Signing bonuses, profit sharing checks and inflation protection aside, Ford is billing its tentative new contract with the United Auto Workers union as a significant step forward in its bid for competitiveness — and CEO Alan Mulally’s goal of rebuilding the carmaker’s credit rating.

In fact, Ford shareholders could benefit from the deal as much as Ford’s unionized workers, especially if the new settlement helps the automaker restore its once-lucrative dividend payments.

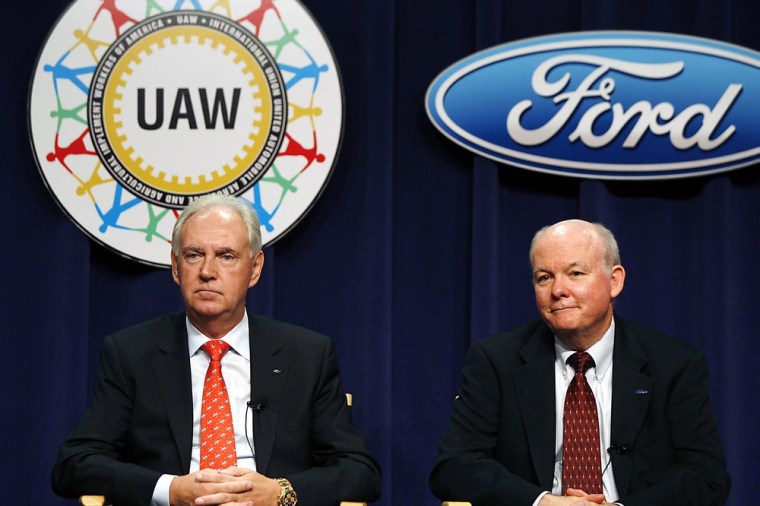

“We believe this agreement ... will enable us to increase our overall competitiveness in the United States,” said Ford’s labor and manufacturing chief John Fleming, something he underscored by noting that the four-year contract, if ratified, will “also permit us to in-source work from Mexico, China, Japan and other parts of the world.”

The settlement at Ford, reached Tuesday morning, comes nearly three weeks after the UAW union came to terms with General Motors, and the proposed contract largely follows the GM pattern.

That means an improved profit-sharing program, a signing bonus and inflation protection. But Ford, considered the healthiest of the Detroit carmakers, bumps the up-front cash to $6,000, a full $1,000 more than at GM, while it will offer four $1,500 lump sum payments meant to compensate for inflation, double what its crosstown rival came up with. Significantly, Ford and GM both avoided any fixed increases in wages — a move that auto analyst Joe Phillippi sees as critical to the companies' long-term competitiveness.

He isn’t alone. Standard & Poor’s has signaled that it might follow an upgrade in GM’s credit rating by also upgrading Ford’s rating. That would meet one of Mulally's top goals — something Ford highlights on its website.

An investment grade rating would deliver more than just bragging rights. It would also mean a significant savings on Ford’s hefty debt. The carmaker borrowed heavily going into the last recession to ensure it could survive. As a result Ford — unlike GM and Chrysler — was able to avoid bankruptcy and a bailout from the federal government.

An upgrade “is paramount in Alan’s mind,” said Phillippi, founder of AutoTrends Consulting. “It would not only help lower [Ford’s] debt costs, but also signal their willingness to reinstate the dividend. They could do that now, but the ratings agencies would probably respond better if they wait until the debt rating has been restored.”

While Ford — like the rest of the auto industry — has been slammed by Wall Street in recent months it is generally seen as best positioned to take advantage of an eventual economic recovery. Ford’s sales were up 9 percent in September, well ahead of some key import competitors, including Honda and Toyota.

Ford remains a leader in the pickup market, with its F-Series and other light truck segments. But with models like the new Fiesta subcompact and midsize Fusion the automaker also is gaining traction in the passenger car segment where it was long an also-ran.

As a result of the new contract, Ford will expand production of the Fusion, now built in Mexico, by adding a line at its plant in Flat Rock, Mich. That factory, known as AutoAlliance, has been operating as a joint venture with longtime affiliate Mazda Motors. But Mazda plans to pull out of the plant, and there had been concerns the facility would close. Its future seems to be rosy as a result of the new UAW contract.

Indeed, Ford’s Fleming announced that the carmaker will add another 5,750 U.S. hourly jobs once the contract is ratified, bringing to 12,000 the number of jobs it has either added or saved. All the new jobs, however, will be classified Tier II, meaning those employees will make significantly less than veteran Ford line workers. To soften concern among the rank-and-file, Ford has agreed to boost Tier II wages by $3.78 an hour to $19.28, still significantly less than the top tier makes.

Ford also will offer buyouts to veteran workers to open up even more Tier II jobs and lower labor costs further.

The auto industry has traditionally had a strong impact on what happens in the rest of American manufacturing, and the settlements at GM and now Ford are being well received, with Jay Timmons, president of the National Association of Manufacturers, declaring that this week’s [Ford] announcement “will create jobs, will make the manufacturing sector stronger.”

For the UAW, it’s two down and one to go. The union still needs to work up a settlement with Chrysler, the smallest and weakest of Detroit’s makers. A settlement seemed close at hand as negotiations approached the Sept. 14 expiration of the old four-year contract. But an unexplained glitch led UAW President Bob King to walk away from Chrysler and focus on the GM settlement -- a move that triggered the rage of Chrysler’s CEO Sergio Marchionne.

The two have since tried to patch things up and negotiations are again moving ahead, though Chrysler is reportedly balking at the signing bonuses and Tier II wage hikes approved at GM and Ford. It insists that anything that increases its costs — which average $50 an hour — must be offset by cuts in other areas.

Observers expect both sides will bend. If not, they face unforeseen risks. Terms of Chrysler’s 2009 federal bailout prohibit both a strike and a company lockout. As a result, a deadlock would leave the final terms of a settlement up to binding arbitration.