For an institution that relies on a reputation for integrity and excellence for its well-being, the past year for the New York Stock Exchange — fraught with scandal and alleged trading misconduct — has been a challenging one.

The world’s biggest stock exchange is seeking to recover from months of bad press stemming from the abrupt departure last September of its former chief executive Richard Grasso over his $188-million pay package and subsequent lawsuit from New York State Attorney General Eliot Spitzer Grasso, demanding the return of at least $100 million.

And months before Grasso’s unceremonious exit, an investigation into questionable trading by specialists — who manage the trading of individual companies’ stocks on the floor of the exchange — came to light, resulting in sanctions against five market-making firms.

Now the 212-year-old Big Board, the marketplace of choice for the world's biggest companies and investment banks, is fighting back, mounting a coordinated campaign to burnish its tarnished name.

Ringing in the changes

Reportedly at the cost of between $15 million and $20 million, the NYSE has released its first new television commercial in a year — a 60-second spot touts the Big Board’s new leadership and promotes a kinder, gentler image of the exchange.

Gone are the American flags and patriotism of older campaigns; in come images of happy children and worldly sophistication.

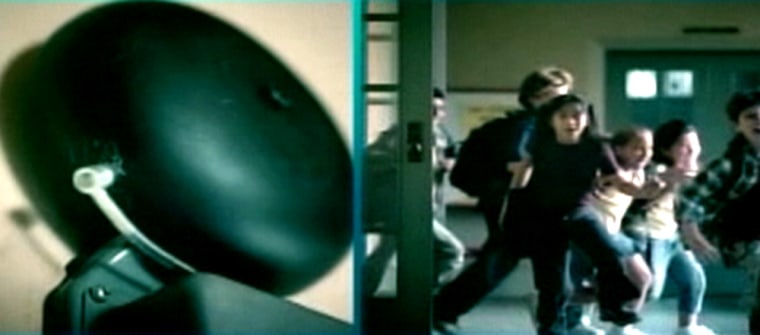

The commercial tells us optimism is celebrated around the world with a ringing bell, and then shows us images of a number of them: a wedding bell, Buddhist bells, a school bell; even a cowbell at a soccer match. Finally, we’re shown the NYSE’s own bell and given the promise that the Exchange has “new standards,” “new leadership” and a “renewed commitment to being the best market on Earth.”

The NYSE's aim: To ring in the changes. The new ad is part of a larger marketing strategy designed to educate the public about changes taking place at the NYSE — including modifications to its governance structure and the appointment of a new leader, former Goldman Sachs executive John Thain — and an overall drive toward greater transparency according to an official at the NYSE.

“We have been in through a difficult period and we think it’s time for us to reconnect with investors,” said an exchange official who asked to be named.

The campaign is not simply an attempt to distance the NYSE from the negative publicity of the Grasso era, the official said. “Transparency is clearly our mantra, and I think that you will now see a series of ads, media relations efforts, educational programs and components on our Web site that drive at demonstrating the value of the exchange, the role it plays and how meaningful it is for investors.”

Goodbye Grasso, hello Thain

Under Grasso, change at the Big Board, which had a reputation for having an “old-boy’s club” atmosphere, was generally stifled, as was any self-expression on the part of the NYSE’s key executives, according to Michael A. Goldstein, an associate professor in the finance department at Babson College in Massachusetts and who has served a one-year term as visiting economist at the NYSE.

“There are many good people at NYSE and they were held back from expressing their judgment on issues because it all had to be cleared through Grasso,” Goldstein said. “I think they have made a mistake by not being more open. They have not really marketed their own story and told people about the good things that are happening there.”

Since taking over the top job at the New York Stock Exchange in January, Chief Executive John Thain has scrambled to present a new image for the NYSE and has worked to push through some important structural changes. He has embraced electronic trading and has promised to develop tools to measure the claim that specialist improve stock prices for investors.

More recently, Thain has started to raise his profile in a way some analysts say shows his increasing comfort with becoming the new face of American capitalism.

With an op-ed piece in Thursday's Wall Street Journal, Thain questioned the costs to U.S. businesses of implementing tougher corporate governance standards. He appeared to be casting off his self-imposed muzzle while sending the public a message: Goodbye Grasso, hello Thain.

"It's wise because there's a void,” said Paul Argenti, a professor of corporate communication at Tuck School of Business at Dartmouth College, who came to know Thain while working as a consultant to Goldman Sachs. “Grasso's moved on ... and we need to hear from who's in charge," he added.

Thorny issues ahead

Still, Thain and the New York Stocks Exchange face thorny issues in the months ahead according to Goldstein.

The Big Board’s longstanding specialist system of stock-trading is currently under scrutiny, he said. Another knotty problem is the so-called “trade-through” rule, which requires stock-trading orders to be executed at the best prices available in the U.S. national markets system — which most of the time means that is on the floor of the NYSE.

Critics of the rule, such as all-electronic stock markets, say the rule is out of date and unfairly advantages the NYSE. They are lobbying to have it repealed — a move that may sap trading volume away from the Big Board by exposing it to competition from automated trading systems. As a compromise, the Securities and Exchange Commission has proposed regulations that modify the rule. That proposal is out for comment until June 30.

“The trade-through rule is a big worry for the exchange, so they want to get their side of the story across,” Goldstein said.

“The electronic trading networks are saying the rule locks them out of the gain, but all the liquidity at is NYSE for a reason. It’s true that other marketplaces around the world no longer use floor-based trading systems, but the most successful trading marketplace in the world is NYSE — this is a not broken system,” he added.

As the NYSE markets itself to the public, it should also focus on fixing the problems that have led to its current predicament according to Ronald Goodstein, an associate professor of marketing at Georgetown University’s McDonough School of Business.

“I advise corporate clients who want to re-brand they need to work on fixing its internal problem, otherwise they’re just blowing smoke,” Goodstein said, adding that the NYSE should focus its campaign on its customers.

“As an individual investor, the exchange doesn’t mean much to me; I won’t invest in it per se, I’ll invest in the companies that list on it,” he said. “So the NYSE needs to differentiate their customers, otherwise their ad campaign could end up being an inefficient use of money. They really want to worry about the big brokerage houses — they are ones who will change things for them.”