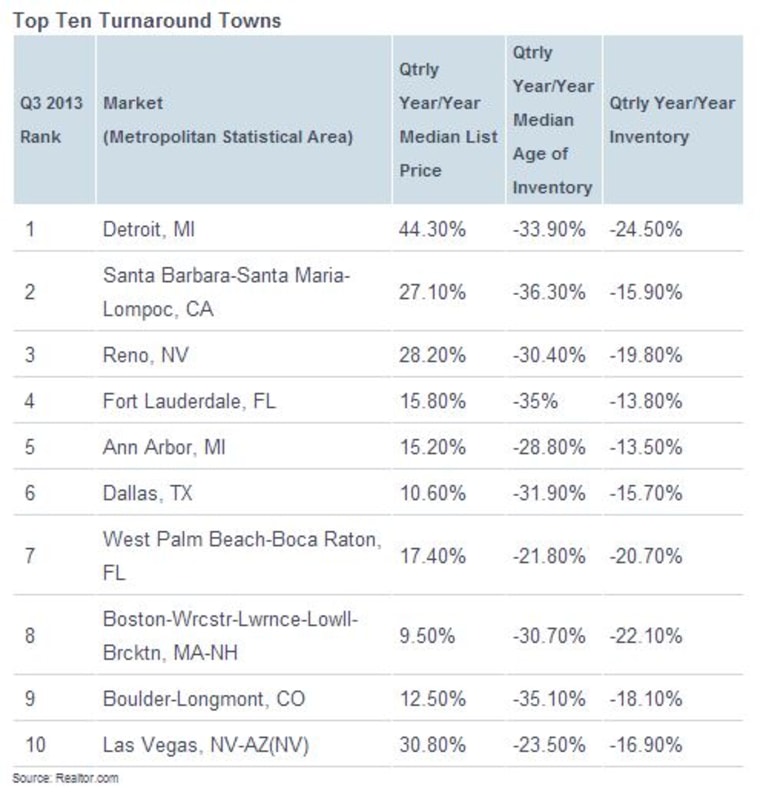

Look at which housing markets are recovering the fastest, and Detroit might not be top of mind. But in a surprising surge, it moved to the highest spot in a ranking of the nation's top 10 "turnaround" housing markets, according to a report from Realtor.com.

The survey looks at median home prices, days on market and supply of homes for sale across the country to determine which markets are recovering fastest.

"Many of the markets have already moved past the 'fast recovery' phase and are moving lower on the list — like Oakland and San Jose (Calif.). This quarter, we're seeing markets that still have 'room to grow' — and that's what we're measuring," said Steve Berkowitz, CEO of Move Inc., which operates realtor.com.

Decimated by the ailing auto industry and forced into a foreclosure crisis well before the national one, Detroit's housing market is bucking bankruptcy and seeing prices rise 44 percent in the third quarter, compared to a year ago. Its inventory is down 24.5 percent and homes are selling 34 percent faster.

Investors are starting to eye Detroit, now that they've run through much of the inventory in other distressed markets, like Phoenix and Las Vegas. They are a big factor in turning some markets around faster than others. Phoenix is not on the top 10 turnaround list because investors have already pushed prices so high there that sales have slowed. Las Vegas fell to No. 10, as nearly half the city's homeowners are still underwater on their mortgages.

"We're noticing a clear split between markets that have experienced major highs and lows in recent years, and those that have proved more resilient," said Errol Samuelson, president of realtor.com. "With the recent moderation in some of the more volatile markets, the subtler acceleration activity becomes more visible."

Local economic factors are finally beginning to play a bigger role in housing again, as they had historically. Technology growth is driving housing not just in Silicon Valley, but in other markets where these companies are moving in and bringing jobs with them.

"Local unemployment rates, an increase in employers, and local investment initiatives play a huge part. Across the country, the national unemployment rate is 7.7 percent. Santa Barbara had an unemployment rate of 6.3 percent in August," noted Berkowitz.

Santa Barbara moved up to second place, despite competition from other hot California markets. Its inventory is young and limited, and values are gaining. The Top 10 has been dominated by California markets in previous quarters, but Santa Barbara is the only one left, as the rest of the state sees a slowdown in sales due to steeper price hikes.

A huge drop in the number of foreclosed homes is clearly playing into many of the turnaround markets. Nationwide, completed foreclosures fell 39 percent from a year ago, according to a new report from CoreLogic. While they are still more than twice the historical norm, they are having far less of an impact on local recoveries than they have in the past few years, during the height of the crisis.

"We're not out of the woods yet, but these are encouraging signs for a return to a healthier housing market in the U.S.," noted Mark Fleming, chief economist for CoreLogic.

Looming changes in economic factors, however, could still impact these strengthening markets. Reduced affordability levels, rising mortgage rates and uncertainty involving the federal debt crisis could limit sales and ease price gains.

—By CNBC's Diana Olick. Follow her on Twitter @Diana_Olick.

Related stories: