Carlos Gomez could be the recording industry's ideal mobile music customer.

His phone is his music player of choice and he spends about $100 a month buying songs for it — often on impulse after hearing a tune on his car radio.

That's why he's not buying an iPhone.

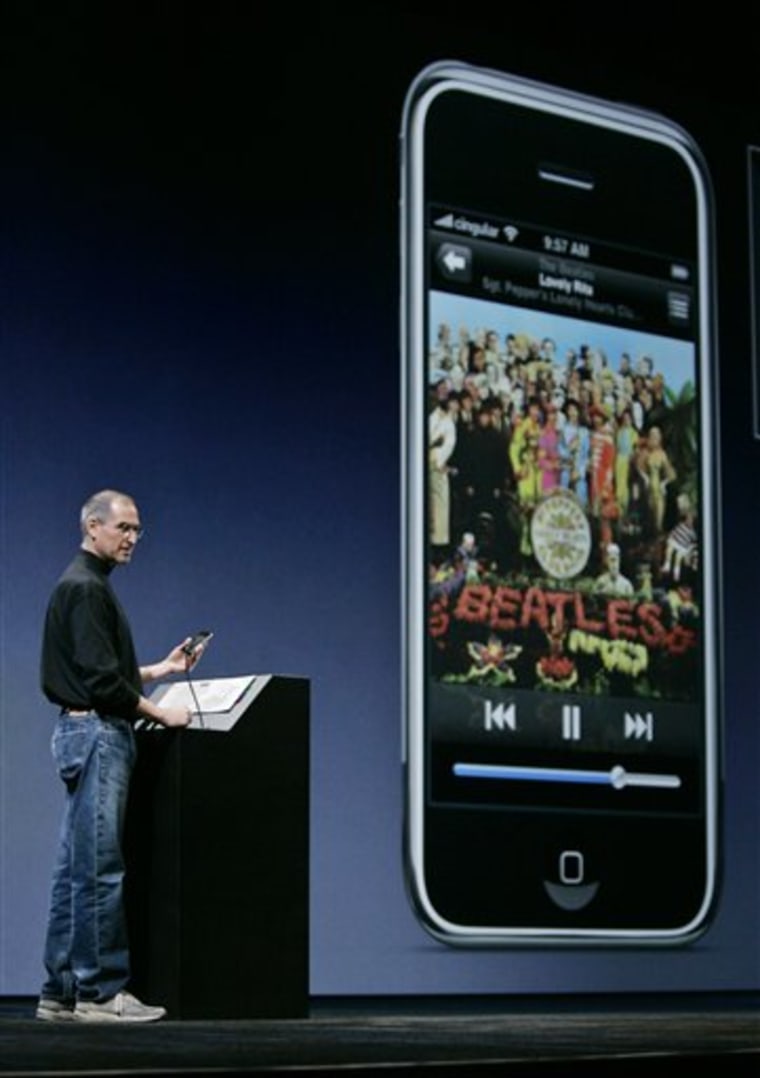

It's not that he doesn't want one. The 24-year-old office clerk is mesmerized by the look and feel of Apple Inc.'s uber-sleek new phone that's a combination cell phone, iPod media player and Web-browsing gadget. He particularly likes its touch-screen navigation.

But Gomez says he won't buy the handset because users can't use it to buy and download music over a wireless network.

Instead, iPhone owners will have to buy music via their computers and then download it to their phones, a process called side-loading.

"I'm not the type of person that likes to wait until I get home," Gomez said. "If I hear it, I want it there and then."

The arrival of the iPhone on Friday has stoked optimism among some music company executives that it will usher in a new wave of easier-to-use mobile music devices or even entice more people into embracing the phone as music player — and into buying more music.

"The introduction of the iPhone is an enormously positive event," said Warner Music Group Corp. CEO Edgar Bronfman Jr. at a conference earlier this month in New York. "It creates more and more consumers who are looking to buy music, but it also galvanizes the mobile industry to compete."

Some analysts, however, say mobile music sales will be dampened as long as users are limited to loading music on their phones via their PCs and Macintosh computers, and blocked from buying music wirelessly.

"The whole idea of on-the-go instant gratification isn't there," said Ted Cohen, managing partner of media consulting firm Tag Strategic.

Currently, Sprint and Verizon Wireless are the only wireless network operators in the U.S. who directly sell full-track downloads for mobile phones, a process referred to as over-the-air downloads. Even so, they trail Apple's iTunes Music Store in digital music sales.

In all, about 386 million digital tracks so far this year have been purchased online or downloaded over-the-air in the U.S., according to Nielsen Mobile. The firm does not break out figures for over-the-air purchases.

About 4 percent of all mobile phone users in the U.S. and 27 percent of those with MP3-capable handsets side-loaded music onto their phones in the first quarter of this year, according to a survey by research firm The NPD Group.

In contrast, just under 1 percent of all wireless subscribers and nearly 6 percent of those with music-player phones downloaded music over-the-air in the same period, the firm said.

AT&T Inc. is the exclusive service provider for the iPhone. Its customers can download ringtones wirelessly but not music tracks. Subscribers with AT&T and other carriers have the option to buy full-length tracks through their phones from digital music retailers such as Napster Inc., but the songs are downloaded to their PCs.

Some analysts say iPhone will keep customers coming back to the iTunes store.

"Apple doesn't really believe, at least so far, in the model of purchasing music on the go," said Charles Golvin, principal mobile analyst for Forrester Research.

"The model that Apple has very steadfastly held to is that your PC or your Mac is the interface for browsing and discovering and purchasing content," he said.

Still, Golvin doesn't expect the iPhone to have much of an impact on iTunes sales.

"I imagine most of the people who'll buy the iPhone will be iPod users already," he said.

Some industry watchers say consumers haven't shown a clear preference for buying mobile music wirelessly.

"Most of the music on phones today is side-loaded," said Dan Cryan, digital music analyst for Screen Digest, a market research firm. "Over-the-air has not proved to be overly popular so far."

One reason is that wireless carriers have traditionally charged more for music downloaded directly to phones — sometimes more than twice the usual 99-cent cost of a track bought using a computer.

Many early music phones have also had small screens, which make for cumbersome navigation through music store menus.

Apple spokeswoman Jennifer Bowcock declined to comment, though the company has posted an online video that shows how the song library can be easily accessed by swiping a finger over the touch screen. In fact, nearly every aspect of the phone is controlled via the screen.

As mobile phones become more sophisticated, the devices represent an increasingly tantalizing revenue opportunity for cash-hungry record labels and digital music retailers.

Early phones could only hold rudimentary monophonic ringtones — simple jingle renditions of recorded songs. Now, phones that play CD-quality music, video and games are common.

As network speeds increase, Internet-capable phones are being used for a number of functions, including streaming radio and TV broadcasts and exchanging instant message with computer users. IPhone users will be able to wirelessly stream videos from YouTube.

As a mere portable music player, the iPhone has far less storage than many higher-end iPods or other standalone portable music players. A 4-gigabyte version costs $499, while an 8-gigabyte model costs $599.

Its bigger screen and touch-screen navigation are seen by many as a step in the right direction for the mobile phone industry, which has often been accused of churning out gadgets that are too cumbersome.

"They're still complicated to use in terms of accessing and downloading music," Bronfman said.

Another drawback is that the speed of wireless networks in the U.S. lags those in other parts of the world, such as Asia and Europe, he said.

At a wireless industry conference earlier this year, EMI Group PLC CEO Eric Nicoli said his company remains open to either the side-loading of tracks purchased online or direct, over-the-air music sales, among other business models.

"We'll try anything and everything, recognizing that the consumer will ultimately decide."