Google Inc. needed just five years to build a business with more than $6 billion in annual revenue, thanks to a cutting-edge advertising model where merchants bid for ad placement and only pay if someone clicks on their ad.

Now, Verizon Communications Inc. is bringing a similar model to a staid corner of the advertising business: the printed “Yellow Pages.”

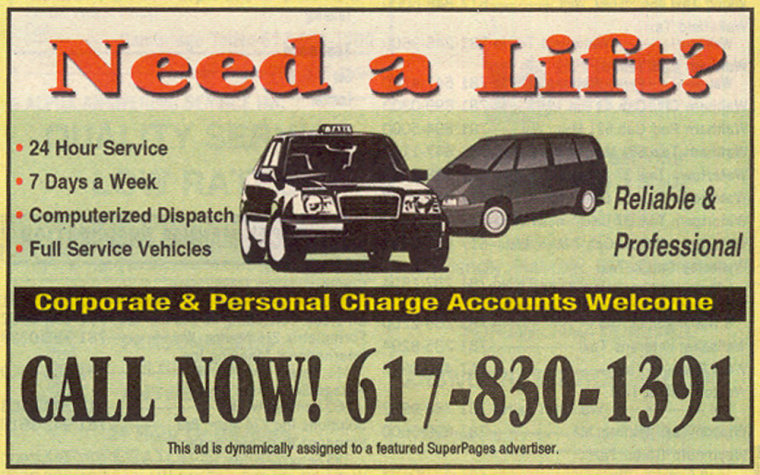

In the latest edition of Boston’s SuperPages, an ad under the “Taxi” heading reads: “Need a Lift? 24 Hour Service. 7 Days a Week ... Reliable and Professional.”

If you call the local number attached to it, the cab company to which you end up speaking depends on when you’re calling: The one paying Verizon the most on a given day will be the one answering.

In fine print, the taxi ad notes it is “dynamically assigned.” Similar ads in the directory are for travel agencies and locksmiths.

Following the trial in Boston, which started in December, Verizon is planning to introduce the ads in 500 directory editions this year, with generic ads for florists, hair dressers, chiropractors and dozens of other categories.

The ads should show up soon in directories in Maryland, Pennsylvania, California and New Jersey, said Robyn Rose, vice president of Internet marketing for Verizon Superpages.com.

“One of our challenges, of course, with the print medium, is that once it’s printed, it’s there for a year,” Rose said. “By doing this, there’s actually an update daily of who will receive the calls based on the top daily bid.”

Depending on the category, businesses pay at least $2 to $6 per call, but Verizon has seen bids reach $10 or $15.

“For example, a restaurant would have a much lower bid than, say, a mortgage company, because their return is much higher on those calls,” Rose said.

'Click-to-call' service

The call routing is handled by eStara Inc., which provides “click-to-call” services for Web sites, including Verizon’s online directory. There, Internet users can click a button next to a company listing, supply their own phone number and immediately receive a call from the listed company.

For the printed SuperPages, eStara keeps track of what companies a consumer calls through the generic numbers. If a consumer calls the “Taxi” number for the first time and is connected to, for instance, Cambridge Coach, Estara will route subsequent calls by that consumer to Cambridge Coach even if it is no longer the high bidder for the number.

Verizon recently started collaborating with Google by having its vast directories sales force sell Google ads to its small-business customers.

But Verizon’s Rose denied that the generic directory ads were inspired by Google, pointing to its own research, which showed that small businesses were much more willing to pay for calls than clicks on online ads.

Analyst Charles Laughlin of The Kelsey Group, a research firm specializing in the directory business, said Verizon’s approach is unique. He considers it a reflection of the Internet, where advertisers can track the performance of ads by the amount of traffic they create.

“Advertisers are being trained to use performance-based advertising by the Internet,” Laughlin said.

Performance tracking has already been introduced to the Yellow Pages in another form, where an ad will carry a special phone number, different from the advertiser’s general number. When a call comes in on that line, the advertiser knows it was generated by the Yellow Pages ad, making it easier to put a value on the ad.

Yellow Page publishers pulled in $14.7 billion last year, according to the Kelsey Group’s figures. It is a low-growth business, but profit margins for incumbents like Verizon are in the 45 percent to 50 percent range, Laughlin said, and holding up fairly well in the face of competition.

In a February survey, Kelsey Group found that 61 percent of consumers turn to the Yellow Pages first when looking for a local business, compared with 12 percent for search engines.

“Usage is eroding but not falling off a cliff,” Laughlin said.