Two attorneys and Wall Street professionals were among 14 people charged Thursday in a widening $53 million insider trading case that has snared one of America's richest men and shown white collar suspects to be using the cover-up tactics of drug dealers.

The actions raise to 20 the number of people who have been charged in the case first disclosed last month with the arrests of Galleon Group founder and hedge fund operator Raj Rajaratnam and five others.

At the time, U.S. Attorney Preet Bharara called the first arrests "a wake-up call for Wall Street."

"Today the alarm bells have only grown louder," he said at a news conference Thursday.

Bharara said the defendants borrowed a "page from the drug dealer's play book" by using anonymous hard-to-trace prepaid cell phones to dodge detection by law enforcement. He said they also discussed falsifying company files to make it appear trades weren't based on secrets.

"When sophisticated business people begin to adopt the methods of common criminals, we have no choice but to treat them as such," he said.

Two tactics prosecutors routinely use in drug cases — confidential informants and court-authorized wiretaps of phones — were used in the insider trading probe on a scale wider than ever before.

The complaints also described FBI agents trailing suspects as they do in drug cases to spot them passing money between one another. Court papers said agents observed cash appearing to be delivered in "an item that appeared to be approximately the size of a VHS tape."

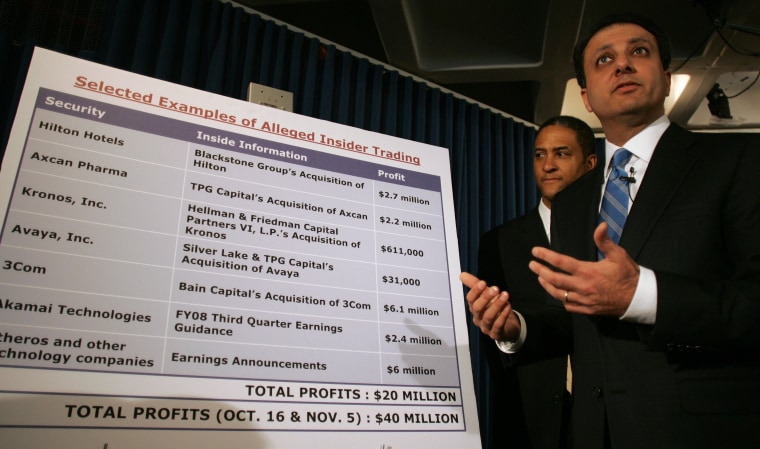

Bharara said total profits alleged by prosecutors was $40 million while the Securities and Exchange Commission raised the total to $53 million, saying it includes millions in profits not described in the criminal complaints.

He said he knew people would ask if the insider trading case was the tip of the iceberg of illicit trading on Wall Street.

"We don't have an answer to that but we aim to find out," he said.

Bharara said eight people were arrested Thursday on securities fraud charges and another five have already pleaded guilty and are cooperating. Another person is still at large, he said.

At a bail hearing for Rajaratnam on Thursday, defense attorney John Dowd criticized the government's case, saying it was "not as overwhelming as the government would like to believe."

A magistrate judge refused a request to reduce Rajaratnam's $100 million bail but he did relax his travel restrictions to let him travel throughout the United States.

Rajaratnam has denied participating in the scheme to use inside information to trade stocks at a profit ahead of public announcements.

In court papers, new details about the alleged scheme emerged.

According to papers filed Thursday in U.S. District Court in Manhattan, Zvi Goffer operated an insider trading network in 2007 and 2008 that included a lawyer who fed tips gleaned from his firm's work on acquisition deals.

Goffer, 32, of Manhattan, worked at Shottenfeld Group LLC in Manhattan in 2007 and at Galleon Group for the first nine months of 2008 before he started his own trading firm, the papers said.

The papers put Goffer in a central role. The SEC said he was nicknamed "the Octopussy" within the insider trading ring because he had a reputation for having his arms in so many sources of inside information.

A criminal complaint prepared by FBI Agent David Makol said Goffer paid others to obtain secrets about public companies' planned merger and acquisition activity that he then used to execute profitable securities trades.

The complaint said Goffer provided conspirators with prepaid cellular telephones so they could communicate in a way that reduced their chance of detection by law enforcement.

Robert Khuzami, the SEC's director of enforcement, said one of those arrested gave a man providing him inside information on a deal a cell phone with two programmed phone numbers labeled "you" and "me."

After the deal was announced, Goffer destroyed the cell phone by removing the electronic card that controlled it, biting it, and throwing away the phone after breaking it in half, Khuzami said.

He warned those on Wall Street who might consider insider trading to obey moral truths.

"And if you find yourself chewing the memory card in your cell phone to destroy your record of a conversation, something has gone terribly wrong with your character," he said.

Among those who fed tips that reached Goffer was Arthur Cutillo, a lawyer with Ropes & Gray, a law firm that held secrets regarding mergers and acquisitions, the complaint said. The tips included information about the announcement in September 2007 that Bain Capital Partners LLC would acquire 3Com, a technology company, the court papers said.

According to the complaint, Cutillo, 33, of Ridgefield, New Jersey, fed tips to another lawyer, Jason Goldfarb, who relayed them to Goffer. Goldfarb, 31, lives in Manhattan.

Lawyers for Goffer, Cutillo and Goldfarb all declined to comment after the men were each released on $500,000 bail.

In a statement, Ropes & Gray said it was "deeply disappointed to learn about this situation, which suggests an extreme breach of this person's duty of trust to our clients and to the firm."

It added: "We cannot comment in detail on an ongoing investigation but we are moving quickly to protect our clients and are cooperating fully with authorities."

The complaint said the government broke the case with the help of a confidential informant and three court-authorized wiretaps, including one on Goffer's cell phone that captured conversations in 2007 and 2008 and another on Goldfarb's phone.

The informant, who executed trades based on insider information while working at a hedge fund, has cooperated with the FBI since July 2007 and has agreed to plead guilty to charges of conspiracy and securities fraud in the hopes of getting leniency, the complaint said.

Among the five who prosecutors said have already pleaded guilty was Roomy Khan, 51, of Fort Lauderdale, Florida. Prosecutors said Khan made $1.6 million by conspiring from 2004 through November 2007 to trade inside information with, among others, an executive at a California technology company, an analyst at a credit rating agency, the manager of two Manhattan hedge funds and other hedge fund executives.

The New York Times has reported that Rajaratnam and Khan apparently met in 1996 when Khan worked at Intel as a product marketing engineer and Rajaratnam followed Intel as a securities analyst.

It said she worked for Rajaratnam at Galleon in 1999 but was fired by the company a year later for violating company policy on the trading of options. Still, it said, she traded inside information with Rajaratnam in the years afterward.