Before the first purchases even hit the holiday shopping bags, a recent consumer survey found that Americans are feeling financially stressed and a bit less charitable than usual.

Citing higher energy prices and financial fatigue from donating to disaster relief, over half the respondents to Boston-based marketing firm Cone Inc.'s survey said the remainder of their charitable giving this year would involve purchases benefiting worthy causes.

But amid the sounds of registers ringing up cause-related sales, additional opportunities for year-round giving exist. It’s just a matter of choosing more charitable payment choices.

“There is a payment product for every consumer, allowing for the incorporation of a personal sense of social or global responsibility into each transaction,” says Alan Schultheis, a director at Edgar, Dunn & Company, a strategy-consulting firm that works with financial institutions on their payment programs.

At Chase Bank, the array of card-carrying causes covers everything from scholarships to Villanova students to offsetting surgical expenses at St. Jude’s Medical Hospital. Similarly, Bank of America and MBNA offer opportunities to benefit the Make-a-Wish Foundation along with numerous wildlife and environmental causes.

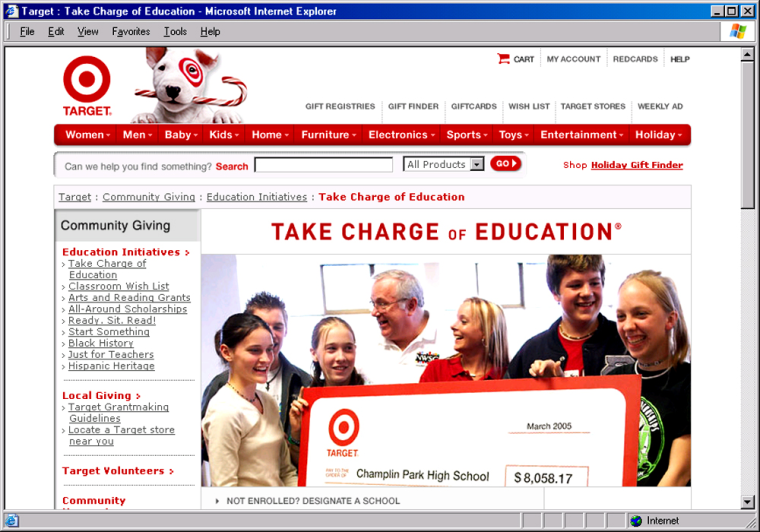

At the merchant level, retailers like Target offer store cards that translate charges into millions of dollars a year for community schools.

Then there is eScrip, which allows any card to link to a cause. On the giving end, eScrip signs up participating merchants — including most of the big national grocery chains, as well as department store Macy’s. On the receiving end it enrolls schools and other community groups. These groups then encourage parents and community members to register their store loyalty or credit cards. A percentage of each purchase made through an enrolled merchant is then credited to the designated group.

“It’s a great way to give because it’s so easy,” says Patty Tesmer of San Diego, whose involvement has followed her children through various schools and moves. “For us it literally turns a weekly expense into books for our school’s library.”

The growing interest in converting transactions into compassion even has airline-linked cards broadening their donation options. “United Airlines’ MileagePlus program now has over 20 different non-profits that members can donate miles to,” says Schultheis.

But with most programs generating no more than 1 percent of sales for the underlying cause how much do these programs really accomplish?

Target’s Take Charge for Education program, with more than 9 million cardholders and 106,000 enrolled schools has raised over $154 million in fundraising dollars since its 1997 inception. The eScrip program has distributed $120 million since 1999. As long as charity cardholding is widespread, the overall giving can be significant.

But at the individual level, the effort looks a bit anemic, certainly when compared to writing checks directly to a charity. For a program receiving 1 percent of each sale, it takes $2,500 in charges to generate a $25 donation. For more typical programs like Amnesty International’s, which accrues contributions at the rate of .50 percent, the same amount of charges only generates $12.50.

“Most people who participate in these programs are just trying to do good through their everyday actions,” says Alana Schmitt Burns, vice president cause branding practices at Cone Inc. in Boston. “It is not a substitute for overall giving.”

Nor will these contributions help once the holiday season gives way to tax season. Write a check to a non-profit and the good cheer extends into a tax deduction. Charge up the same donation by using a credit card, and the deduction is no longer the taxpayer’s to take. Technically the contribution becomes a ‘reward’ to the cardholder, like an airline ticket or car rental upgrade. The actual donor and recipient of the deduction is the card-issuing corporation.

If carrying a socially responsible piece of plastic seems insufficient, or responsible money management dictates payment with cash, by debit card or check, maintaining an account with a socially responsible bank offers another avenue for spending with good cause.

ShoreBank Pacific bills itself as the first and only bank with an environmental mission. What that means is that from its Salmon Nation bankcard to environmental audits of its loan recipients, environmental consequences rule the bank’s actions.

“Our products need to work for the community and for the environment, not just for the profit of the bank,” says Laurie Landeros, Eco Deposits manager for ShoreBank Pacific in Ilwaco, Washington.

For its sister bank ShoreBank, a Chicago-headquartered institution with branch offices in Detroit and Cleveland, the mission is socially responsible community development. The bank which has long been a depository for socially responsible mutual fund companies, channels the money gathered through its Development Deposits — checking and savings accounts and CDs — to fund affordable housing, business formation and growth in underserved neighborhoods.

Whether keeping checking and savings accounts with a bank where green means more than the color of money or carrying plastic for the greater good, shoppers looking for ways to get a bigger bang for their spent bucks have an abundance of socially responsible payment options that will keep the giving going year-round.

Creating charitable alliances

Before charging into a charitable alignment with a cause-related credit card, be sure to look past the graphics on the front of the credit card and at the fine print to determine just how much the card will cost versus the benefits it will accrue. Some cards are merely affiliated. The actual amount of the donation is tied to cardholder renewal rates or is simply up to the issuer’s discretion — it is not actually linked to the cardholder’s behavior.

Other cards, after factoring in the annual fees or interest rate charges, could cost more than the underlying charity would receive from qualifying purchases especially if the cardholder routinely carries a balance. In such cases it may make more sense to use an unaffiliated no fee/low interest card and donate to the organization outright. Many affinity cards, however, appear to have no annual fees and competitive interest rates. Information on specific offerings can be found on the card issuers’ Web sites or through each non-profit.

Also before engaging in any form of giving, do a background check on the legitimacy and effectiveness of the non-profit organization. Ratings and background information can be found online in a variety of places, including:

For information about banks that have socially responsible mandates, see the website for the Community Investing Campaign for more information.