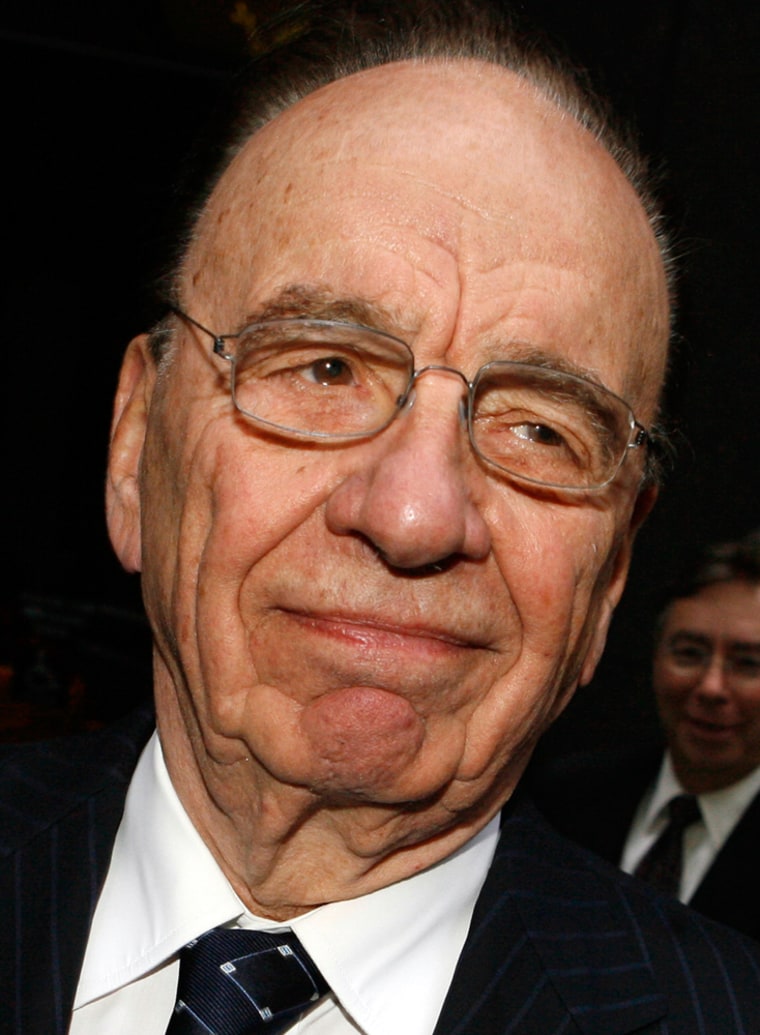

The fate of Dow Jones & Co. now rests with the Bancroft family, the company’s longtime controlling shareholders, who must decide whether to sell the publisher of The Wall Street Journal to Rupert Murdoch’s News Corp., a global media conglomerate that owns Twentieth Century Fox and the Fox News Channel.

The board of Dow Jones said late Tuesday it was ready to sign off on Murdoch’s proposal to buy the company for $5 billion. However, the key remains with the Bancroft family, whose three dozen members have been deeply divided over whether to sell to Murdoch. The are expected to meet Monday to discuss the deal.

Dow Jones wound up agreeing to Murdoch’s initial offer without a last-minute price increase, as efforts by some board members and a union representing Wall Street Journal reporters failed to come up with viable alternatives to Murdoch’s $60-per-share bid, which represents a premium of about 65 percent over where Dow Jones shares were trading before the offer became public in early May.

Predicting Bancrofts hard

If the Bancrofts do sink the deal, it would surely result in a sharp drop in Dow Jones shares and the likelihood of shareholder lawsuits.

Predicting how the Bancrofts will vote has been difficult. The family has controlled the storied newspaper publisher for more than a century and views it as a public trust.

Family members have been concerned about the potential of the Journal’s coverage to be affected by corporate interests, and they initially rebuffed Murdoch’s offer, only to reconsider later. They insisted on, and received, a commitment to create an oversight board which must approve the hiring or firing of top editors at the Journal.

Dow Jones said in its statement that News Corp. was prepared to move ahead with a deal provided that a “satisfactory” level of votes controlled by the Bancrofts is committed to endorsing the deal “promptly,” but News Corp. didn’t indicate what level of voting it would consider sufficient, and a News Corp. spokesman declined to elaborate.

Together, the Bancroft family controls 64 percent of the shareholder vote. Since many institutional investors are likely to support a sale, News Corp. doesn’t need all of the Bancrofts to endorse the deal, perhaps just enough of them to provide about half of the family’s voting power.

Two Bancroft family members who are also Dow Jones directors have been seeking to thwart Murdoch’s efforts, but neither appeared close to succeeding.

Trying to block sale

Christopher Bancroft has reached out to investors to buy enough shares of Dow Jones to block a sale, and Leslie Hill has been trying to find other buyers, according to the Journal. Bancroft didn’t return a call for comment, and no phone number was listed for Hill.

The Journal reported on its Web site that Bancroft left Tuesday night’s board meeting early and that Hill abstained from the vote, as did another board member, German publishing executive Dieter von Holtzbrinck. A Dow Jones spokeswoman declined to comment.

Jim Ottaway Jr., a former Dow Jones board member, has also been a vocal opponent to the deal, saying he’s concerned about the Journal’s newsroom remaining independent. Ottaway said in an interview Tuesday that he and his brother David, who together control about 7 percent of the vote, would oppose Murdoch.

“If the Bancroft family decides to sell Dow Jones, it should find a better buyer and a better home for one of the great journalistic institutions of our society,” Ottaway said.

Murdoch has said concerns he would meddle with the Journal’s coverage are unwarranted. He has been mainly silent about how the process is going but expressed frustration about the drawn-out negotiations last week, telling The Associated Press at a conference for media CEOs in Idaho that the Bancrofts “keep changing their minds.”

News Corp. said in a statement Tuesday night it was “grateful” to Dow Jones’ board for its “strong vote of support” in favor of its offer.

Long wanted Journal

Murdoch has long wanted to own the Journal, along with its clout on Wall Street and a history of outstanding journalism. He has said he would invest in the Journal’s online and overseas operations and help build a business-themed cable news channel that would rival General Electric Co.’s highly profitable CNBC network.

Even with the fate of Dow Jones undecided, News Corp. set a date last week for the new business channel to launch in October, apparently regardless of whether a sale of Dow Jones goes through.

News Corp. also owns the Fox broadcast network, the online social networking site MySpace, the New York Post, and other newspapers in the United Kingdom and Murdoch’s native Australia.

Besides the Journal, Dow Jones also owns Dow Jones Newswires, the Factiva news database, Barron’s, a group of community newspapers and several well-known stock market indicators including the Dow Jones industrial average.

Despite its clout in the business world, Dow Jones remains a relatively small player among media companies and many have wondered whether it can remain independent.

Its electronic financial news service Dow Jones Newswires faces even tougher competition now that two of its main competitors, Reuters Group PLC and Thomson Corp., have agreed to combine. The first reports of that deal emerged just days after the Bancrofts initially turned down Murdoch’s approach.

The Bancroft family members own one-quarter of Dow Jones but have control of the shareholder vote through a special class of shares that have 10 votes each versus one vote for every publicly held share.

The family members are descended from Clarence Barron, a Dow Jones correspondent who bought control of the company in 1902. Over the years, family ties to Dow Jones have become more remote, and no Bancroft is involved in its day-to-day operations, unlike other family-controlled newspaper companies such as The New York Times Co. and The Washington Post Co.