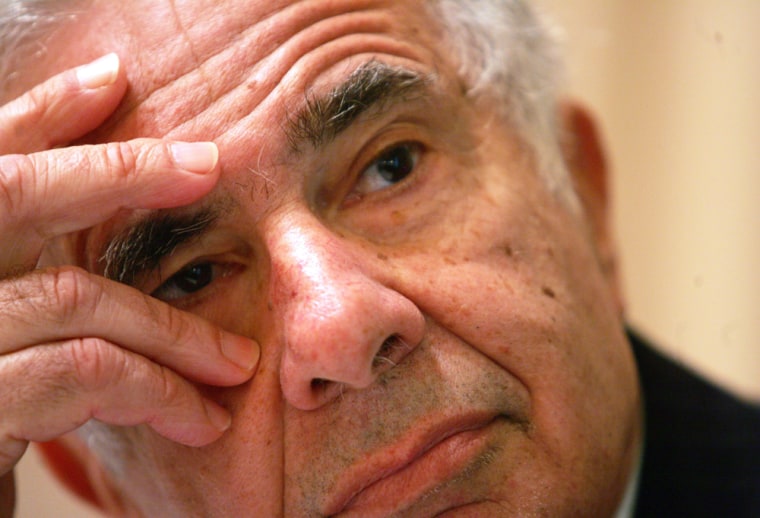

No one on Wall Street gets CEOs quaking like legendary shareholder activist Carl Icahn. That’s bad news for Yahoo chief executive Jerry Yang, following Icahn’s announcement that he is launching a proxy fight to oust the directors of the Internet company.

“Icahn is your worst nightmare,” says Mark Stevens, author of the book "King Icahn" and head of a management firm called MSCO. “He thinks of business like chess. He’s always 10 moves ahead, and he always wins.”

Beleaguered Yahoo investors appear certain to benefit, says Sanford Bernstein analyst Jeffrey Lindsay.

“There will be adult supervision at last,” he says. “Yahoo can’t live in a delusional bubble.”

Lindsay adds that the 10-member dissident board that Icahn has nominated to replace Yahoo’s board is a “good slate of directors.” They include heavy hitters like ex-Viacom CEO Frank Biondi, Internet billionaire Mark Cuban and a slew of business sharpshooters.

Already, Icahn’s entry into the Microsoft-Yahoo fray has spurred an uptick in Yahoo’s stock price, dubbed the “Icahn lift.” Icahn already owns about 59 million shares of Yahoo stock worth $1.6 billion and has notified antitrust regulators that he wants to buy much more. Typically, hedge funds pile in after Icahn, sending stock even higher and making the billionaire investor even richer.

Some insiders, frustrated that Microsoft's efforts to acquire Yahoo fell apart this month, are cheering Icahn’s white knight appearance. Few Yahoo shareholders, even fund managers, have the clout or ability to take on an activist role.

But Icahn is a powerful, relentless activist. The 72-year-old Princeton graduate ranks No. 46 on Forbes 2008 billionaire’s list with a fortune valued at nearly $15 billion. Always golden at making money, Icahn even paid for half his college tuition with money he won at poker.

He is a tight money manager known to drive old cars and use old tennis balls. When Stevens visited Icahn’s home once, the billionaire was using TWA soap he got when he took over the now-defunct airline in the 1980s.

Icahn’s investment track record is impressive. According to FactSet SharkWatch, Icahn has entered 18 proxy fights since 1994 and has won 10 of them. Proxy fights are notoriously difficult and expensive to win, but Icahn follows a simple method: He buys up a minority stake in a company he thinks is badly run. Then he humiliates management.

When Icahn took a run at Motorola, he took out a full-page ad in The Wall Street Journal that slammed Ed Zander, its CEO. Icahn has even called some CEOs morons. “He always felt the Ivy League was looking down on him,” says Stevens, adding that Icahn is a workaholic. “He has never forgotten that.”

Then Icahn begins making demands. With Yahoo, he has said that its board of directors acted “irrationally and lost the faith of shareholders.” He wants to replace Yahoo’s 10-member board with his own at Yahoo’s annual meeting July 3.

So far, some Yahoo shareholders are lining up with Icahn. The hedge fund Paulson & Co., which owns 50 million share of Yahoo, plans to vote for Icahn’s list of directors. And The Jacob Internet Fund, which holds 100,000 share of Yahoo stock also backs Icahn.

“This is a unique opportunity, where Icahn can put pressure on Yahoo,” says Ryan Jacob, the co-manager of the fund. “Shareholders weren’t properly represented.” He thinks that Icahn has a 50-50 chance of prevailing over Yahoo’s board.

Not that Icahn always wins. When Icahn took on Time Warner in 2006, he failed to get all his demands met, including breaking up Time Warner into four parts. However, Icahn still reportedly owns Time Warner shares.

“He doesn’t stop,” says Stevens. “He’s like a Chinese water torture machine. He’s missed a couple of times, but he never goes away.”

One thing is certain: Icahn always forces change. “Yahoo isn’t going to be the same,” says Stevens, who thinks that Icahn may succeed in wooing Microsoft CEO Steve Ballmer back to Yahoo with a revived bid.

“He’ll make Ballmer look like a wimp, though,” says Stevens. Bernstein's Lindsay sees Icahn as a “welcome light” for Yahoo, helping create a “quick, clean takeover.”

What are Yang’s options? “He’d want to have Warren Buffet or Rupert Murdoch on his side,” says Stevens. “They don’t mess with each other.”

Meanwhile, in March Google sailed past Yahoo to become the most popular U.S. Web site, according to ComScore.

As for fund manager Ryan Jacob, he laments having sold 50,000 shares of Yahoo after the Microsoft deal fell apart. “Wish I’d held it,” he says.