A Web site promising discounted prescription drugs from Canada has been taking thousands of dollars from checking accounts around the United States -- but the account owners say they'd never even heard of the service until they spotted the transaction on their bank statements.

PharmacyCards.com claims to offer 80 percent drug discounts and lists an address in West Vancouver, British Columbia as its home. But the phone number listed on the site goes to a third-party firm in Montreal and the real company at the B.C. address, Accutype, said it had never heard of PharmacyCards.com. The company actually processing the checks, Interbill, said it stopped accepting payments for the Web site in the middle of last week after receiving numerous complaints.

Canadian authorities are investigating, and the Federal Trade Commission says it has received complaints about the site from Canadian authorities. The U.S. Secret Service is also investigating, according to Accutype.

How many people were caught up in the alleged scam is unclear, but in nearly every case, victims report that PharmacyCards.com somehow managed to withdraw $139 from their checking accounts.

"I had never heard of them," said Melissa Rozecki of New Jersey. "Then one day when I was checking my bank balance online I saw an "automatic debit" for $139 ... I wish I could tell you how they did it."

Vancouver's Better Business Bureau, which has given the company an "unsatisfactory" rating, said it has received 335 inquiries about PharmacyCards.com. A consumer complaint Web site, RipoffReport.com, said it has received over 700 e-mails related to the company.

From Vancouver, to Montreal, to Florida, to India

Accutype, the company whose West Vancouver address is listed on PharmacyCards.com's domain registration, offers secretarial and basic mail services. It has no relationship with PharmacyCards, said employee Chrisy Bux, but mail addressed to that firm began arriving in February. Her company is returning most of the mail to senders, she said, adding that the U.S. Secret Service had recently visited the store as part of its investigation into PharmacyCards.

Sgt. Paul Skelton of the West Vancouver Police said his office is investigating several complaints it has received about PharmacyCards.com. He said investigators there traced the site to computer servers in Florida.

In addition to the West Vancouver address, PharmacyCards.com's domain registration information lists a contact phone number in India. Calls placed to that number weren't answered. By Monday afternoon, the Web site itself had stopped operating.

When people call the phone number listed next to the charge on their accounts, they reach operators who identify themselves as employees of Client Care Relations in Montreal -- a third-party firm which handles phone calls for PharmacyCards.com. Operators tell callers that there's no way to reach PharmacyCards.com and then offer to refund their money.

Many alleged victims say they were told they'd been signed up for the service by default -- that they had failed to respond to an "opt-out" notice mailed to their homes within 10 days, thus authorizing the charge.

That's what happened to Sam Steiner, of Portland, Ore. When he called the company to complain, an operator told him that "at some point they would have mailed me something informing me that if I didn't respond to their service within ten days of receipt, that it would be considered my authorization for their transaction."

The operator later suggested Steiner take drastic action to avoid further trouble.

"She then said ... I would recommend to avoid a further hassle that you close your account before the affiliate partner uses your information again,'" he said. "So I asked her how they got my bank account information in the first place, which she responded, "from an affiliate partner,' and refused to give any specific name. "

When MSNBC.com tried the toll-free number, an operator there, who wouldn't give her name, said she is taking complaints and offering dissatisfied consumers refunds within 15 days. She said PharmacyCards.com was a legitimate company, and had many satisfied customers, and said the consumers who are complaining are probably just confused. She insisted they must have given their account information to a PharmacyCards.com affiliate.

While one consumer reported receiving a refund, many others have not. And still others faced additional troubles because of the unexpected withdrawal.

"Because of this charge, my account was overdrawn, but (PharmacyCards.com) would not pay for any of those fees," said Jennifer King of Michigan.

Checks with wrong signatures -- or none at all

Brijesh Tripathi of San Francisco, who discovered a $139 debit from his checking account in early March, said he was sure he had never authorized anyone to take money out of his bank.

Like many other consumers who've complained, Tripathi said PharmacyCards.com appeared to have physically cashed a check drawn on his account, but signed by a person named "Susan Walker." He has no idea how the firm got its hands on a check from his checkbook, or why a bank would cash it with the Susan Walker signature.

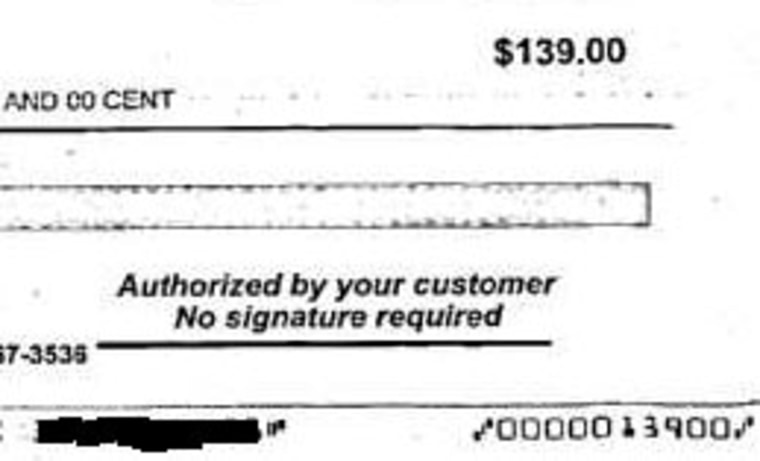

Many people have received copies of the canceled checks that PharmacyCards.com used to withdraw the money from their account. The checks were generally signed not with a fake signature of the account holder, but by a third party, with a stamp nearby that says "authorized signatory." In other cases there is no signature at all -- just a stamp that says: "Authorized by your customer: No signature required."

The checks are often very old, based on the check number used, which is far out of sequence with current checks, consumers say. Many are befuddled that their banks would cash such checks.

But banking consultant Rob Douglas said he's not surprised.

"Every bank has a story of checks coming through, forgeries where even the bank name is misspelled," Douglas said. "They don't really look at any of that. Processing checks is a high-speed operation. ... If a large number of checks were turned in on a corporate line, or through the mail, nobody would really be looking at them."

The payee on the check was Interbill, a third-party payment processor that said it has stopped accepting payments for PharmacyCards.com.

"We recognized 10 or 12 days ago that there seemed to be an inordinate amount of returns," said Thomas Wills, managing director at Interbill. "As result of that .... we elected to terminate the processing relationship. The funds have been frozen. At end of the day, the funds are available (in PharmacyCard.com's bank account), no consumers should lose anything."

Wills said the "authorized signatory" procedure was not uncommon, and compared it to check-by-phone services, which also don't require consumer signatures.

He said Interbill processed payments for the site for about six weeks, but wouldn't say how many transactions had been processed, or how much money PharmacyCards.com had withdrawn from its bank account before it was frozen. He wouldn't provide any other details about PharmacyCards.com, saying the matter was under investigation, other than to say the sites' publishers were based in the United Kingdom.

Fraud big business in Canada

Fraud has become a growing problem for Canada. Just last week, Canada's Competition Bureau announced a guilty plea by Ontario-based Medical Discount Inc. in connection with a similar drug discount plan scheme.

Canadian officials said the firm's telemarketers used high pressure sales techniques to induce potential clients, mainly residents of the United States, to purchase a medical discount plan and release bank account information. Funds were then withdrawn without authorization from the client. The company was fined $125,000 and received a four-year prohibition banning them the sale of health-care discount programs.

Canadian authorities estimate that con artists based in Vancouver, Montreal and Toronto bilked people around the world out of $100 million last year -- about three-quarters of that from U.S. residents.

A special Canadian telemarketing fraud task force called Phonebusters, based in Quebec, is working to beat back the crime. FBI agents are also stationed in Toronto, Montreal, and Vancouver, and work with the Royal Canadian Mounted Police to catch telemarketing con artists.