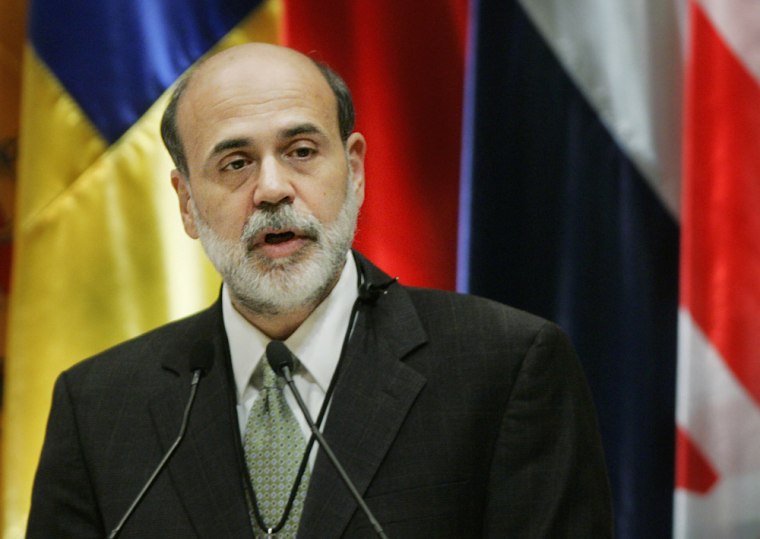

Federal Reserve Chairman Ben Bernanke is promising that the central bank will remain vigilant in fighting inflation. The comments sent shock waves through financial markets hoping the Fed was about to call a cease-fire on interest rate increases.

Instead, Bernanke’s comments are likely to mean further increases in borrowing costs for consumers on their home and auto loans and credit card debt and for small businesses trying to raise money at their local bank.

The comments to an international monetary conference on Monday were exactly the opposite of what Wall Street was expecting.

Investors had grown hopeful that a slew of slower-than-anticipated economic reports, including a shockingly small 75,000 job increase last month, would persuade the Fed to call a halt to further rate increases.

While acknowledging in his comments that economic growth did appear to be slowing, Bernanke chose to also emphasize a number of troubling developments regarding inflation.

He noted in particular that core inflation, excluding energy and food, was rising at an annual rate of 3.2 percent by one inflation gauge and 3 percent by another.

“These are unwelcome developments,” he said.

Bernanke said that the Fed “will be vigilant to ensure that the recent pattern of elevated monthly core inflation readings is not sustained.”

That was all Wall Street investors needed to hear on Monday to trigger a stock sell-off that pushed the Dow Jones industrial average down by 199.15 points, or 1.77 percent, the biggest one-day sell-off since the Dow sank by 214 points on May 17, the day the government released a report on consumer prices that showed a worrisome uptick in inflation pressures.

Stock markets in Asia and Europe followed suit on Tuesday. In Tokyo, the benchmark Nikkei 225 index dropped 1.81 percent, while India’s benchmark Sensex index fell 2.5 percent. In Europe, London’s key index, the FTSE 100, fell more than 1 percent by early afternoon, while key stock indexes were down almost 1 percent in Frankfurt, Germany, and 1.4 percent in Paris.

Bernanke “provided an emphatic commitment to maintaining price stability that suggests to me that he will be pushing for another tightening at the end of the month,” said Stephen Stanley, chief economist at RBS Greenwich Capital.

Economists had been hoping that the Fed, which had pushed a key rate up for a 16th consecutive time in May, would take a pause at the Fed’s June 28-29 meeting.

However, many analysts now believe that not only is a pause in June off the table, but that the Fed might decide to keep pushing rates higher at the August meeting as well.

Part of the reason, they believe, is that Bernanke, who succeeded Fed legend Alan Greenspan on Feb. 1, wants to prove his inflation-fighting mettle, much the same way Greenspan did when he took over in August 1987, pushing through a half-point increase in rates at his first meeting.

Bernanke “is earning his inflation-fighting credentials, which have been questioned on Wall Street,” said Mark Zandi, chief economist at Moody’s Economy.com.

But the outcome could be the same for both men, a risk of overdoing the rate hikes. Greenspan’s half-point increase was blamed for contributing to unease that triggered the Black Monday stock market crash in October of 1987.

But economists said Bernanke is apparently willing to run the risk of raising rates too high because he does not want to let the Fed’s credibility as an inflation fighter, won over two decades, slip away.

“He is sending a very strong signal that it will be important to stop inflationary forces and expectations from building further,” said Lynn Reaser, chief economist at Bank of America Investment Strategies Group.

Part of the problem, analysts said, is that Bernanke has gotten off to a rocky start in terms of communicating his intentions to Wall Street. He first stumbled in testimony before the Joint Economic Committee on April 27 when he raised the possibility that the central bank might pause in hiking rates to assess the impact the earlier increases were having on the economy.

When the markets rallied strongly on the belief that Bernanke was signaling not just a pause but a halt to the two-year rate campaign, the new Fed chairman complained to a reporter at a Washington dinner that he had been misinterpreted. Those comments sent markets plunging when they were reported two days later.

A chastened Bernanke said that any further comments he made would be through “regular and formal channels.”

But his remarks in Monday’s speech caught the markets by surprise, demonstrating that even when Bernanke is using normal channels he can send investors on a roller-coaster ride.

Analysts predicted as long as Bernanke remains worried that the central bank is behind the curve on fighting inflation, interest rates will keep rising.