The Securities and Exchange Commission is preparing new civil fraud charges against several “high-level” executives and financial advisers of the defunct Stanford Financial Group, according to a report on CNBC.

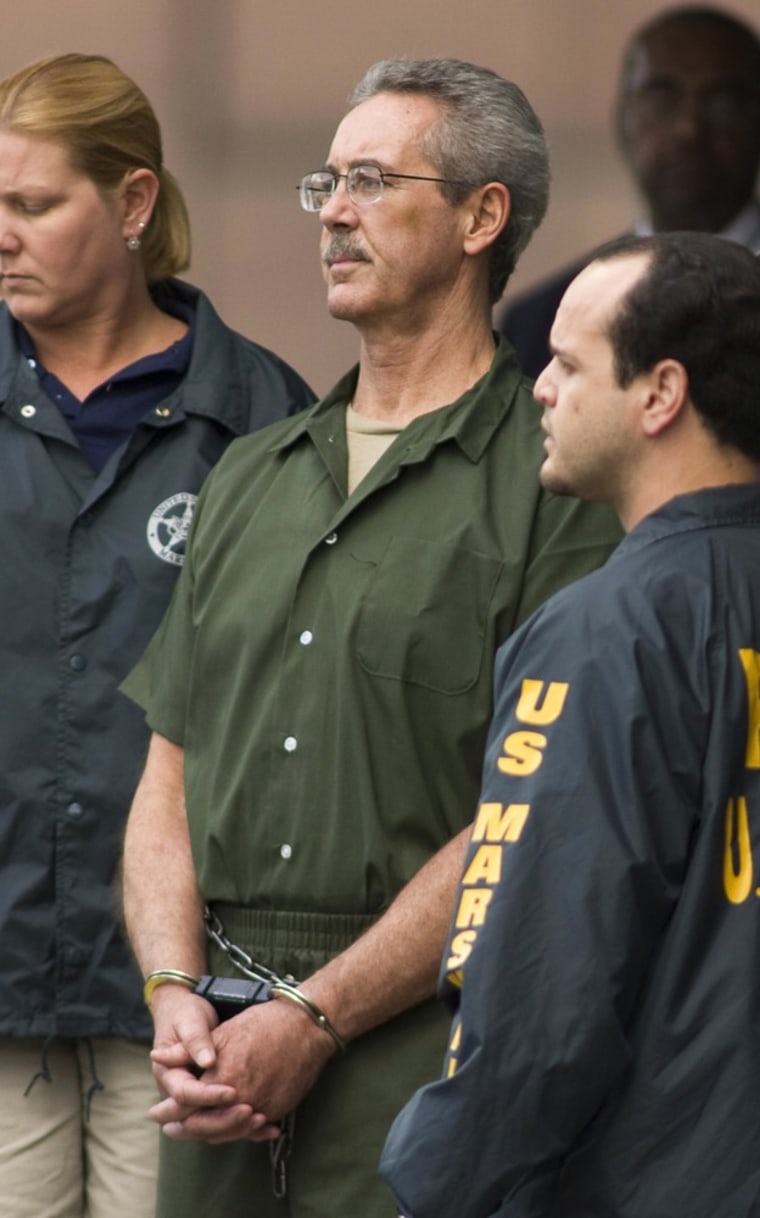

The individuals, who were not identified, would join company founder R. Allen Stanford and several others charged in an alleged $7 billion Ponzi scheme.

The new charges are revealed in prepared testimony by Rose L. Romero, Director of the SEC’s Fort Worth Regional Office, who is appearing with several other SEC officials in a hearing before the Senate Banking Committee Wednesday.

Romero says the individuals have received Wells notices — the SEC’s formal notification that it intends to file charges.

“We have, through our Wells Process, notified several former Stanford executives that we intend to recommend fraud charges against them,” the written testimony said. “These persons include former high level executives and financial advisors.”

The Stanford case is one of several high-profile failures by the SEC. The agency's Inspector General, H. David Kotz, found in a report released in March that investigators in the Fort Worth Regional Office were aware of the possible Ponzi scheme as far back as 1997, but did not lower the boom on the firm until February of 2009.

In testimony prepared for Wednesday’s Senate hearing, the SEC’s chief enforcement official Robert Khuzami said the agency has toughened its efforts to shut down financial misconduct after failing to act quickly in the cases of Stanford and Bernard Madoff.

SEC Enforcement Director Khuzami said the SEC has “moved aggressively” to put in place reforms recommended by the SEC inspector general, who found that the SEC knew since 1997 that Stanford likely was operating a Ponzi scheme but waited 12 years to bring fraud charges against the billionaire.

Khuzami also told the Senate Banking Committee that the SEC is working to provide “maximum recovery” to investors hurt in Stanford’s alleged $7 billion fraud.