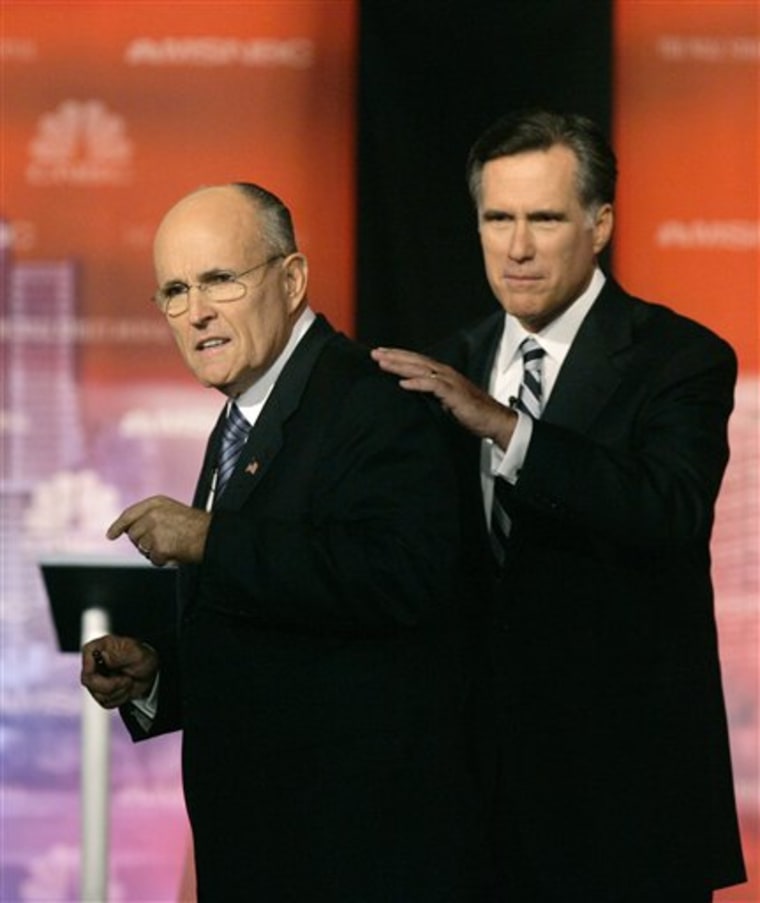

Rudy Giuliani and Mitt Romney used a classic Republican argument when they clashed in this week's presidential debate: I'm a big tax-cutter, and the other guy isn't.

In office, Giuliani had the most success.

While mayor of New York, Giuliani pushed through billions of dollars in tax cuts. Romney, as governor of Massachusetts, tried to cut millions but largely failed.

"If you look at their respective records in office, both Mayor Giuliani and Mitt Romney advocated for lower taxes, but Mayor Giuliani was more successful in getting it done," said Pat Toomey, a former Pennsylvania congressman who heads the anti-tax Club for Growth.

In some respects, the two men have similar histories. Both faced hostile environments when they took office. New York's city council and both chambers of the Massachusetts Legislature were controlled by Democrats.

Both inherited budget deficits requiring immediate spending cuts or tax increases, and both managed to cut spending and resist raising taxes.

Both also sought tax cuts. In New York, Giuliani managed to reduce income taxes, sales taxes, hotel taxes, commercial rent taxes and co-op and condo taxes, among others. The city cut taxes by 7 percent or 8 percent, according to the city's Independent Budget Office and the Citizens Budget Commission.

Giuliani's estimate is that his tax cuts totaled $9 billion; the commission puts the total at $5.8 billion.

One reason for the discrepancy is that the commission credits state lawmakers, not Giuliani, with an income tax reduction. Giuliani aides say that's silly and that he lobbied hard for the cut.

In Tuesday's debate, Giuliani said: "I controlled taxes. I brought taxes down by 17 percent. Under him, taxes went up 11 percent per capita. I led; he lagged."

Giuliani was referring to the tax burden on individuals in New York and Massachusetts, relying on federal and city estimates. Romney's campaign says it's unfair to use the figure because it includes 2002, before he took office.

Romney said Giuliani was talking baloney.

"Mayor, you've got to check your facts. No taxes - I did not increase taxes in Massachusetts. I lowered taxes," Romney said.

Romney's record is mixed. In Massachusetts, he tried repeatedly to cut state income taxes from 5.3 percent to 5 percent, a reduction that would have been worth hundreds of millions of dollars annually, but he was rebuffed by state lawmakers.

He did manage to get one-year rebates of $275 million by persuading lawmakers to give back retroactive capital gains taxes. The increase had been approved before Romney took office.

Romney also pushed through tax credits for investment, manufacturing and research, sales tax holidays and property tax relief for older people.

State lawmakers also rebuffed Romney's efforts to cut spending, resulting in another approach - Romney increased fines and fees, such as higher prices for golfing or boating. And he made businesses pay more by closing loopholes they had been using to lower their taxes. By some estimates, the fines and tax revenue totaled some $700 million.

Romney said in the debate that Giuliani fought to keep tax revenues coming to New York with a tax on commuters living outside the city, "which was a very substantial tax, an almost $400 million tax on commuters coming into New York."

Giuliani aides said Romney also increased taxes for workers who lived outside Massachusetts.

Romney advertises that he has signed a pledge not to raise taxes, which Giuliani has refused to do. Giuliani's campaign points out Romney refused to sign a no-new-taxes pledge in 2002.

The two also argued over spending. Romney has been criticizing Giuliani because the mayor fought to eliminate a line-item veto, which a president can use to reject specific spending items.

After Congress gave President Clinton the line-item veto in 1996, and Clinton used it to keep New York from raising taxes on hospitals, Giuliani filed a lawsuit that resulted in a Supreme Court ruling that the line-item veto was unconstitutional.

"I'm in favor of the line-item veto," Romney said in the debate. "I'd have never gone to the Supreme Court and said it's unconstitutional."

Toomey, of the Club for Growth, says the candidates "were both pretty good on spending."

"They both cut spending in the early years and let spending grow in the later years," he said. "On balance, they were much better than most big-city mayors and most governors, so they both did a reasonably good job on the spending front."