What goes up must go down.

Sir Issac Newton, the physicist and mathematician, was talking about the laws of gravity. But he could have been talking about modern economies and markets, which over the past 25 years have been punctuated by "the bubble-and-bust mentality," as President Barack Obama described it.

There was the Russian financial crisis in 1998, which led to the failure of the early hedge fund Long-Term Capital Management and the near failure of Bear Stearns. There was the Argentine economic crisis in 1999, which put that country in bankruptcy. Back in the U.S, there was the dot-com boom and bust in 2000.

And then there was granddaddy of them all: the subprime-led crisis of 2008. That led to the Great Recession, which, in turn, created a global panic and morphed further into a series of crises across Europe. "You never know who's swimming naked until the tide goes out," Warren Buffett famously said.

So have we learned anything from the past 25 years? Or are we sitting on the edge of another crisis?

First, the good news. We are unlikely to have another bank-led, debt-fueled crisis anytime soon, simply because the 2008 financial crisis slammed the brakes on the rapid increase in leverage that preceded it. The economy hasn't prospered enough for banks—or any other financial institutions—to take on the kinds of enormous risk with debt to spur a renewed crisis of confidence.

U.S. banks have much higher capital requirements, and the Dodd-Frank regulations should help mitigate the possibility of another panic, at least around the edges. Banks in Europe and Asia are under similar constraints. The risk of a bank failure spreading like wildfire through the global financial system has been taken down a notch.

Debt, we've learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains—pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies—but all require one similar ingredient to create a true crisis: too much leverage.

"You never know who's swimming naked until the tide goes out."

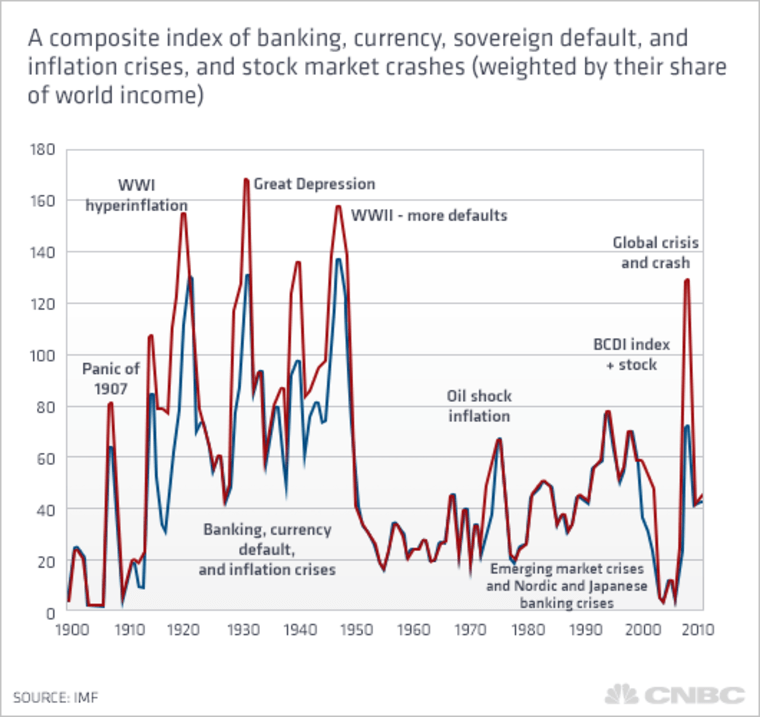

Carmen Reinhart and Kenneth Rogoff, two professors of economics, studied centuries of financial crises and panics, repeatedly coming to the same conclusion. "If there is one theme to the vast range of crises we consider," they wrote in their book, "This Time Is Different," "it is that excessive debt accumulation, whether it be by the government, banks, corporations or consumers, often poses greater systemic risks than it seems during the booms."

Now the bad news: While we might not have a bank-led crisis, there is now more sovereign debt in the system than ever. In rich countries, the burden on governments of a graying population, expanding welfare payments and shrinking tax-paying work forces has been significantly compounded by huge increases in government debt in the wake of the crisis.

Forget about banks that are too big to fail; the focus should be on cities, municipalities and countries that are too big to fail. There is still a lot of leverage in the system.

It is just coming in a different form. More dangerously, we've learned that confidence doesn't evaporate over years and months; it happens in hours and minutes. The moment a large investor doesn't believe a government will pay back its debt when it says it will, a crisis of confidence could develop. Investors have scant patience for the years of good governance—politically fraught fiscal restructuring, austerity and debt rescheduling—it takes to defuse a sovereign-debt crisis.

The euphoria around economic booms often obscures the possibility for a bust, which explains why leaders typically miss the warning signs. "Debt fueled booms all too often provide false affirmation of a government's policies, a financial institution's ability to make outsized profits, or a country's standard of living. Most of these booms end badly," Reinhart and Rogoff write. Indeed, it is possible that the flood-the-zone strategy of the Federal Reserve and European Central Bank to pump the system with money could backfire badly.

"Critics contend that the mopping-up-after strategy sows the seeds of yet more bubbles. It is argued, for example, that the Fed's super low interest rates after the stock market bubble burst led us directly to the housing bubble. The Fed now stands accused of being a serial bubble blower," Alan Blinder, a professor of economics and public affairs at Princeton and former Fed vice chairman, wrote in an Op-ed in The New York Times.

When did Blinder write that? Not in 2012, or 2014. He wrote it in 2008, just two months before Lehman Brothers collapsed.

If he's right, a crisis may well be coming again. It's just a matter of when.

Tune into CNBC on Tuesday, April 29, 2014 at 7 p.m. ET for a one-hour special about the full CNBC 25 list of people who made the biggest impact in business and finance over the last 25 years.