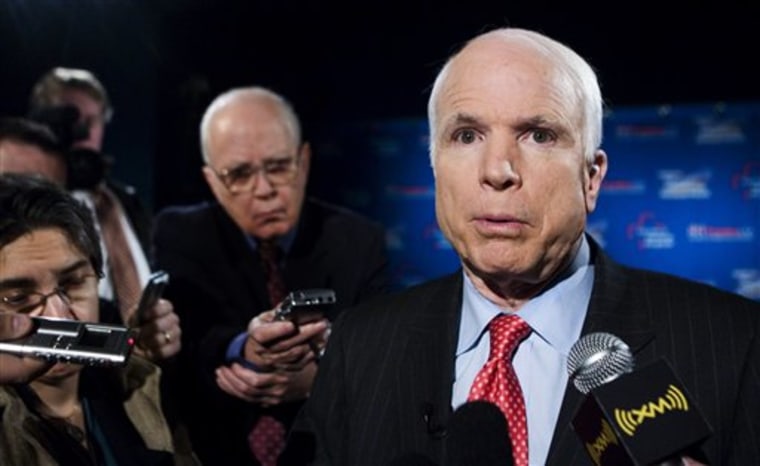

John McCain clarified an element of his health care plan, saying that employers who provide their workers coverage still would get tax breaks.

The Republican presidential candidate said that has been the case since he first announced his proposal three weeks ago, and he apologized for any confusion.

At the time, aides indicated that to help pay for the sweeping reforms, McCain would end a provision in the tax code that allows employers to deduct the cost of health care from their taxable earnings.

But, McCain told a health care forum sponsored by the Kaiser Family Foundation: "There's no reason for us to remove the employer tax incentive. I think that should stay exactly as it is."

Employer tax incentive

Rather, he said his plan calls for getting rid of what he views as the bias toward employer-sponsored insurance by changing the code as it relates to individuals who have employer-sponsored insurance.

Afterward, McCain explained to reporters: "The employer tax deduction stays in place so the employer still has the incentive to provide health insurance to the employee, but the employee now loses the health tax incentive and it is replaced by the refundable tax credit."

He said that was the way his plan always has been, and added: "I'm sorry if there was any misunderstanding."

The details

Under the plan, employees who have employer-provided health insurance would be taxed on the portion of their coverage that their employer pays. Aides say those costs would be offset by providing tax credits of $2,500 to individuals and $5,000 to families. They said low-income and middle-income people would benefit from the changes the most, while people in the top tax bracket and whose employers pay $15,000 or more of their health insurance costs would break even or pay higher taxes.

During the forum, McCain also defended his opposition to Democratic calls for requiring all people to carry insurance and the absence of a proposal for universal coverage in his plan, saying: "I don't think that there should be a mandate for every American to have health insurance."

Asked about his rivals' plans, McCain called those offered by Rudy Giuliani and Mitt Romney not as comprehensive or as oriented toward critical problems as his plan.