For much of its 97-year history, the U.S. Federal Reserve has been an opaque, imposing, somewhat mysterious institution that relied on secrecy to hide its innermost deliberations from global financial markets.

No more.

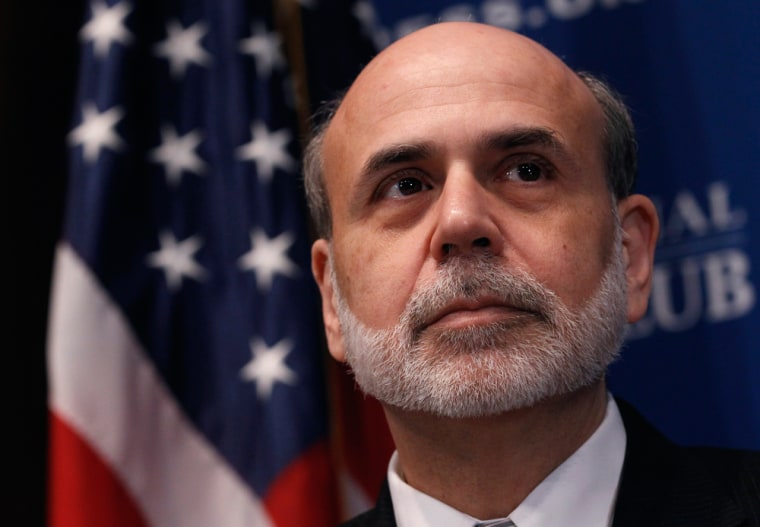

In the five years since the ascension of Chairman Ben Bernanke, Fed board members and regional bank presidents have been increasingly outspoken about policy disagreements. Bernanke's testimony to Congress has transformed "Fedspeak" — the imponderable dialect spoken by his predecessor Alan Greenspan, into plain English.

That policy of openness — some have called it the Fed's Glasnost — will reach a new milestone Wednesday when Bernanke holds the first regularly scheduled briefing ever given by a Fed chief, kicking off what is to be a quarterly event. The briefing, to be broadcast live on the Fed’s website and other outlets, will begin at 2:15 p.m. EDT after a regular meeting of the policymaking Federal Open Market Committee.

The official agenda promises a review of the Fed's "current economic projections" and "additional context for the FOMC's policy decisions." But Bernanke could face a long list of questions about the Fed's effort to stave off economic disaster beginning in 2008 and boost the flagging recovery more recently.

Bernanke has faced reporters before but never quite like this. He has made himself more accessible than previous Fed chiefs, giving plain-spoken interviews to "60 Minutes" and PBS and answering moderated questions submitted on notecards at the National Press Club. On Wednesday, Bernanke will field questions directly from reporters in the traditional style familiar to viewers of round-the-clock cable news.

It is a far cry from a time as recently as the 1980s when the Fed did not even announce when it intervened in markets to change short-term interest rates. In those days Fed-watching was a serious and potentially lucrative business as traders could make or lose vast sums by correctly divining the central bank's intentions.

Since then the Fed has come a long way, gradually lifting the veil to release policy decisions at the conclusion of regular meetings, minutes a few weeks later and even full transcripts after a civilized five-year interval.

The Fed's historic policy of obfuscation was not simply the product of an ultra-conservative institution seeking to deliberate freely without the risk of second-guessing from outsiders (though that was part of it). In the last decades of the 20th century, the outsized role of both the central bank and U.S. financial centers on the global money system meant public pronouncements risked sending markets into a tailspin.

While Greenspan was known as a master of the inscrutable comment, he was matched by his predecessor Paul Volcker, who chaired the Fed during a period of high inflation and enormous interest-rate turbulence.

“Volcker told me in his own words that he loved to leave the market totally confused with regard to what he was going to do,” said longtime Fed watcher David Jones of DMJ Advisors. “Because if half the market thought he was doing something and the other half thought he wasn’t, it would smooth, in his view, the market impact of Fed moves.”

That type of ambiguity could be hugely risky in today's world, where huge rivers of capital move instantaneously through globally interconnected markets. Trades are executed in milliseconds by computers controlled by algorithms, not stray words or phrases uttered by Fed officials.

That’s not to say that markets don’t wait on the Fed’s every word. The written statements that follow policy-setting meetings are scoured for tiny changes in syntax and grammar. Lately, the Fed’s promise to continue its easy-money policy “for an extended period” has become the bond market's latest cliffhanger.

Bernanke surely will be asked about whether the policy is working and especially whether the Fed's controversial decision to buy an additional $600 billion in Treasury securities beginning last November did anything to boost economic growth.

"The Fed has an opportunity in the press conference to explain its strategy and the reasoning far, far more completely than it ever could in the policy statement," said former St. Louis Fed President William Poole.

"By laying out a smooth trajectory, the hope is that it would minimize disruptions and prevent an overreaction," said Kenneth Kuttner, a former Fed economist who teaches at Williams College and has co-authored research with Bernanke on how markets react to monetary policy changes.

Whatever the motive, there has never been a greater demand for Fed transparency than in the aftermath of one of the worst financial crises in its history. When the credit market collapsed in 2008 the Fed embarked on an unprecedented — some say risky — strategy of trying to put out the financial flames by flooding the system with cash.

The strategy was controversial, to say the least.

“The Fed has come out of the credit crisis really shocked by the mouth of criticism — particularly from Congress,” said Jones. “We’ve never seen withering criticism like this, especially from many of the newly elected Republicans in the midterms.”

Part of the central bank's new policy, then, is public relations: Bernanke has been a tireless champion of the Fed’s massive response to the crisis that began in 2008, drawing on his years as a college professor to patiently explain it and better answer his critics.

Some $2.3 trillion later, the program is set to end in June; Wednesday’ news conference will almost certainly focus on questions about how well the policy worked, and what else the Fed has up its sleeve to try to keep the economic recovery on track.

With no clear policy in place past June, and the economy showing worrying signs of slowing again, the stakes are high for Bernanke.

“The Fed may have ended up setting up high expectations — not just for transparency but for clarity when there is a huge amount of uncertainty with respect to how this recovery is going,” said Jones.