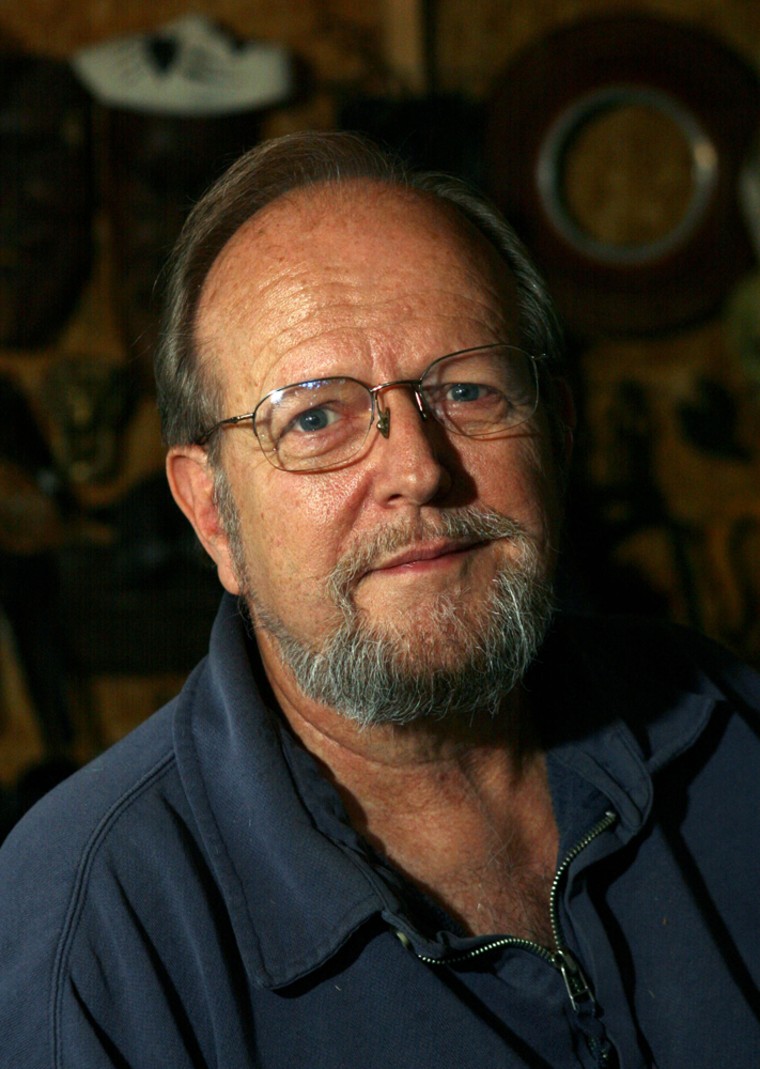

Richard H. Freund had it all planned out: He’d work until he was 70 and his wife, a psychotherapist, turned 62.

Then, he’d retire and rely on several sources of income to fund a life making artwork and traveling around the country in a trailer.

Those plans were upended last spring, when Freund, then 66, found out that he would be losing his job as a computer programmer in the housing industry, and faced what looked certain to be a difficult job search.

Although the financial tradeoff was wrenching — his annual income is now half what it was when he was working — he felt he had little choice but to retire.

“At my age and in this job market, I didn’t even consider unemployment. I just went straight to Social Security,” he said.

Until now, much of the attention in this recession has been focused on the group of older workers who will toil for more years than they expected because stock market losses have put a severe dent in their retirement nest egg.

Now, new research suggests that a larger group of workers ages 62 to 69 could find themselves with a thornier problem: No job, no prospect for finding another, and forced to retire earlier than they, or their finances, were prepared for.

“Those people, the risk that they’re subject to is not the stock market, it’s the labor market,” said Phillip Levine, a professor of economics at Wellesley College and co-author of a recent paper looking at that phenomenon.

Already, there are signs some older workers are falling into that trap.

Mark Hinkle, a spokesman with the Social Security Administration, said applications for retirement benefits for the fiscal year ended Sept. 30, 2009, rose 22 percent over the 2008 fiscal year, to 2.57 million. That’s much higher than the 15 percent increase that had been projected because of the increase in people hitting retirement age. Hinkle said the discrepancy can be attributed to the impact of the weak economy.

‘They’re different people’

Levine, the economics professor, said it’s true that more people ages 55 and older are in the work force than at the start of the recession, but that follows a long-term trend. History shows that some older workers — particularly those who are better educated and wealthier — can be expected to stay in the labor force longer as they try to boost their beleaguered stock portfolios.

But at the same time, he said, a look back at previous recessions suggests that another group of workers — who are more likely to be less well-educated and poorer — may lose their jobs in this recession and not be able to find new work. For those people, forced retirement will be the only option.

“You can think of both happening at the same time,” Levine said. “They’re different people.”

Based on historical trends, Levine predicts that the group of people who are forced out of the labor market because of the recession will be about 50 percent larger than the group who elects to stay in their jobs longer because of the stock market crash.

Being forced to retire earlier than you want to can have serious economic repercussions. In addition to losing your full income and benefits earlier, a person who must start collecting Social Security at age 62 instead of age 65 could see around a 20 percent drop in their monthly benefit, Levine said.

“The bottom line in all of this is a lot more attention needs to be paid to the problems of less skilled workers when they lose their jobs, and that hasn’t really happened,” he said.

‘A terribly insecure situation’

When Richard Filloon decided several years back that he was ready for a career change, he had no idea what path that would take him on.

After 30 years as a salesman in pest control, he has spent the past few years selling everything from health insurance to cemetery plots. Most recently he was laid off from a job taking reservations for Hawaiian lunch and dinner cruises.

Now, at age 62, he’s decided that his only option is to start drawing Social Security early, rather than waiting until age 66 as he’d always expected. His first payment is scheduled to arrive Nov. 10.

The decision to take Social Security early will mean that he will get about $1,100 a month, several hundred dollars less than if he had waited until age 66. But he said he sees little choice because he has been unable to find another job. Although he does have some investment savings, it’s not nearly enough to fund his golden years.

That situation is quite common. A survey by the Employee Benefit Research Institute found that 42 percent of workers believe they will need to accumulate about $500,000 in retirement savings to live comfortably in retirement. Yet only 26 percent of workers over age 55 had saved more than $250,000 toward their retirement, the survey found.

After years of living what he calls an average middle-class existence, Filloon, who lives in Stanton, Calif., is now sharing a house with eight people and trying to scrimp wherever he can. He has no health insurance.

“This is a terribly insecure situation and I know that, but there’s nothing I can do,” he said.

Filloon is hopeful that he’ll eventually be able to find a part-time job, but fears most of the jobs he applies for are going to younger candidates.

“Maybe they think that we’ll quit because we don’t want to work for $10 an hour, but I’d be happy to make $10 an hour,” he said.

Living on much, much less

Freund, the former computer programmer, said his income has gone from about $73,000 a year to around $37,000 in pension and Social Security payments since he lost his job.

Meanwhile, other sources of income he and his wife had planned on for retirement are evaporating.

Freund’s 401(k) savings, already severely diminished by the stock market crash, was used to pay off student loans and other expenses so that they could lower their monthly bills in line with their reduced income.

The couple, who live in Redlands, Calif., also had to delay a plan to add to their retirement income with a reverse mortgage because his wife is not yet old enough to qualify.

The recession also has severely crimped his wife’s business as a psychotherapist. The couple expects her income will drop from about $48,000 last year to about half that this year.

If business keeps falling, she might have to go out of business completely even though she isn’t yet old enough to collect Social Security.

Also, although he is covered by Medicare, they aren’t sure what to do about her health coverage once his subsidized COBRA runs out.

They’ve reduced their life insurance policies and consolidated other insurance bills and monthly expenses, cutting hundreds of dollars from their budget. They are buying some food in bulk and shopping at Wal-Mart and the Dollar Store for the rest of their groceries, saving another $100 a month.

They spend more time at home, and when they do go out, it’s to the discount movie theater. For Christmas, they’ve already told their kids to expect handmade gifts.

“We’re cutting our budget (and) scrimping every possible way we can,” Freund said. “We’re financially challenged, but we’re going to make it.”

Freund, who recently turned 67, said he is grateful they have found a way to hang on to their house and their cars, and he said being forced out of the job market early has had a silver lining.

Now, he is free to focus full-time on his artwork, making pieces from found objects, and he hopes he may make some money selling the work.

Also, the couple ended up receiving the first six months of Freund’s Social Security payments retroactively in a lump sum, and they’ve used that to buy a travel trailer. They hope eventually they will have enough money to fund the cross-country trip they dreamed of before the recession hit.

“I’m both angry and upset, and I’m also very grateful,” he said.