Back in the 1960s, counterculture guru Timothy Leary urged people to “Turn on, tune in, drop out.” In the coming months, American motorists will be urged to “plug in, turn on and buy,” as the first mass-production electric vehicles hit the market.

By some estimates, as many as three dozen plug-in hybrids, extended-range electric vehicles and battery-electric cars will reach market by mid-decade, but industry executives say the coming months will be critical to building acceptance for vehicles that have some serious drawbacks compared to conventional, gas-powered cars, trucks and crossovers.

Yet Nissan and GM, which are launching the nation's first two mass-market electric vehicles, are busy taking potshots at each other’s offerings, in typical industry fashion. The two carmakers are sniping at each other even as they admit that for the good of the overall market it might be better to harmonize on the merits of electric propulsion.

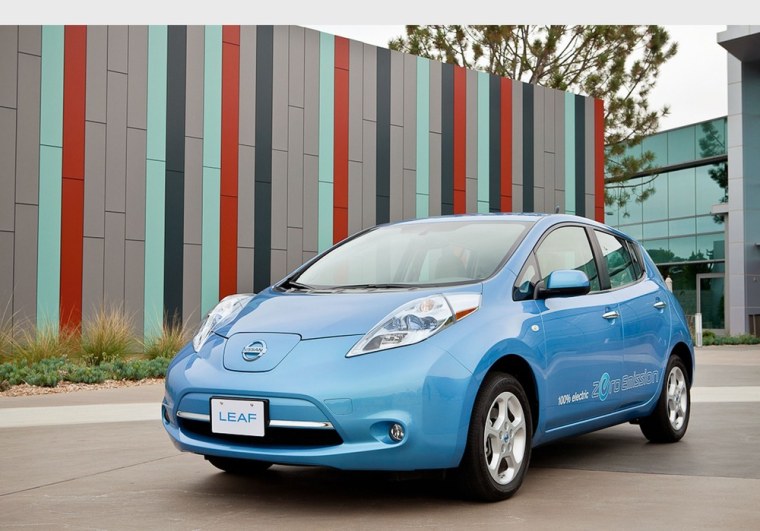

Japan's Nissan is about to launch the 2011 Leaf, a compact, five-seat battery car, while American-based General Motors is rolling out the 2011 Chevrolet Volt, a plug-in hybrid. Both carmakers hope to ride a wave of interest and enthusiasm for green machines while downplaying their disadvantages.

Whether they — and a wave of lithium-powered products to follow — will succeed is anything but certain. A new study by California-based J.D. Power and Associates cautions that even a decade from now, battery-based vehicles are likely to capture only 7.3 percent of the global automotive market.

To push beyond, J.D. Power researchers say, the industry will need to significantly reduce battery costs — and hope for external pressures, such as a big run-up in petroleum prices or new government mandates.

Even before the first salable version of the Leaf rolled off the assembly line last Thursday, Nissan’s marketing machine was already going to work. As many as 10,000 potential buyers had the chance to lift the hood and take a short test drive during the first four stops of a 23-city tour, Nissan product planner Mark Perry said in an interview at the company's U.S. headquarters near Nashville, Tenn.

The Drive Electric tour is part of a buzz-building campaign that has blended traditional advertising with social and event marketing. Nissan even set up a website to let so-called “hand-raisers” plunk down a refundable $99 deposit. Earlier this month, Nissan halted that preliminary reservation process because it claimed to have already received 20,000 deposits.

Even though a chunk of those potential buyers probably won’t follow through, Nissan officials are confident they’ll have more than enough demand to generate about that many sales during the first year on the U.S. market.

Chevrolet has slightly more modest numbers in mind for the Volt’s first year on the market, but is also making an aggressive pitch to put the hybrid (Chevy prefers to call the Volt an extended-range electric vehicle) in front of the public. That includes a national tour of its own, including a stop coinciding with the L.A. Fashion Weekend festivities.

Chevy’s big marketing push uses the tagline “More Car than Electric,” which some see as a not-so-subtle swipe at the Leaf.

Nissan’s battery car has an estimated range of about 100 miles per charge, and the carmaker has been training its retailers to carefully quiz potential buyers to make sure the Leaf is right for them. The vast majority of Americans, said Perry, drive less than 100 miles a day, but even so, the carmaker is well aware of so-called “range anxiety.”

GM is aware of it too, so much so that it is trademarking the term. The maker’s strategy in developing the Volt was to provide enough range on battery power (roughly 40 miles) to satisfy about 70 percent of American commuters, according to federal data. For longer drives, Volt’s onboard backup (a 1.4-liter gasoline engine) kicks in, allowing it to keep going like a conventional automobile.

But GM landed in some hot water recently when it turned out the carmaker had shifted gears between unveiling the original Volt concept nearly three years ago and the production car's launch.

Until recently, GM had said that at all times Volt’s wheels would be powered solely by its electric motors. Earlier this month, however, it was forced to concede that under some demanding conditions the gas engine would assist the electric motor and provide a direct mechanical boost.

“That’s an embarrassing bit of news,” said analyst Joe Phillippi of AutoTrends Consulting, although he quickly added that “the public is not likely to care much about it if the car drives as well as GM promises.”

What worries Phillippi and other analysts more is the potential damage from having Nissan and GM take potshots at one another, dismissing the potential, never mind the green bona fides, of their new electric cars.

“It could wind up looking like two politicians cutting each other down in public,” said a senior GM executive on the Volt program, who asked not to be identified by name. In the end, the public could wind up mistrusting both.

Credibility will be a critical factor in marketing the new electric cars and building a market for the next generation of electric vehicles, said David Champion, the head of automotive testing for the influential Consumer Reports magazine.

“I don’t think Nissan or Chevrolet will have any problem selling the first [year’s production] because of pent-up demand” among dedicated environmentalists and techno-early adopters, he said. The question is whether demand will build beyond those select groups.

In real world conditions, Champion said motorists “will be surprised” by how much of their daily driving could be handled by either the Volt or the Leaf. But while some consumers will opt for the new technology for emotional reasons, the mainstream market will need it for more practical reasons.

“It’s going to be a very difficult numbers game for consumers” to decide if the economics justify turning to electric propulsion, he said.

Nissan has swallowed hard and announced a price of $32,780 for the Leaf, about $8,000 less than the Volt. Both are being offered, on lease, for $350 a month.

Intent on kick-starting the nascent battery car market, the federal government is kicking in a $7,500 tax credit, and more than a dozen states have announced incentives of their own, ranging from the elimination of sales tax for the purchase in Washington state to a $6,000 tax break in Colorado. Some communities are offering additional cash, while several employers, notably Hollywood’s Fox and Sony studios, are offering another $5,000 in assistance. Live and work in the right place and you might get a Leaf for as little as $12,280.

At that price, consumers might finally get charged up about electric propulsion.