You worked hard for that money you’re about to send to the IRS in less than two weeks. Like many tax filers you're probably asking yourself where all that money goes when the state and federal governments get their hands on it.

If you have trouble balancing your checkbook, imagine trying to keep track of where $3.6 trillion goes every year. That’s roughly what Uncle Sam spent last year.

For the complete, gory details, you can check the latest estimates from the official budget at the Government Printing Office, where you’ll find the government’s finances sliced and diced — by agency, department, function and source. But we’re going to skip reading the 250-page version and get our numbers from a summary analysis from the Center on Budget and Policy Priorities.

A $3.6 trillion budget has a lot of large numbers. To make it a little easier to imagine which of those tax dollars is yours, here’s roughly how the federal budget compares to your budget and mine. Picture Uncle Sam, sitting at the kitchen table, trying to make ends meet.

Let’s assume for this exercise that the federal budget came to $52,000 a year — or $1,000 a week — which is about the median household income in the U.S. For our purposes, that $1,000 a week is tax free. (Uncle Sam doesn't pay taxes, he collects them.)

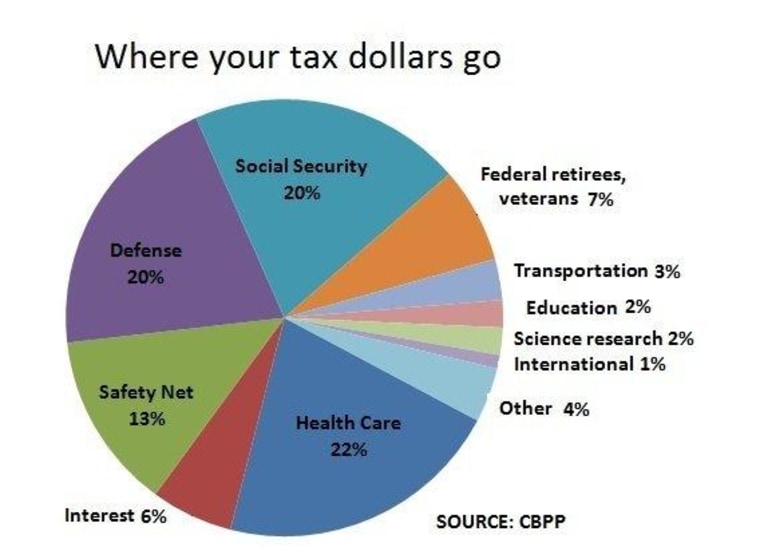

Last year, the three biggest federal budget items were Social Security, health care and defense spending. So if Uncle Sam was a median wage earner, he'd have spent more than $600 of his $1,000 weekly paycheck on just those three programs.

On his annual salary of $52,000, the cost of federal health care works out to a little more than $11,000 a year. The biggest chunk of that (about $125 of his weekly paycheck) went to pay for Medicare, which provides health coverage for people over 65. The rest ($95) went for Medicaid, which covers low-income families and individual, and state-administered health coverage for children.

While most households are having a hard time setting aside a few bucks a month for their IRAs, your government is busy stashing away retirement cash for a rainy day; about $200 of the weekly paycheck went to the Social Security fund. (Just for fun, compare that to how much of your weekly paycheck goes to retirement savings.)

Next up is military spending. This includes a variety of defense costs, including salaries for the troops, operating and maintenance costs, “procurement” (stuff you bought), and research, development, test and evaluation of all those things you bought. Throw in another few bucks for things like “atomic energy defense activities” and housing the troops, and Uncle Sam paid about $200 a week to keep the nation safe. (That’s about $10,400 for the year.)

Unfortunately, Uncle Sam — like many Americans — has been living beyond his means and spending more than he takes in. To make up the difference, the Treasury steps up by selling more debt — more or less the way American households use credit cards. Interest on the Treasury’s credit card eats up about 6 percent, or the equivalent of about $64, of Uncle Sam's weekly spending.

There’s also a line in his budget for “income security” which includes things like unemployment insurance, food and nutrition programs, and housing assistance. That's roughly 13 percent of federal spending, or about $130 a week for a median income earner. Another 7 percent, or $70 a week, goes to pay benefits for federal retirees and veterans.

So far, so good. After paying these bills, our favorite uncle has about $135 left from the weekly paycheck. That leaves just $20 (2 percent of federal spending) for education; another $20 for science and medical research; and $30 for transportation costs, including highways, air travel and water transport.

While some Americans complain about seeing their tax dollars going to fund aid to other countries, it’s not a big number. In the 2011 fiscal year budget, the equivalent of less than $5 of the $1,000 a week went to pay for foreign aid and the cost of housing ambassadors around the world to conduct international affairs.

That leaves just $60 left to cover everything else: from agriculture to the environment and the judiciary, including federal law enforcement, courts and prisons. The Treasury has to manage all this spending without the convenience of online bill paying.

That's where Uncle Sam spent your money. Depending on where you live, you also kicked in a portion of the $1 trillion spent in fiscal 2011 by the 50 states and the District of Columbia. The breakdown there is a little easier to track, according to the CPBB. (The math is also easier because $1 trillion is a nice round number.)

Spending levels vary state by state, but by far the biggest single chunk of your state tax payments went to a classroom. Some 26 percent — or roughly $260 billion of all state spending — went to K-12 education; another 13 percent, or $130 billion went to community colleges, state universities and vocational and technical schools.

Another $130 billion paid for state-managed healthcare programs, primarily Medicaid and the Children's Health Insurance Program (CHIP.)

About $50 billion was spent by the states on transportation — fixing roads, rebuilding bridges and keeping public transportation systems moving. Another $45 billion went to pay for state prisons and parole and juvenile justice programs.

Public assistance for the poor consumed just $12 billion of all state spending, or an average of just one penny of every dollar of your state taxes.

After that, comparisons of state budgets get a little harder: about $350 billion worth of state spending goes to categories that don't match up easily, according to the CPBB. Those include public workers pension and benefits programs, aid to local governments and unrestricted spending like property tax relief.

Spending levels also vary widely: West Virginia spends just 11 percent of its budget on K-12 education, for example, while Vermont spends 33 percent. In Wyoming, just 7 percent of state spending goes to Medicaid, while that program consumes 30 percent of spending in Missouri and Florida.