The verb “googling” has become synonymous with Internet searches, a fact that speaks to Google’s dominance. But don’t expect the verb “msn-yahooing” to become part of the lexicon anytime soon.

Even with the $44.6 billion bid by Microsoft Corp. to buy Yahoo Inc., the combined company would be unable to knock Google Inc. off its web search and web advertising throne, industry watchers say.

“It’s going to be awfully hard to take two complex companies that are trailing, put them together to beat a company that has the tremendous momentum of Google,” says Bob Monroe, associate teaching professor in information technology and computer science at the Tepper School of Business at Carnegie Mellon in Pittsburgh, PA.

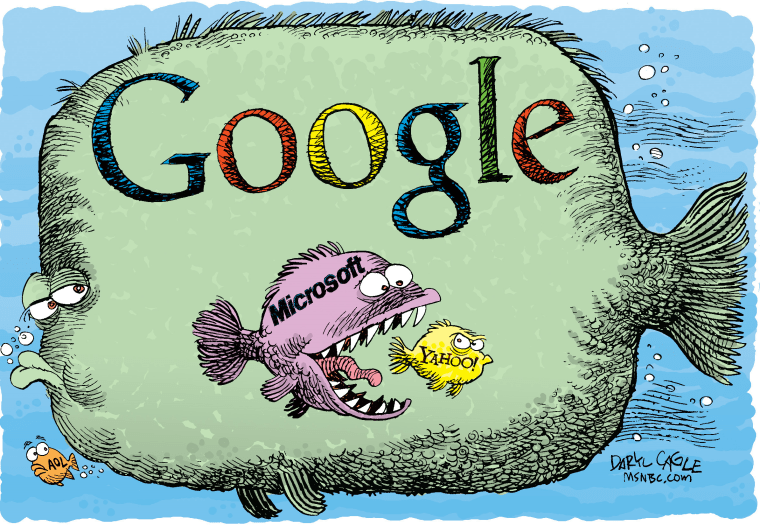

Indeed, even a merged Microsoft and Yahoo would still be dwarfed by Google. The web giant holds nearly 60 percent of the Internet search market share, compared to what would be a 33 percent stake for the combined Microsoft-Yahoo.

But the deal would go a long way in helping the two companies in their battle for the lucrative Internet advertising space that is expected to explode in the next decade. “I think this deal is a no brainer,” says Rich Munarriz, senior analyst of media and technology at The Motley Fool. They need to marry, he explains, because alone they would be unable to at least give Google a run for its money.

“Even with Yahoo on Microsoft’s shoulders, the company would still come up to Google’s belly button,” he quips.

While the deal makes sense to many technology analysts, most agree there will be challenges.

First off, is the issue of combining two very different cultures. Yahoo is seen by many as more cutting-edge and creative, compared to Microsoft’s more business-like image. Bringing together two very different workforces will be a challenge, says Andy Zaleta, a partner in the technology practice at recruiting firm Battalia Winston.

Employees at firms that are acquired – in this case Yahoo – are typically the ones whose jobs are most threatened, Zaleta says. But, he points out, Microsoft has already reached out to software developers at Yahoo, offering them retention packages if the deal goes through.

So that means, upper level management and those outside of the engineering sphere, he adds, may have the most to lose if such a deal goes through.

As far as regulatory hurdles, most analysts believe the deal will have little problem getting past a U.S. Justice Department review because even merged the company would be no where near the size of Google in the Internet search space.

But in Europe, the battle may be harder to win.

It’s hard to predict exactly what the European Community will do, but Jonathan Yarmis, an analyst with AMR Research, says it will all come down to “who the EC hates more: Microsoft or Google.”

“They hate anything that strengthens Microsoft but there is also growing concern over anything that strengthens Google,” he notes.

Microsoft shareholders might not be that happy with the prospect either.

Anant Sundaram, finance professor at the Tuck School of Business at Dartmouth in Hanover, N.H., says, “This is a great deal for Yahoo's shareholders, but an iffy one for Microsoft's shareholders.”

“The $31 per share offer by Microsoft for Yahoo, for a total valuation of $44.6 billion, seems like a substantial overpayment,” he explains. “While this valuation presumes revenue synergies from increased advertising and moves into newer areas such as video and mobile, as well as cost synergies from R and D efficiencies and other cost reductions, the 62 percent premium over yesterday's closing sets tough synergy goals to achieve.”

A tough economy will only make matters worse, he adds.

But Motley Fool’s Munarriz says it’s a move Microsoft had to make if the company was going to get in the Internet search and ad game with Google.

“You can’t compete with something like a Google but you can hold off the bleeding,” he explains. “Buying Yahoo is like a tourniquet for Microsoft."

The big surprise, Munarriz surmises, is if Yahoo says no to the offer.

There is no other publicly traded company that can afford the deal that Microsoft has put on the table, he says. While Google could make a bid for Yahoo, he adds, no regulator would ever go for such a combination because it would surely hinder competition in the search arena.

While all these Internet portals want people surfing the web to do searches on their websites, thus capturing the coveted eyeballs, the real money is in the advertising dollars businesses spend with Google, Microsoft and Yahoo in order to get to those eyeballs.

Google is clearly the leader in this regard. “Most people start their day out on the web by going to Google,” says Carnegie Mellon’s Monroe. Neither Yahoo nor Microsoft, he adds, “offers software or services that are significantly more compelling than Google.”

AMR’s Yarmis disagrees. He believes Microsoft has some decent technology that enables them to monetize traffic, but the problem is the software company just doesn’t have enough search traffic.

Outside of search, though, Google hasn’t been nearly as dominant.

Google’s web mail, for example, is still in beta and hasn’t been the mail powerhouse some analysts expected. Yahoo’s and Microsoft’s service, however, have done much better, Monroe says.

So if Microsoft and Yahoo can get it together and create a viable alternative to Google, companies that pay ad revenues to Google now may reap the benefits down the line when it comes to choice. “Advertisers are scared of Google’s growing power,” notes Yarmis.