As if homebuilders didn't have enough to worry about with plunging home prices and rising foreclosures, the surge in oil prices is driving up the cost of key construction materials and further eroding homebuyers' confidence.

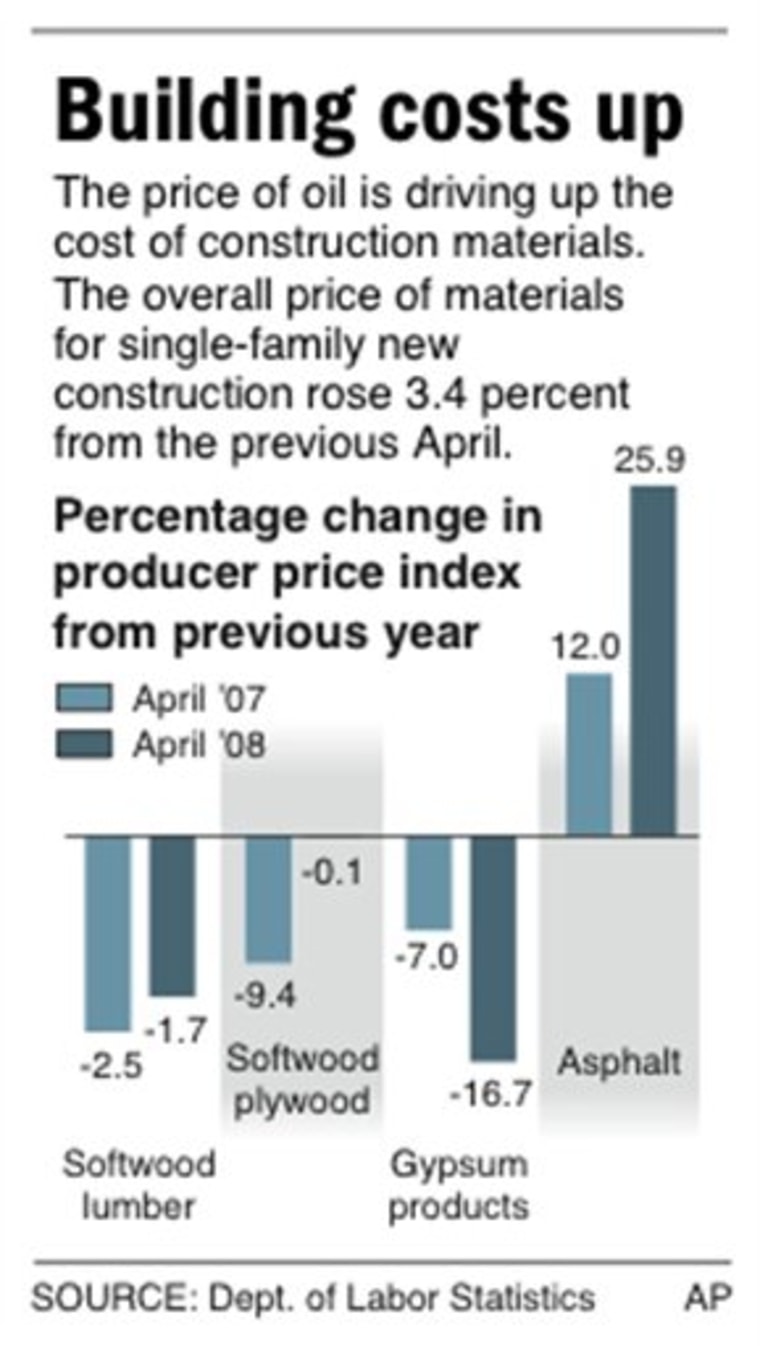

Prices have gone up for steel, aluminum, copper, concrete, brick, asphalt and plumbing fixtures, among other materials, and homebuilders are feeling pressure from suppliers to foot the bill. In sum, the wholesale cost of building materials for new home construction rose 3.4 percent overall in April from a year earlier, according to the Labor Department.

"Any material that is petroleum-based or transportation-intensive will have pricing pressure during periods of rising oil prices," said Tony Callahan, senior vice president of Purchasing, Planning & Design for Atlanta-based Beazer Homes USA Inc. "Manufacturers are trying to push cost increases through for materials like asphalt roof shingles, carpet, insulation."

The price increases represent another hurdle for homebuilders, which already are reeling from 40 percent buyer cancellation rates and billions of dollars in write downs on undeveloped land. The companies are already struggling through the second year of a housing bust that some industry analysts say isn't likely to improve before 2010.

Earlier this week, two rating agencies slashed the debt ratings for several builders. The debt of companies including Ryland, D.R. Horton and Centex has been branded as "junk." So on top of higher material costs, the builders will have to pay higher interest rates if they need to borrow more money.

Many builders have moved to slash costs by switching to less expensive materials like flooring and kitchen countertops, for example. They've also shifted to building smaller houses that cost less to build and can be offered at lower prices.

Callahan said Beazer is favoring suppliers who work to cut costs by reducing the number of trips to a job site, for example, or reducing how much of the material used in project is wasted.

During a conference call with Wall Street analysts last week, Toll Brothers Inc. CEO Robert Toll cracked wise when asked what steps the company was taking to reduce material costs amid rising oil prices.

"We're making trips to Saudi Arabia to try to get them to cut down the price of oil so that every other product that we use doesn't go up, but unfortunately, they haven't listened to us," Toll quipped.

The Horsham, Pa.-based luxury builder has seen prices rise for asphalt-based materials, concrete, steel and other commodities.

"Unfortunately, I think we'll be caught in a squeeze and those costs will go up a little bit, if not more than a little bit," Toll said.

Oil-related materials such asphalt, used in roofing, siding, and for paving driveways, have seen the biggest percentage jump in costs as oil prices have climbed.

Asphalt was up almost 26 percent in April from a year earlier. At the same time, diesel fuel, used by trucks and heavy machinery on construction sites, saw the biggest price spike in April — a jump of about 66 percent.

Of course, some products homebuilders need have fallen in price, including softwood lumber and gypsum, which is used to make drywall. The price of gypsum was down more than 16 percent in April, while softwood lumber declined nearly 12 percent.

During the boom years, heavy demand drove up prices for lumber, drywall, cement and other building materials. Now that home construction in many areas is near a standstill, suppliers have been forced to give back those price gains.

"The major public homebuilders have been trying to squeeze prices out of their suppliers and I think have been successful in doing that over the past 24 months or so," said Robert Rulla, homebuilding and building materials analyst for Fitch Ratings.

But if oil prices continue to surge, homebuilders may not be able to avoid higher costs. They also may have to tack those costs onto the purchase price of their homes and risk losing customers.

"Even though homebuilders would like to pass on the costs of these sorts of things, they cannot right now," said Joseph Snider, homebuilding analyst for Moody's Investors Service.

For now, higher oil prices may be hurting consumers more than homebuilders — but that still hurts homebuilders.

U.S. gas prices hit an average of $4.06 a gallon Thursday and many consumers are already paying close to $5 a gallon. That pocketbook pinch may persuade buyers they're too financially squeezed to buy a home, analysts say.

And to eroding consumer confidence add declining home prices and tighter mortgage lending.

"Those are much more critical than the effect of oil right now on the building products," Snider said. "That may change if oil keeps going up."