Greece fended off a bankruptcy that would have roiled global markets and threatened the future of the euro when lawmakers on Wednesday backed controversial austerity measures in the face of violent protests.

Investors cheered the bill — which aims to cut spending and raise taxes by €28 billion ($40 billion) and raise €50 billion ($71 billion) in privatizations over five years — but, in Athens, the mood was dark. In a haze of tear gas, protesters hurled anything they could find at riot police and tried to blockade the Parliament building.

A Greek default would threaten the viability of the euro, the EU's common currency, and send shock waves through global markets similar to those that kicked off the global financial meltdown after the collapse of Lehman Brothers in 2008.

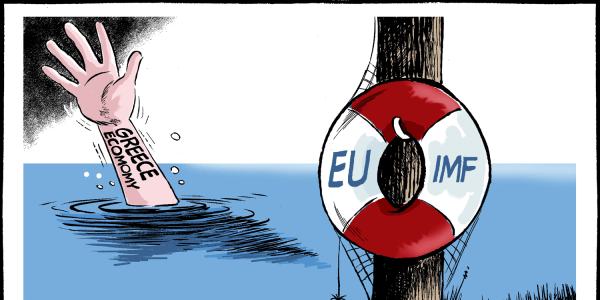

While world markets rose on the news that the bill passed, Greece is not yet out of the woods. The bill — along with another that must be passed Thursday on implementing the austerity package — will release the next €12 billion ($17 billion) installment of a €110 billion ($157 billion) international bailout from the European Union and the International Monetary Fund. Eurogroup head Jean-Claude Juncker indicated after the vote that Greece would get the fifth batch of its bailout loans.

But many Greeks complain they have already paid dearly in a year that has seen public sector salaries and pensions cut and unemployment rise to above 16 percent.

"This is bad, the country will be sold for a piece of bread," said Dimitris Kostopoulos, a 48-year-old insurer who was protesting Wednesday. "There were many other more appropriate alternatives to this. Parliament has once again betrayed us."

The next installment Greece hopes to get will only see it through September, leaving open the question of how the country, burdened with piles of debt, will right itself.

On Sunday, eurozone finance ministers will meet in Brussels to make progress on a second bailout for Greece that is hoped will address more long-term problems. As part of that plan, banks are expected to share some of the burden, possibly by rolling over Greek bonds that they hold, as French banks have already volunteered to do.

Prime Minister George Papandreou has said the second bailout will be roughly the same size as the first.

But many economists expect even that reprieve will not be enough, and Greece will need a more significant restructuring of its debt.

"We must avoid the country's collapse with every effort," Papandreou said before the vote. "Outside, many are protesting. Some are truly suffering, others are losing their privileges. It is their democratic right. But they and no one else must never suffer the consequences ... of a collapse."

But the specter of continued protests could undermine the government's ability to implement the harsh austerity measures, which slap taxes on even some of the lowest-paid Greeks and raise consumer taxes during a recession.

"While approval of the package is an essential first step toward Greece getting the much-needed funding it needs from the EU/IMF to meet its upcoming financial obligations, they are not out of the water just yet," said Carl Campus, an analyst at BMO Capital Markets.

As lawmakers voted, stun grenades echoed across the square outside Parliament and acrid clouds of tear gas and orange and green mist from smoke bombs and flares hung in the air. Several banks and storefronts were smashed, while a Socialist dissenter who backed the government at the last minute, Alexandros Athanassiadis, was briefly assaulted by protesters after leaving Parliament on foot.

One group of anarchists armed with staves and iron bars attacked finance ministry offices just off Syntagma Square, smashing windows at the entrance and on higher floors. A post office on the ground floor of the ministry building was set on fire, sending acrid grey smoke billowing into the sky.

In cat-and-mouse clashes with police, rioters erected makeshift barricades with benches, chairs and garbage bins on the fringes of the square, where thousands of peaceful protesters demonstrated against the austerity plan.

Slideshow 6 photos

Greek Economy

A general strike that began Tuesday also ground the country to a halt, grounding planes, docking ferries and stranding tourists during the busy summer season.

By Wednesday night, police said 38 officers had been injured, including one who was seriously hurt when he was hit in the face by a chunk of marble. Thirty protesters were detained, with 11 of them arrested. Emergency services said they had treated 47 protesters for injuries.

Dozens of injured were treated at a makeshift first aid center set up inside the square's metro station. Most were treated for breathing problems, contusions and broken bones, volunteers at the first aid center said, appealing for medical supplies.

Across Europe, officials hailed the vote as an act of "national responsibility" and urged Greek lawmakers to follow up with another positive vote Thursday.

"That's really good news," German Chancellor Angela Merkel said when told of the outcome of the vote on her way out of an economic forum in Berlin. Germany is Greece's biggest creditor.

In a joint statement, the heads of the EU commission and council, Jose Manuel Barroso and Herman Van Rompuy, said Greece had taken "a vital step back — from the very grave scenario of default."

Equally, relief was the main response in markets. Soon after the vote, the euro was trading at a fairly elevated level around the $1.44 mark while stock markets around the world were posting big gains.

The unpopular package of spending cuts and tax hikes passed by 155 votes to 138, with five opposition deputies voting "present" — a ballot which backs neither side.