in first quarter, but much of the increase was fueled by rising gasoline prices. Households have had to dip into savings to spend more.

The increased spending will be hard to sustain unless employers continue to create jobs faster than the workforce expands. Some economists, including Bernanke, suspect that the burst of new hires last winter was simply a reversal of some of the steep layoffs put in place after the economy’s sharp 2008 contraction. If so, the recent job market rebound may only be temporary.

“In a weak recovery, we're going to have a really hard time getting this unemployment rate down below 8 percent,” said Roach. “If you add in the underemployment, you've still got mid-teens in terms of broad-based measures of labor market distress in the United States, which is really without precedent for a so-called peacetime expansion."

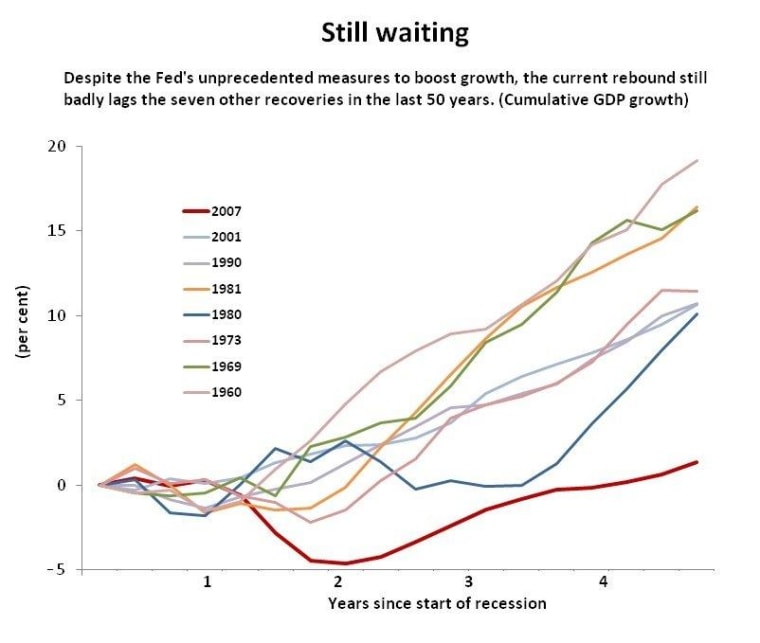

Despite the Fed’s unprecedented measures, the current expansion badly lags other recoveries. More than four years after the recession of 2007 began, the U.S. economy has barely recovered the ground lost to the steepest downturn in 50 years. This far into past recoveries, by comparison, growth had advanced by anywhere between 10 and 20 percent.

As the U.S. economy slogs along, the global economy faces renewed pressures over which Fed policymakers have little or no control.

After a period of relative stability, Europe’s financial crisis appears ready to enter another turbulent chapter. In the past few weeks, fresh concerns about Spanish banks, political upheaval in Holland, and French president Nicolas Sarkozy's narrow loss in early round voting to his Socialist rival have cast doubts on a shaky set of European reforms pieced together to avert a wider crisis. With the exception of Germany, most of Europe has lapsed back into recession.

Growth in China, following a historic economic transformation, also appears to be slowing. Though still strong by Western standards, China’s slowdown represents a further slackening of demand for goods and services sold by U.S. and European companies.

The slowdown comes amid another historic shift in demand, as consumer spending in the developing world is becoming the key source for growth an increasingly global economy.

U.S. consumption as a percentage of world GDP peaked at about 22 percent in 2002, and has declined steadily since then, according to a recent report from economists at IHS Global Insight. Two years later, consumer spending in Western Europe peaked at almost 18 percent of the global economy. The economists predict that by 2015, consumers in those two regions will account for just 26.0 percent of world GDP, down from 38.5 percent in 2002.

Growth from consumers in emerging markets like Brazil, Russia, India and China, meanwhile, is accelerating, rising to 8.1 percent of world GDP in 2010 from about 4.4 percent from 1995 through 2005. IHS Global Insight predicts the figure will hit 12.0 percent by 2015.

The shift has been accelerated by the Great Recession, the Eurozone debt debacle, and anemic growth in Europe and the United States, they said. But it’s also being propelled by strong demographic and economic forces.

“Emerging markets' consumers are now entering the world stage in greater numbers and are making a noticeable impression on multinational corporations, which view consumers in these nations as the ‘low-hanging fruit’ compared to the fatigued and frugal consumers in the developed countries," the economists said.