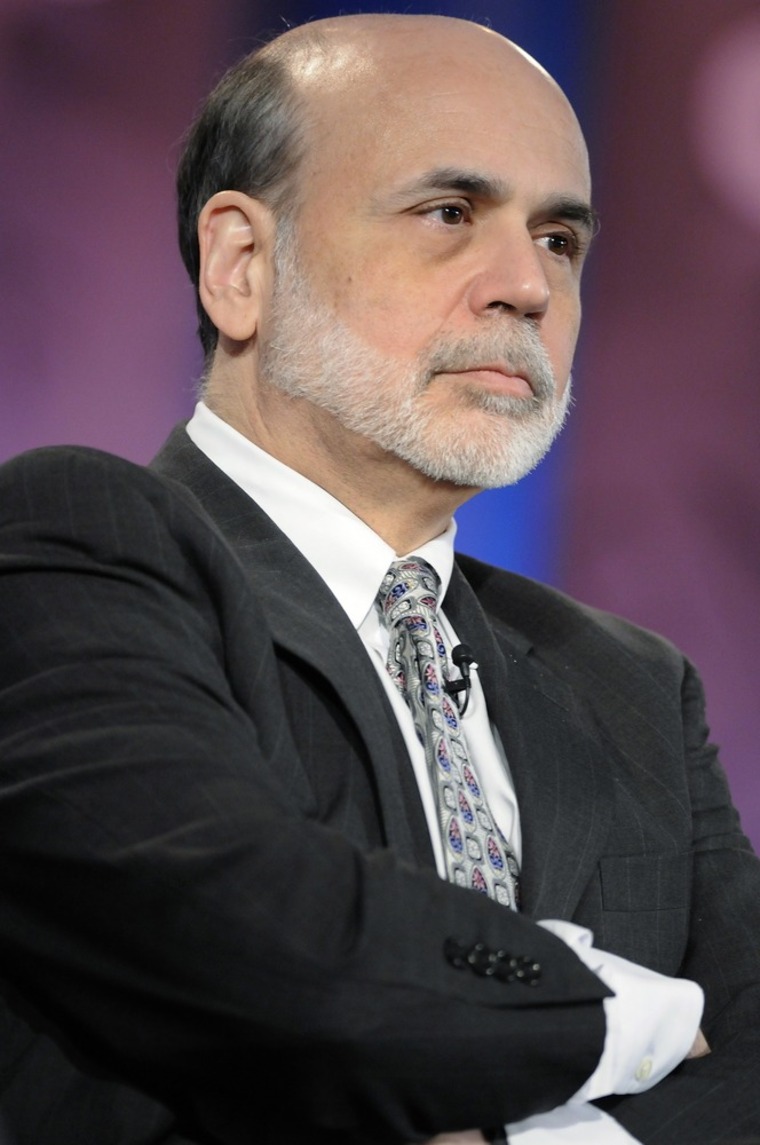

The United States can't fully recover from the worst recession in decades until hiring improves, Federal Reserve Chairman Ben Bernanke said Thursday.

The economy is strengthening, and will likely grow at a faster pace this year as more confident consumers and companies spend more, Bernanke said in prepared remarks to the National Press Club in Washington, D.C. But he warned that the growth won't be strong enough to quickly drive down high unemployment, and it could take several years before it returns to more normal levels.

“Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established,” he said.

Following the delivery of his prepared speech, Bernanke took questions from the financial journalists gathered at the event — a radical departure for a sitting chairman of the U.S. Federal Reserve.

Fed chairmen have in the past occasionally spoken with the media off the record, but a formal press conference by a sitting chairman of the Fed is an unusual event.

Comments by such a powerful figure in the world’s financial system can be interpreted in various ways, and can influence how billions of dollars of wealth are invested.

But with the economy still unstable and most of the Fed’s ammunition to spur growth already spent, Bernanke appears to want to boost the economy by exerting his influence through the media.

“Transparency is important,” Bernanke said regarding his decision to field questions from the media.

“The public needs to know what we are doing and why we are doing it,” he added, noting that a Fed committee is considering the establishment of a regular Fed press conference and will issue its recommendations on the plan soon .

Bernanke’s prepared remarks suggest the Fed will stick with its program to prime the economy by purchasing $600 billion of Treasury bonds by the end of June.

Bernanke said it will take "several years" for unemployment to return to more normal levels. Last month, the Fed chief was more specific, saying it would take four or five years for the unemployment rate to drop to a historically normal level of around 5.5 percent or 6 percent.

The Fed chief spoke one day before the government releases its employment snapshot for January. Economists believe the unemployment rate ticked up to 9.5 percent last month, from 9.4 percent in December, and employers added a net total of around 146,000 jobs. Job-creation would need to be twice as fast each month to make a noticeable dent in unemployment.

Bernanke also urged Congress and the White House to come up with a long-term plan to reduce the government's $1 trillion-plus budget deficits.

Big deficits could hurt the economy, he warned. Investors would demand more returns on government loans and interest rates would soar. Higher borrowing costs would crimp spending by consumers and businesses, slowing economic activity.

"If government debt and deficits were actually to grow at the pace envisioned, the economic and financial effect would be severe," Bernanke said.

The budget deficit has averaged approximately 9 percent of the nation's $14 trillion economy over the past two years. That's up from an average of 2 percent during the three years before the recession, Bernanke said.

On the economy, Bernanke said he expected inflation to be quite low despite a recent increase in commodities prices, such as oil and gasoline. The Fed has said that it believes competitive pressures will prevent companies from passing along all of these higher costs by significantly boosting prices to consumers.