The number of banks with risky levels of bad loans rose only slightly in the last quarter of 2009, partly because the FDIC closed so many failing banks, according to federal data analyzed by the at American University in Washington.

Four ways to check your financial institution:

- Look up any bank in the

- Look up any

- Check the list of the

- Check the

A total of 389 banks had “troubled asset ratios” above 100 at the end of December, up slightly from 369 banks in September, according to the analysis. A ratio above 100 means a bank had more troubled loans than money set aside to cover potential losses.

The FDIC closed 140 failed banks in 2009, including 45 in the fourth quarter alone. Nearly all had very high levels of bad loans.

The new analysis relies on information reported by banks to the Federal Deposit Insurance Corp. as of Dec. 31. Journalists at American University calculated each bank's troubled asset ratio, which compares troubled loans against the bank's capital and loan loss reserves.

Troubled assets include loans that are 90 days or more past due, loans on which the bank is no longer collecting interest and real estate the bank already owns, usually through foreclosure. A similar measure, known as a Texas Ratio, is commonly used by bank analysts as an indicator of stress on a bank, though such ratios can't capture all the nuances of a bank's condition.

The number of banks with ratios above 100 has risen sharply, from 24 at the end of 2007 to 163 in the last quarter of 2008 and 389 currently.

During that same period, the number of banks has fallen by more than 500, from 8,542 banks at the end of 2007 to 8,008 banks at the end of 2009. Therefore, the percentage of banks with high ratios has climbed sharply to 4.9 percent, or one out of every 20 banks.

The FDIC said 702 banks were on its troubled bank list at the end of 2009, up from 552 just three months earlier. That list is secret. Analysts often use shorthand measures such as the Texas Ratio for one clue to the banks on that list.

"Recovery in the banking industry tends to lag behind the economy, as the industry works through its problem assets," FDIC Chairman Sheila Bair said in the FDIC's quarterly summary.

Depositors are protectedThe rising troubled asset ratios show the increasing pressure that the recession and bad loans, particularly on commercial real estate, have placed on the nation's banks.

The American Bankers Association opposes the sharing of ratios like these with the public, and cautions that a heavy debt load does not ensure that a bank will fail.

While the troubled asset ratio is not a predictor of bank failure, most of the banks that have failed do have high ratios. Still, banks with high ratios can recover, as borrowers resume making scheduled payments or the bank is able to raise more capital.

Even when a bank does fail, no depositor has lost a dime in insured deposits since the FDIC was created in 1934. That protection has its limits. The basic limit had been $100,000 per depositor per bank but has been increased to $250,000 through Dec. 31, 2013. The FDIC has and a to help you determine your level of protection.

In short, the FDIC's advice boils down to this: If your deposits are under the FDIC limits, you're protected even if your bank should fail. If your deposits exceed those limits, the best protection is to move deposits into smaller accounts at more than one FDIC-insured bank.

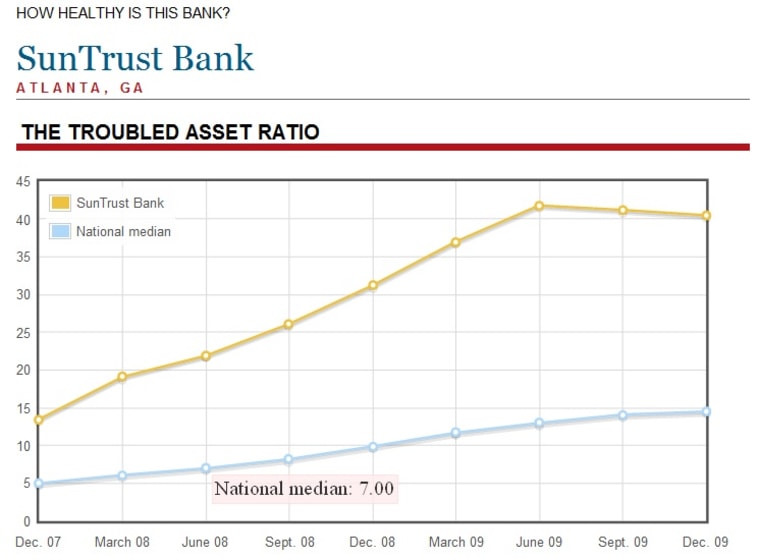

Along the same lines, the national median for the troubled asset ratio continued to rise: At the end of 2007, the median ration was 5 percent — half the banks in the U.S. were above that level, and half below. The midpoint rose to 9.9 percent at the end of 2008 and hit 14.5 by the end of 2009.

The total of badly past due loans and foreclosed properties at all banks reached more than $367 billion in December, up from $348 billion in September and $237 billion at the end of 2008. More details of the overall pattern are in the American University report.

Limitations of the ratio

The troubled asset ratio was devised in the early 1980s by journalist Wendell Cochran, now senior editor of the Investigative Reporting Workshop at American University Others do similar calculations.

The reports in most cases do not include the billions in federal money injected onto the balance sheets of bank holding companies in the form of so-called TARP funds.

The ratio does not include the value of non-loan assets that have caused so much trouble in the past year, particularly for some larger banks that moved away from traditional commercial banking. Nor does it reflect mortgage-backed securities, collateralized debt obligations, etc. In this way, the ratio may underestimate the real depth of problems.

And no ratio can get at all the detailed information — such as the individual loan files, quality of management, potential for raising other capital — that a regulator would use to evaluate a bank's safety and soundness.