Between the severity of Toyota’s safety problems and the company’s slow response in addressing them, there’s no doubt the Japanese automaker has bungled its approach to a spate of safety issues.

The latest problem came to light Thursday, when Toyota acknowledged design problems with the brakes on its highly touted Prius hybrid. F or months, drivers in the U.S. and Japan had been complaining about braking problems in the new, third-generation Prius.

Still, even though Toyota's problems are self-inflicted, the company isn’t exactly getting any help from its friends in the United States. Some of them may be feeling a bit of glee over the Japanese company's woes, which come after a disastrous year for the industry that saw both General Motors and Chrysler file for bankruptcy protection.

As Toyota widened a massive recall over unintended acceleration issues last month, Ford and GM began offering $1,000 bonuses to customers who wanted to trade in their Toyotas, openly using the crisis to win back market share they have been losing for decades to their overseas rival.

Transportation Secretary Ray LaHood chimed in this week, saying Toyota officials were "a little safety deaf" and then warning Americans not to drive the recalled cars. He later backtracked but said the Obama administration would "hold Toyota's feet to the fire."

“The American auto industry has always had the quality bogeyman on its back, and this is a way to kind of level the playing field,” said George E. Hoffer, an economics professor at Virginia Commonwealth University who has studied auto recalls extensively.

For years, U.S. automakers have been the ones fighting a reputation for being less reliable than their Japanese counterparts, with the best-known recalls generally involving U.S. cars such as Ford Explorers with tire problems.

Toyota until now has enjoyed a sterling reputation for safety and reliability, but ironically that could be making a bad situation worse.

“This is what’s going to hurt Toyota: They have been held to a higher standard,” Hoffer said.

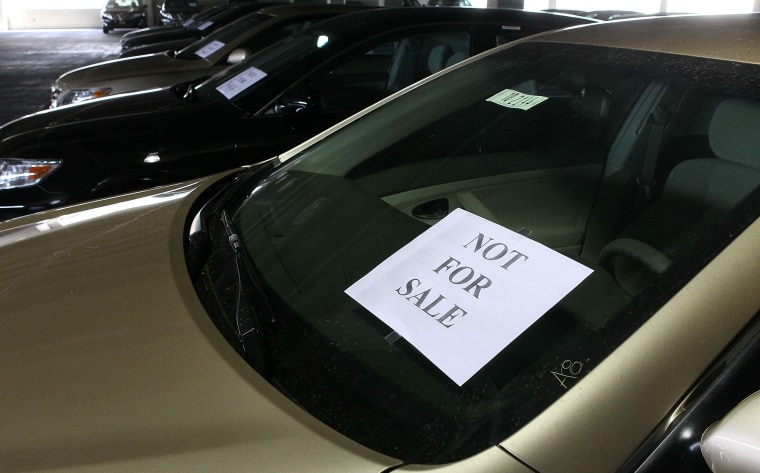

Toyota has recalled 8.1 million vehicles worldwide over concerns that accelerator pedals can get stuck in a depressed position. Hoping to contain the damage, the company halted production and ordered dealers temporarily to stop selling popular models including the Camry and the Corolla.

Toyota is shipping dealers a small steel part that it says will stop the the friction behind the problem once the part is inserted into the accelerator mechanism.

As Toyota stumbles, U.S. carmakers have a golden opportunity to demonstrate their value after the industry's humiliating bailout at the height of last year's economic crisis. GM and Ford already saw double-digit sales gains in January, while Toyota's U.S. sales fell to their lowest level in more than a decade.

“It’s the first good news of any great consequence … which has come their way in (years),” said Gerald C. Meyers, a professor of management at the University of Michigan and the former chairman and chief executive of American Motors Corp.

Although LaHood acknowledged that he misspoke Wednesday in his Capitol Hill testimony, there is good reason for him and other officials to be frustrated by Toyota’s response to the gas pedal problems, which many have criticized as slow and confusing to customers.

Still, Meyers said LaHood also probably wants to be seen as aggressive to head off any efforts by Congress to blame his agency for not acting.

Others wonder whether the Obama administration’s involvement in bailing out the U.S. auto industry is playing a role in its reaction.

“The administration is piling on the story,” Hoffer said. “This definitely has taken on a political aura.”

Hoffer notes that there are others who may have an interest in showcasing Toyota’s troubles. They include labor officials upset about the company’s plans to close the NUMMI (New United Motor Manufacturing Inc.) plant in Fremont, Calif., and politicians who see the rise of the Japanese automaker as playing a key role in job losses and other woes in their districts.

Any hint of schadenfreude is bad news for Toyota, which has enough on its hands with the massive recall.

“This is not going to go away in a week or two or even in a month or two,” said Dennis Virag, president of The Automotive Consulting Group. “It’s going to take years before Toyota could recapture its reputation, if it ever does.”

He sees Ford as being the biggest beneficiary of Toyota’s woes, since it has a product mix that could appeal to Toyota customers, with General Motors also seeing a boost.

“It’s an intensely competitive industry and manufacturers don’t let you forget other manufacturers’ problems, because it puts them in a favorable competitive situation,” Virag said.

Hoffer said his research has shown a direct correlation between a massive recall and a boost in competitors’ sales.

Still, he said automakers likely will proceed cautiously — in public at least — with any strategy to snag business from Toyota. That’s because most automakers know well that they could end up being the target at some point as well.

“It’s kind of a dangerous game to play, because there but for the grace of God go you,” Hoffer said.