At first, the flat-screen TV craze was a playground only for the rich. Now less expensive rear-projection flat-screen televisions are making it possible to bring a home-theater setup into the living room, for about half the price of their thinner, flashier counterparts.

Digital Light Processing rear-projection TVs have emerged as the star of the middle market. Thanks to DLP, consumers who recoil at the price of a large flat-screen TV can actually walk away with one from Best Buy or Circuit City Stores without ending up in credit counseling. For instance, Samsung's 50-inch-wide HDTV plasma screens go for about $7,000 at Best Buy, while a 50-inch Samsung DLP costs about $3,500. Pioneer's 50-inch plasma TV, which goes for $10,000, may make DLP seem downright reasonable.

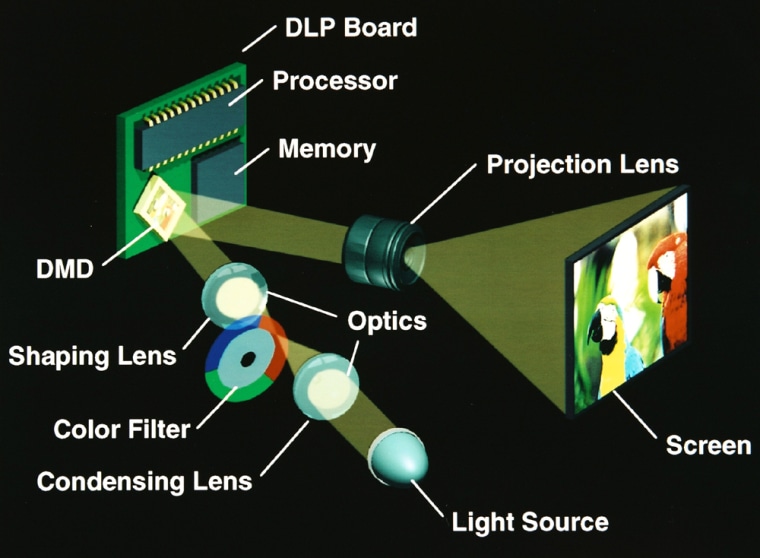

DLP technology, developed and manufactured by Texas Instruments, is mainly used in movie theater projectors, rear-projection televisions and room projectors. It uses a chip embedded with hundreds of thousands of tiny mirrors that move to reflect light, creating a gray-scale image to which color filters are added.

At a resolution of 1,280 by 720 pixels, DLP's clarity is on par with a plasma screen TV. Andrew Shulklapper, vice president of television market research at DisplaySearch, says most people who buy DLP televisions are very happy with their quality.

"People should go to the store and just choose what they like," says Shulklapper. "It's like buying an expensive car. Some people are BMW people and others like Mercedes. They are both great cars; it's just a matter of personal taste."

Weight and thickness

Aside from price, the main differences between the less expensive projection TVs and their sleeker cousins are weight and thickness. Most DLP televisions are about 16 inches deep, compared with 2 to 4 inches for flat-panel TVs. DLP televisions are bulkier, but tend to be slightly lighter than flat-screen TVs.

Samsung's 50-inch DLP weighs about 85 pounds. The plasma version weighs about 93 pounds. Though many people buy plasma televisions to hang on a wall, they often end up putting them on a stand because the TVs are too heavy to install easily. DLP televisions can also go on matching stands that cost about $300.

But at the Consumer Electronics Show in Las Vegas in January 2004, Thomson and original equipment manufacturer InFocus showed a prototype of a rear-projection television less than 7 inches thick. Though they are not currently on the market now and are expected to be much more expensive than standard DLPs, the showcase made it clear that thinner DLPs are on the horizon.

"What happens with the InFocus 7-inch DLP will be very intriguing," says Shulklapper. "Everything will depend on how it is priced. It will have to be less expensive than plasma to win out," he says.

Sharp hopes to exploit this market opportunity. At the opening of a LCD factory in Japan last month, Sharp President Katsuhiko Machida said that the company will enter the DLP market to meet the surging demand for less expensive large-screen TVs. The electronics firm will likely have DLPs on store shelves by early 2005, possibly earlier, says Sharp spokesman Dave Fogelson.

Cost is king

The market is growing quickly. On April 26, Texas Instruments said it had shipped its 3 millionth DLP chip, reflecting 50 percent growth in the last eight months. Recent data from iSuppli/Stanford Resources on units 40 inches and larger show that DLP is making steady progress in the TV market. It's true that traditional cathode ray tube TVs still make up the majority of units shipped, taking 94.6 percent of the market in 2002 and 81.3 percent in 2003. DLP, however, is climbing: It was up to 3.8 percent in 2003 from a mere 0.8 percent in 2002. ISuppli expects DLP market share to reach 8.5 percent in 2004 and 10.5 percent in 2005.

But in the economics of the television market, cost is king. Even with DLP's high-resolution picture, coming price drops will change the consumer landscape.

"We expect that LCD and plasma could get down to $2,000, but that rear-projection televisions may go down to $1500," says Barry Young, vice president and chief financial officer at Display Search.

If DLP prices drop to just $500 below flat panels, rear-projection TVs will have a tougher time competing with the chic, thin form of plasma and LCD displays.