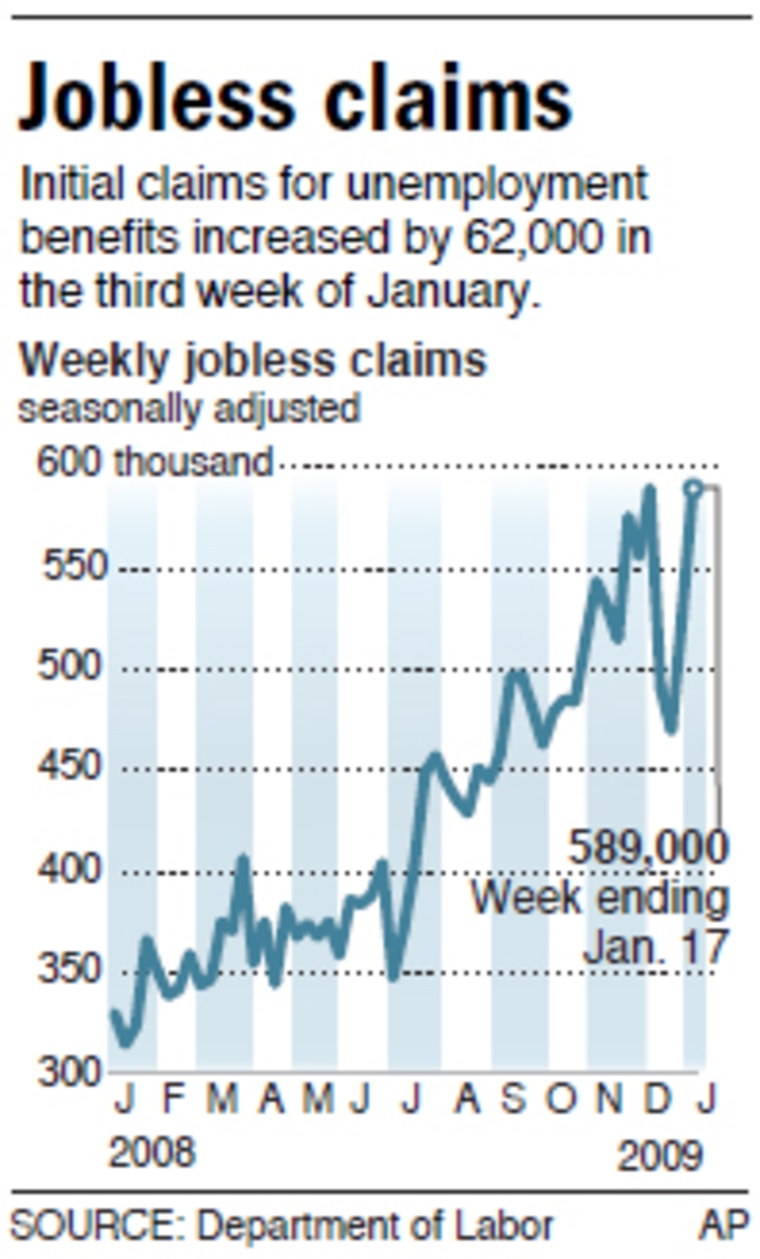

The number of new unemployment claims jumped more than expected last week, as companies continue to cut jobs at a furious pace and more Americans turn to an extended benefits program.

The Labor Department reported Thursday that initial jobless benefit claims rose to a seasonally adjusted 589,000 in the week ending Jan. 17, from an upwardly revised figure of 527,000 the previous week. The latest tally was well above Wall Street economists' expectations of 540,000 new claims.

The total matches a 26-year high reached four weeks ago. The last time claims were higher was in November 1982, when the economy was emerging from a steep recession, though the work force has grown by about half since then.

The increase is partly due to a backlog of claims that piled up in recent weeks in several states that experienced computer crashes due to a crush of applications, a Labor Department analyst said. The four-week average of claims, which smoothes out fluctuations, was 519,250, the same as the previous week.

But the layoffs continued Thursday. Microsoft Corp. said it will cut up to 5,000 jobs over the next 18 months as profit tumbles amid weakness in the personal computer market, and chemical maker Huntsman Corp. will slash 1,175 jobs this year, representing more than 9 percent of its work force, to reduce costs as demand slows amid the global economic downturn. Salt Lake City-based Huntsman also plans to cut an additional 490 contractors.

First-time jobless claims dipped over the holidays after reaching 589,000 in the week ending Dec. 20. Most economists attributed the decline to unusual seasonal factors, such as below-average holiday hiring by retailers due to the recession. That meant fewer workers were laid off afterward.

"It is clear from the latest numbers that the underlying trend in claims is still upwards," Ian Shepherdson, chief U.S. economist for High Frequency Economics, wrote in a research note. "We have no hope that the peak is anywhere near."

Another sign of the deepening recession came in a Commerce Department report that showed new home construction plunged 15.5 percent to a record low last month. Construction of new homes and apartments fell to an annual rate of 550,000 in December, below analysts' expectations of 610,000.

The report capped a miserable year for new home construction. Builders broke ground on 904,000 units last year, also the lowest since records began in 1959.

Meanwhile, rates on 30-year mortgages rose above 5 percent this week, ending a five-week run at record low levels, Freddie Mac reported. Average rates on 30-year fixed mortgages rose to 5.12 percent this week from 4.96 percent last week, which was the lowest since Freddie Mac started its survey in April 1971.

Wall Street moved sharply lower in response to the worse-than-expected economic data, concerns about the nation's banks and disappointing results from Microsoft. The Dow Jones industrial average lost more than 220 points in afternoon trading.

Emergency extension

The Labor Department report showed that the number of people continuing to seek jobless benefits rose by 97,000 to 4.6 million. That was above analysts' expectations of 4.55 million and up substantially from a year ago, when 2.7 million people were continuing to receive unemployment checks.

The Obama administration is proposing to extend jobless benefits, which typically last about six months, and overhaul the unemployment insurance system as part of an $825 billion stimulus package currently being considered in the House.

The weak job market has caused millions of laid off workers who have exhausted their unemployment insurance to seek benefits under an emergency federal extension of the program authorized by Congress last June.

More than 2 million Americans requested benefits under the extended program in the week ending Jan. 3, the most recent data available. That's in addition to the 4.6 million people covered under the regular unemployment insurance system, though the 2 million figure is not seasonally adjusted and is volatile.

Roughly 900,000 people sought benefits under the emergency program the week ending Nov. 29. The rapid increase since then is partly due to an extension of the program Congress approved Nov. 21, a Labor Department analyst said.

Overall, the large number of Americans continuing to receive benefits is an indication that many laid off workers are having difficulty finding new jobs.

Economists consider jobless claims a timely, if volatile, indicator of the health of the labor markets and broader economy. A year ago, initial claims stood at 324,000.

Companies from a range of sectors are hemorrhaging jobs amid a recession now in its second year. Consumers have dramatically cut back their spending, which accounts for about two-thirds of the economy, in response to declining home values and plummeting stock portfolios.

On Wednesday alone, at least four companies announced layoffs. Intel Corp. said it plans to cut up to 6,000 manufacturing jobs as the company struggles with lower demand for personal computers. United Airlines parent UAL Corp. said it would eliminate 1,000 jobs, on top of 1,500 it cut late last year. Industrial parts and systems maker Eaton Corp. said it is cutting 5,200 jobs, and airplane maker Hawker Beechcraft Corp. said it would eliminate workers after laying off 500 last year, though it didn't provide details.

Radio broadcaster Clear Channel Communications Inc., oil and gas company ConocoPhillips, and media company Time Warner Inc. also announced job cuts in the past week.