Chicago philanthropist Richard Kiphart contributed generously to Barack Obama's campaign and is glad he backed a winner.

But he's among many donors and recipients in the philanthropic world worrying that Obama's new tax proposals could deter future giving at a time when many nonprofits already are in crisis mode.

"I just think they're wrong on this," said Kiphart, a corporate finance executive at global investment firm William Blair & Company. "All these organizations are crying: 'Why are they doing this to us?'"

The proposed change "could be a disincentive to some donors who might further cap their gifts on account of the new limit," said Diana Aviv, president and CEO of Independent Sector, a coalition of 600 charities, foundations and corporate philanthropy programs. "This could be a problem for many struggling nonprofits vital to our communities that are already facing a very difficult fundraising environment."

Many wealthy Americans weren't shocked when Obama's budget proposal called for raising their income taxes. But there was surprise — and some alarm — over a separate proposal to limit the deductions that couples earning more than $250,000 can claim for charitable gifts.

Under the plan, a donor in the highest tax bracket would save $280 on a $1,000 charitable deduction, instead of $396.

Obama's budget director, Peter Orszag, says the change wouldn't occur until 2011, when the administration hopes a recovery will be under way, and there's a chance the proposal will die in Congress. But many in the nonprofit world are uneasy.

"This is a time of tremendous anxiety in the nonprofit sector," said Kathleen McCarthy, director of the Center for the Study of Philanthropy at City University of New York.

"A lot of these organizations are going to die in the next six or nine months," she said. "Saying you want to play around with the tax code only makes things worse psychologically."

$3.87 billion drop?

Nonprofit officials and philanthropy experts interviewed by The Associated Press agreed that tax consequences are a secondary factor for many donors.

"I would guess that most of the people who support the museum do so because they have a passion for our mission and not because of the tax breaks," said Tim Hallman, director of marketing and communications at San Francisco's Asian Art Museum.

But even if only a minority of donors were deterred by the tax change, it could affect billions of dollars in donations.

Using 2006 tax data, the most recent available, Indiana University's Center on Philanthropy estimated last month that giving by affluent households would have been 4.8 percent less if Obama's proposed higher taxes and deduction limits had been in effect — a drop of $3.87 billion.

Impact exaggerated?

Patrick Rooney, the center's interim executive director, said stock market gyrations have an even bigger impact on giving.

"Most people don't become donors or non-donors because of changes in the tax code," he said. "On the other hand, if you're living on your wealth and you've seen your stack of chips fall 50 percent in value, you're going to re-evaluate everything. You're not going to lose your house so you can keep making donations."

The Center on Budget and Policy Priorities, a nonpartisan research organization and policy institute, said Obama’s proposals would affect only the top 1.2 percent of affluent U.S. households and would reduce total charitable contributions by only 1.3 percent.

“This proposal has been attacked on the grounds that it would lead to substantial reductions in charitable contributions and hit charities at a time when they face increased need and decreased contributions due to the recession,” the center said in a statement. “Careful examination indicates that these criticisms are greatly exaggerated or wrong.”

In a blog post last week Orzag defended the tax increases and denied that it will have a drastic impact on charities.

"About 75 percent of overall contributions would not even be affected by the proposed income tax change — because the contributions come from individuals who would not be affected or from corporations or foundations not subject to the individual income tax," he wrote.

He also said the budget contains other proposed changes, such as retaining an estate tax, that "will create stronger incentives" for giving.

Darwinian moment

A Bank of America study released Wednesday found that 52 percent of wealthy Americans wouldn't change their contributions even if they received no charitable deductions at all. According to the study, 37 percent said their gifts would decrease somewhat; 10 percent said their gifts would decrease dramatically.

The study, based on responses from 700 wealthy households to a detailed questionnaire, asked about gifts made in 2007, before the recession, and did not ask how households would respond to the sort of reduced tax benefit that Obama proposes.

Claire Costello of Bank of America Philanthropic Management said a sense of crisis was prompting donors and nonprofits to think harder about such factors as efficiency and accountability.

"It's making everybody on both sides of the giving equation be more thoughtful," she said. "It's a Darwinian moment for the nonprofit sector."

Second thoughts

At Wesleyan University in Connecticut, the vice president for university relations, Barbara-Jan Wilson, said gifts so far this fiscal year were running ahead of last year. But she worries that next year will be worse as recession-scarred donors balk at making pledges.

Wilson doubts that deductions are a prime factor in motivating Wesleyan donors, yet also suggests that Obama's proposed changes "might send the wrong message."

"We want a tax code and tax laws that encourage philanthropy," she said.

Among the biggest recent donations to higher education was a $35 million gift to Indiana University's law school by alumnus Michael Maurer. The gift, for scholarships, had been long in the planning but was announced in December amid grim economic news.

Maurer, in a telephone interview, said the recession prompted "second thoughts, but not serious second thoughts" about his gift.

"I made a commitment," he said. "In the business world you keep your commitments."

Proposal short-lived?

Kimerly Rorschach, director of the Nasher Museum of Art on the Duke University campus in Durham, N.C., predicted Obama's tax proposals would have minimal effect.

"People give to organizations that they love and believe in and want to support," she said. "And they've been doing that since long before tax deductions existed."

Obama's idea of limiting tax deductions for the wealthy is running into opposition in his own party. Both chairmen of the tax-writing committees have indicated they are not keen on the plan.

Senate Finance Committee chairman Sen. Max Baucus, D-Mont., said that he is “especially concerned about the 28 percent limitation” on deductions, and is “wondering about viability of that provision.”

Ways and Means Committee Chairman Rep. Charles Rangel, D-N.Y., said Tuesday that he would "never want to adversely affect anything that is charitable or good."

Eric Kessler, who advises major donors and foundations for Arabella Philanthropic Investment Advisors, says the proposed limits would not likely immediately affect the behavior of the biggest donors, who tend to plot their giving strategically. "I think it has an effect over time, but I don’t think anybody’s going to pick up the paper tomorrow and say, let’s forgo our commitment to the local theater group," he told The Chronicle of Philanthropy.

But he says the caps could affect mid-range donors — say those who give in the $1,000 range — "who are less driven by strategy and for whom the deduction plays a significant role in their giving."

Doing the math

Victor Behar, 73, of Durham, who, along with his wife, Lenore, gives to the Nasher and other nonprofits, said the proposed changes would be unlikely to deter them. He said the overall state of the economy is a bigger problem.

"Our income is fairly fixed," he said. "It is dependent on what the stock market does, what the 401k does. If it continues to dwindle, we would be limited in what we would continue to give to. But that tax law change won't affect the way we give."

Kiphart, speaking at his Chicago office, said he was sure the tax proposal, if enacted, would curtail donations.

"People do factor deductions in, they just do," he said. "They're going to do the math."

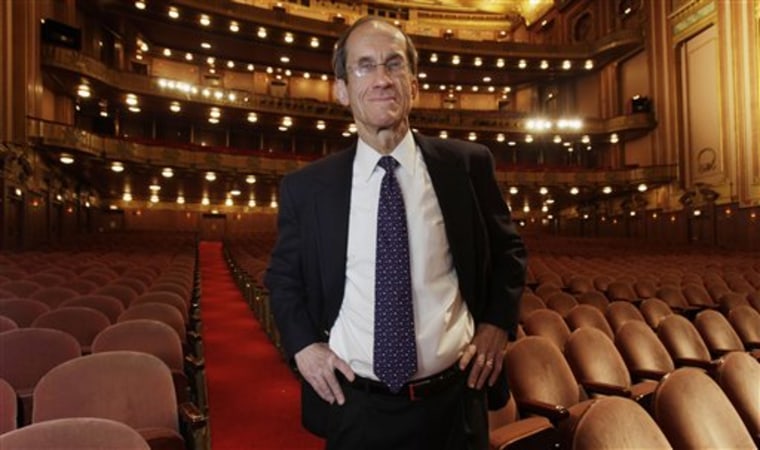

Kiphart — who said he gives several million dollars a year to many causes, from African aid programs to Chicago's Lyric Opera — wouldn't rule out giving less himself.

"I'm not going to stop giving, but it is a question of margins," he said. "Could it affect my giving by 10 percent? I'm not sure."

Even a modest drop-off could devastate many nonprofits that now barely break even, Kiphart said, citing Lyric Opera as an example.

Kiphart is president of the board of the opera, which gets 34 percent of its operating budget from donations.

"If we're off by 10 percent, we can make it for one year," he said. "But if it's more than one year, we will start to cut operas."

He said it wasn't just wealthy aficionados who'd be hurt — it would also be students, who get discounted tickets thanks to donations.

"You could say, hey, these people are rich, they don't deserve the deduction," he said. "But do you want to encourage them to give or not encourage them to give? Is it good that they're giving more of their income — or is it bad?"