As Vice President Joe Biden and congressional negotiators hunt for budget cuts, major Medicare changes that could squeeze billions in savings got a boost Wednesday from a nonpartisan panel of experts that advises lawmakers.

Those changes are already under consideration in the budget talks, officials say.

One idea would revamp Medicare's outdated copayments and deductibles to provide better protection against catastrophic expenses, but it could lead to seniors paying a bigger share of the cost for some everyday services. The goal is to save taxpayers money by discouraging overtreatment.

The impact on individual seniors is less clear. Few details are available, but such changes could create winners and losers.

Slideshow 13 photos

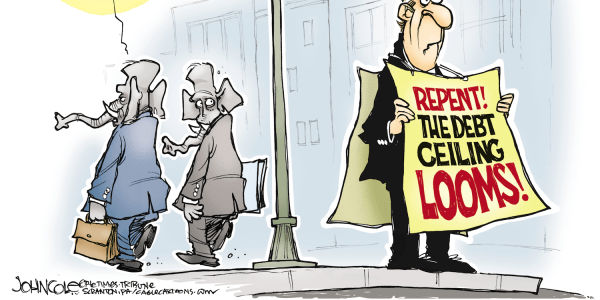

Raise the Debt Ceiling

Seniors with high medical costs would gain from having a limit on their financial exposure, protection that Medicare doesn't now provide. Those who see the doctor often for more manageable problems could end up paying more. Overall, premiums for private insurance that many seniors get to fill in Medicare's gaps could become more affordable.

The other idea under consideration would shift nearly 9 million high-cost beneficiaries with both Medicare and Medicaid into managed-care insurance plans, to better coordinate services and cut duplication.

The Medicare Payment Advisory Commission did not endorse any specific approach, but its traditional midyear report to Congress made clear that both issues are overdue for a fix.

"The status quo ... has led to care that is often not coordinated, sometimes inappropriate, and occasionally risky to patients," said the report, referring to Medicare's traditional fee-for-service benefit. "It has also left beneficiaries with rising ... premiums and out-of-pocket costs and has left taxpayers with the unsustainable burden of financing the program."

The aim should be "to give beneficiaries better protection against high (out-of-pocket) spending and to promote incentives for them to weigh their use of discretionary care, without discouraging needed care," said the report from MedPAC, as the commission is known.

Officials familiar with the negotiations between Biden and leading lawmakers of both parties said the two Medicare options are under consideration. The officials spoke on condition of anonymity because the budget talks are confidential.

Biden's goal is to find savings that will help the administration reach a deal with congressional Republicans to increase the nation's $14.3 trillion debt ceiling. That's needed to prevent the government from lurching into an unprecedented default on its interest payments to creditors, which could destabilize the already wobbly economy.

Prospects for the talks are uncertain, since both political parties are locked into their positions. House Republicans are on record that they will not vote to approve a debt increase without deep spending cuts. Democrats, meanwhile, are taking a hard line against any reduction in Medicare benefits, including increased copayments for visits to doctors and hospitals.

A sweeping overhaul of Medicare and Medicaid backed by House Republicans seems to have no chance. Instead, the budget negotiators are looking at a list of proposals outlined last year by President Barack Obama's deficit reduction panel. Most involve cuts in payments to medical service providers and drug companies, but some would affect seniors directly.

The deficit panel estimated that revamping Medicare's cost-sharing rules would save $110 billion from 2012 to 2020. Additional savings would come from limiting the ability of private insurers to fully shield seniors from Medicare's out-of-pocket costs. Many seniors purchase private "Medigap" coverage that caps their total annual costs and allows them to escape a bewildering assortment of Medicare deductibles and copayments.

For example, Medicare's hospital deductible is $1,132 for the first 60 days, while the annual deductible for doctor visits is $162. There is no copayment for the first 20 days in a nursing home, but beneficiaries must pay full cost after 100 days.

Obama's deficit panel recommended a single annual deductible of $550 for hospital care and medical services, with a 20-percent copayment on health spending above the deductible. The copayment would drop to 5 percent for costs over $5,500. Beneficiaries would pay no more than $7,500 a year total out-of-pocket, a consumer safeguard now missing from Medicare.

But there would be a trade-off.

Under the panel's proposal, Medigap insurance plans would be prohibited from covering the first $500 in cost sharing, and could only cover half of the next $5,000. Except for low-income seniors and some with employer-provided retiree coverage, beneficiaries would be responsible for at least $500 of their medical expenses, and as much as $7,500.

The second proposal, shifting high-cost beneficiaries into Medicaid managed care plans, would save $12 billion from 2012 to 2020. This group includes many low-income people, patients in nursing homes, and individuals with multiple complicated health problems. They receive coverage both through Medicare and Medicaid at a cost well above that for typical beneficiaries in either program.

Wednesday's MedPAC report cautioned that both of the changes would take time to carry out, and will require close attention to prevent unintended consequences for seniors and disabled beneficiaries.