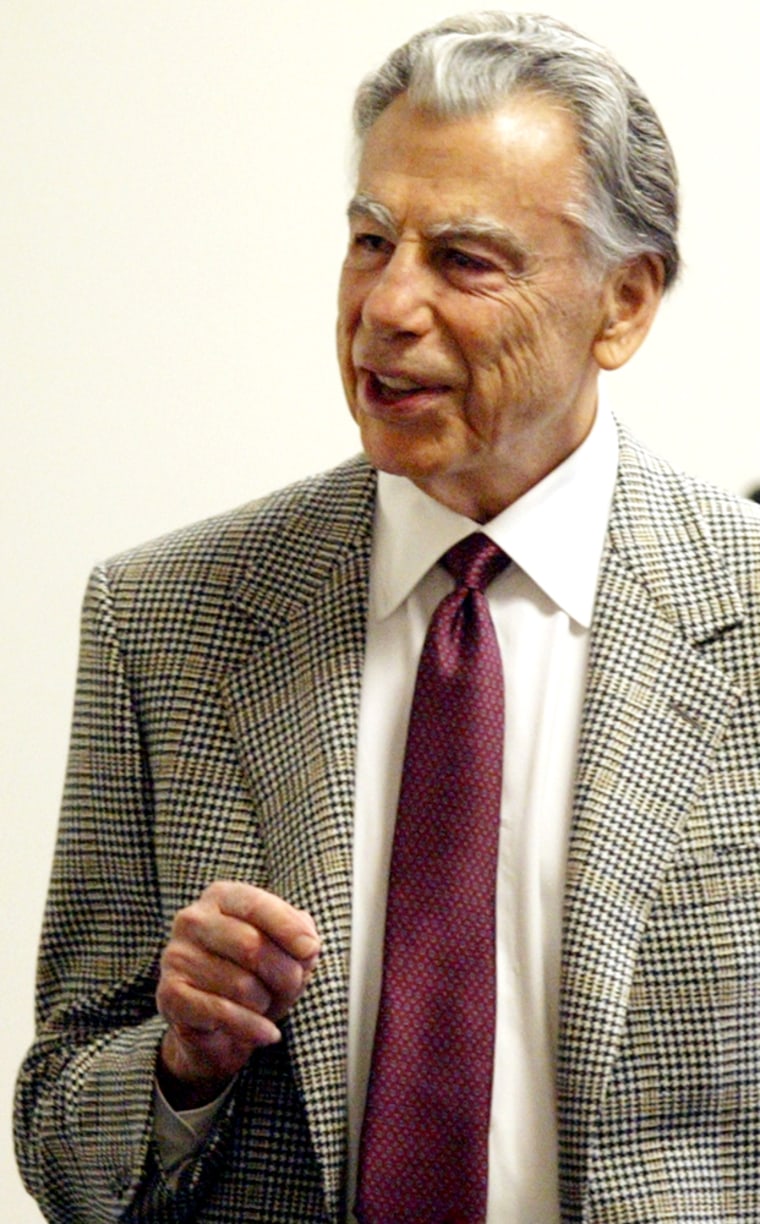

Just when things were starting to look up for General Motors, the ailing automaker finds itself in a fight with an 89-year-old former amateur boxer with a mean right hook.

Billionaire investor Kirk Kerkorian who owns nearly 10 percent of GM and was known in his fighting days as “Rifle Right,” hit back at the automaker recently after the company said it would abandon talks about an alliance with France’s Renault and Japan’s Nissan. Kerkorian abruptly canceled a plan to boost his stake in GM and recalled Jerome York, a representative from his Tracinda investment vehicle, from GM’s board.

Kerkorian, who made his fortune investing in Las Vegas property and began snapping up GM shares just last year, was a major proponent of the alliance with Nissan, Renault and their charismatic CEO Carlos Ghosn. After considering the plan for nearly three months, GM rebuffed its largest shareholder and announced that there would be no deal.

The stage is now set for Kerkorian to either beat a retreat and sell his stake in GM, or dig in and wage all-out war with GM, its board and chief executive Rick Wagoner. Kerkorian’s options include a proxy fight, in which he would attempt to gather support from enough shareholders to force management changes, or a hostile takeover bid.

With his 9.9 percent stake in GM worth $1.6 billion, Kerkorian is unlikely to “go quietly into the night,” said Kevin Reale, research director for AMR Research, an industry consulting company.

York’s departure from the board “sends a message that we could see a proxy fight or a takeover,” Reale said. “York not being on the board frees up Kerkorian and Tracinda from the regulatory restrictions that come from having an insider at the company.”

Institutional Shareholder Services, which advises on proxy votes, sees a growing chance that Kerkorian will challenge the GM board in a proxy fight.

When Jerome York resigned from the GM board he did not disguise his annoyance, citing his “grave reservations” about the company’s business model, contending in a resignation letter that the environment in the company’s boardroom was not receptive to new ideas. He was also critical of GM’s decision not to bring in outside advisers to evaluate the potential alliance with Renault and Nissan.

The tone of York’s resignation letter suggests he is setting the stage for an eventual showdown with management, according to an ISS research note.

“One of the first arguments dissidents who run proxy fights make is that the board has failed in its oversight of management,” ISS said in its note. “Mr. York's resignation letter is a roadmap of a potential line of argument Mr. Kerkorian may make to shareholders in the future.”

But ISS noted that “the best defense to a proxy fight is a strong share price.” GM has been among the Dow’s best performers this year, up nearly 70 percent from its close last year, when it was near a 25-year low.

Much now depends on GM’s third-quarter earnings report, due for release Oct. 25. Even though analysts think GM’s turnaround plan — which includes massive job reductions and plant closures — is not nearly complete, there are rumors that the company’s profit report will be better than expected.

An upbeat earnings report would benefit Wagoner as a stamp of approval of his stewardship of the turnaround plan, effectively warding off any challenges, Reale said.

“This would be a positive sign of what Wagoner can do with GM,” Reale said. “If the company’s doing well, why would major shareholders offer votes open to Kerkorian?”

Many auto industry observers agree that Wagoner and his management team are on track with their plan to shrink the Detroit automaker, which has struggled to stem its massive losses amid slow sales of trucks and SUVs.

“Things are looking brighter at GM — they are more on target than they have been in decades,” said Jack Nerad, editorial director and executive market analyst for Kelley Blue Book, which tracks the industry. “So we are really seeing a resurgence, particularly when it comes to their new products. There’s an absence of defects, and I’m very impressed with the new large SUVs — the Tahoe, the Escalade and the Yukon are great products for that segment.”

But Kerkorian is known as a tenacious and active investor, determined to influence the companies in which he invests. A decade ago he stunned Detroit when he made a failed takeover bid for the then-independent automaker Chrysler.

GM appears to be preparing for a similarly hostile advance. The company recently made changes to its by-laws to provide an early warning of any shareholder revolt. The changes effectively make it harder for someone like Kerkorian to pull off a takeover bid without first notifying GM’s board.

And The Detroit News reports that GM has retained two heavyweight investment banks, Goldman Sachs and Morgan Stanley, to help prepare for a Kerkorian-led proxy fight or other hostile action.