At first, 26-year-old London resident Rachel Slack carried around both her Apple iPod and her mobile phone. But in November, after buying a Sony Ericsson W800i Walkman phone with enough memory for about 100 songs, she started leaving her iPod at home. "I always carry my phone with me, but the iPod is an extra. It made sense to just use my phone for both," Slack says.

Should Apple be worried about people like Slack? Maybe. Phones able to store and play MP3s have been on the market in Europe at least since 2001. But the latest models are starting to encroach on iPod territory in terms of song storage.

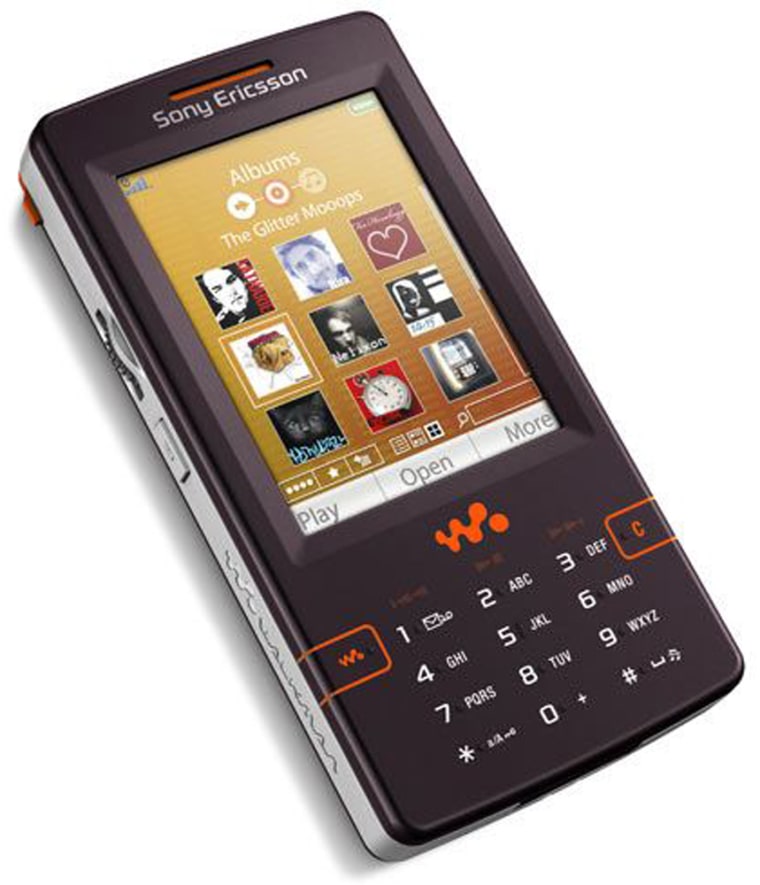

Sony Ericsson's soon-to-be released W950i Walkman phone (expected to cost upwards of $500 before operator subsidies) can hold up to 4,000 songs in 4 GB of solid-state memory—still much less than a 15,000-song, $399 iPod, but plenty for people who don't need to have their comprehensive collection of 1970s acid-rock albums with them all the time. "It's all I need on the ride to work in the morning," says Slack of her Sony Ericsson.

So far, iPod and iTunes sales don't show any sign of suffering from the proliferation of music phones, analysts say. In Britain about 8% of all adults listen to music stored on their phones, vs. 17% who listen to music on an iPod or other dedicated music player, according to market researcher Gartner Group (see BusinessWeek.com, 4/25/05, "iPod Killers?").

But as music phones with lots of memory become commonplace, it's inevitable that they will chip away at the middle and lower ends of the market for digital music players. Already, more Japanese download songs onto their mobile phones than over their PCs. An estimated 27% of the mobile phones sold globally this year will be able to store and play music, according to market research firm Ovum. By 2010, the number will hit 69%.

"In Europe 400 million people have mobile phones," says Matthias Immel, vice-president for consumer marketing at T-Mobile International, a unit of Germany's Deutsche Telekom. "Sooner or later all 400 million will have a mobile phone that is capable of playing music, and that will of course change the landscape."

Apple tacitly recognizes the threat. It has formed a partnership with Motorola, which offers phones with iTunes software. But versions on the market so far hold a maximum of only 100 songs, a sign that Apple is wary of cannibalizing its own lucrative market for iPod devices (see BusinessWeek.com, 10/8/05, “Apple's Phone Isn't Ringing Any Chimes”).

For mobile-service providers, the proliferation of music-capable phones opens up a source of new revenue they desperately need as the price of traditional voice minutes tumbles. Vodafone and Deutsche Telekom are among those who have launched their own music-download services.

SFR, the mobile-phone unit of France's Vivendi, has a catalog of 500,000 songs available for download to mobile or PC, and says its 1.5 million 3G subscribers already buy an average of four songs a month. "The service-providers have to look for new revenue streams. Entertainment is clearly high up there," says Daren Siddall, an analyst at Gartner.

The revenue isn't the only benefit to the telcos. They hope music will drive customers to make more intensive use of the 3G networks they have spent billions to create. "It's a great way of taking a dull technical thing like 3G and bringing it to life," says Edward Kershaw, head of music at Vodafone in London. One hope: If consumers get hooked on downloading music over the air, they could forgo downloading via the PC entirely.

To spur adoption, carriers are splashing out marketing money. Deutsche Telekom's T-Mobile, for example, has designed a whole music-based campaign around singer Robbie Williams. The idea is to spur not only downloads but also use of 3G streaming services, while helping the whole T-Mobile brand look younger and hipper.

Via a deal with Williams, one of Europe's top acts, T-Mobile users can catch his concerts live on their cell phone screens as well as download his songs and ring-tones onto their phones. So far 250,000 customers have downloaded Williams tunes, according to T-Mobile. Williams also appears in T-Mobile commercials and there is even a special Robbie Williams edition phone, based on a Sony Ericsson Walkman.

Of course, Apple won't be toppled easily. The company's iTunes software for transferring music from a PC to an iPod is still easier to use than similar software that Nokia and handset makers provide for their phones. "It can take a while for you to transfer music from your computer to the phone," says John Shepherd, a 24-year-old office administrator in London, who adds that he nevertheless prefers to store his music on his phone.

In addition, it will be difficult for mobile-service providers to undercut Apple iTunes on the price of a song download. In Britain, iTunes sells songs for 79 pence ($1.45) and albums for £7.99 ($14.40). "The price has been set by Apple and it's been set very low, so the margins are very slim," says Ovum analyst Michele Mackenzie.

The operators know that and are pursuing a different strategy. They figure mobile downloads are most likely to be impulse purchases—a user hears a song and wants it now. Sony Ericsson already sells technology allowing users to record part of a song they hear on the street, then instantly get information about the artist by connecting to the Internet and conducting a search.

The Japanese market suggests that Vodafone's Kershaw may be right about the potential for over-the-air music sales. Already, Japanese consumers download more songs onto their mobile phones then they do to PCs. As European mobile-download services become more competitive in price, convenience, and sound quality, Apple could start to lose market share. "The benefit Vodafone and competitors can bring is that we're connected all the time. That gives us enormous power," Kershaw says.

The mobile-service providers are also learning fast about the download market. They realized early on, for example, that cell phone users didn't want to buy songs they could only store and play on their phones. So services such as Deutsche Telekom's Musicload let customers buy a track or album for their phone, then separately download a copy onto a PC at no extra charge. Customers are allowed to burn songs onto CDs as well as storing them inside their phone.

Apple still beats music phones on memory and battery life. The phones are getting better fast, though. Nokia's N91, which costs about $600 before operator subsidies, can hold 3,000 songs and play for 10 hours. By comparison, the top-of-the-line 60 GB iPod, which costs $399, holds 15,000 songs and plays for 20 hours on a charge.

"These kinds of smart phones begin to deliver a really compelling music experience," says Thomas Husson, an analyst at Jupiter Research in Paris. Nokia does not release sales figures for the N91, but the company is "selling everything we can produce," says Jonas Geust, Nokia vice-president for music.

And of course a phone-music-player is also a phone, not to mention a digital camera, Web browser, alarm clock, and portable game player (see BusinessWeek.com, 4/14/06, “Mobile Phone Bonanza”).

"There will still be a market for MP3 players just as there is still a market for digital cameras," says Steve Walker, vice-president for product marketing at Sony Ericsson in London. "But there is a segment of the market that sees one device with two functions as an advantage."