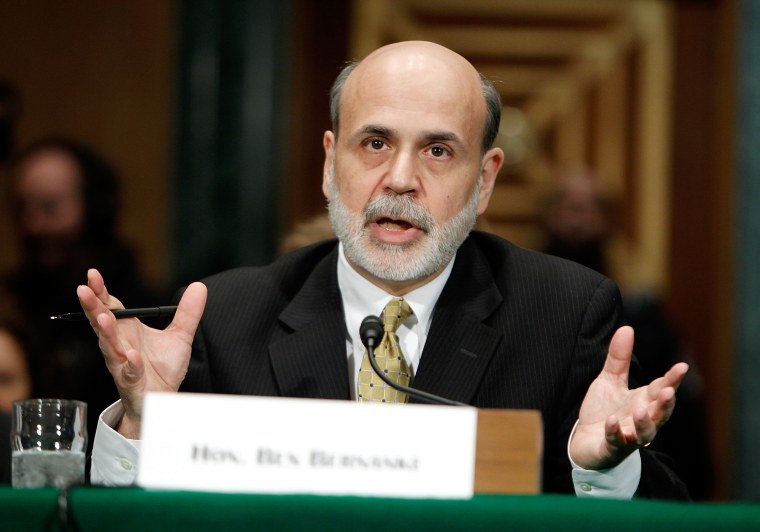

Federal Reserve Chairman Ben Bernanke told lawmakers Thursday that the central bank is looking into the use by Goldman Sachs and other Wall Street firms of a sophisticated investment instrument to make bets that Greece will default on its debt.

Bernanke said the Fed is looking into companies' use of credit default swaps, a form of insurance against bond defaults. Bernanke made the comments at the start of a Senate Banking Committee hearing, where the Fed chief delivered his twice-a-year economic report to Congress.

"Obviously, using these instruments in a way that intentionally destabilizes a company or a country is counterproductive, " Bernanke said, adding that the Securities and Exchange Commission probably will be looking into this matter as well.

"We'll certainly be evaluating what we can learn from the activities of the holding companies that we supervise here in the U.S.," Bernanke said.

The panel's chairman, Sen. Christopher Dodd, D-Conn., said he is troubled that this practice could worsen Greece's debt crisis.

"We have a situation in which major financial institutions are amplifying a public crisis for what would appear to be for private gain," Dodd said.

Dodd wondered whether there ought to be limits on the use of credit default swaps to prevent "the intentional creation of runs against governments."

On another topic, Bernanke said that the snowstorms and bad weather that has recently plagued the country is likely to have a short-term — but not permanent — impact on unemployment and layoffs. He said policymakers will "have to be careful about not overinterpreting" upcoming data.

Even though the economy is growing once again, senators on both side of the aisle worried about high unemployment, now at 9.7 percent, rising home foreclosures and difficulties people and businesses have in getting loans.

"The state of our economy as a whole may be improving, but if we're talking about the situation of ordinary American families, I think I can sum up this recovery in three words: not good enough," Dodd said.

Senators pressed Bernanke for ideas about what Congress can do to help out, especially in bringing down unemployment. The Senate on Wednesday approved a package aimed at generating jobs by giving companies a tax break for hiring the unemployed.

Bernanke shied away from providing recommendations but did say that if additional stimulus measures are approved, it would be "very constructive" to pair them with a plan on how the government intends to lower record-high deficits down the road.