In the biggest-ticket domain name sale in years, a small Austin marketing firm has paid $2.75 million for CreditCards.com. Despite the rocky history of high-priced domain sales, participants say it was a fair price, and the sale may signal a new gold rush for Internet address speculators.

"It's like prime real estate, there's only so much of this real estate to go around. I feel like we bought a slice of Park Avenue," said ClickSuccess CEO Dan Smith. The sale was actually completed in March, but just announced Tuesday.

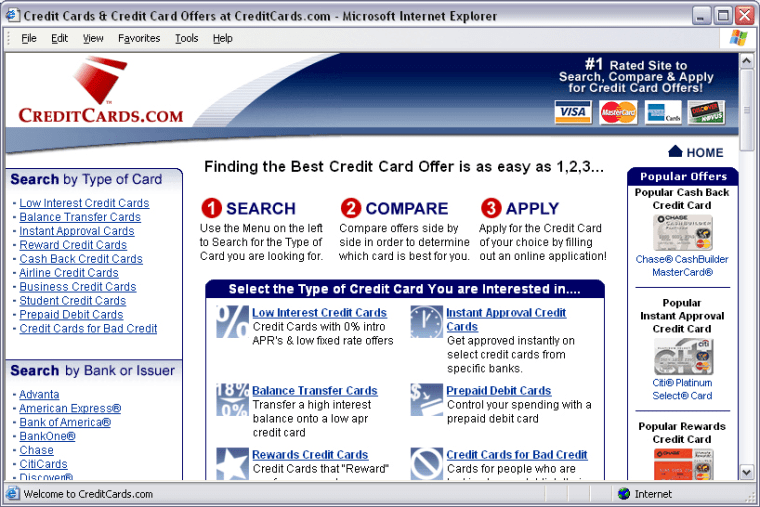

CreditCards.com allows consumers to compare interest rates and other terms on hundreds of credit cards.

Multi-million dollar domain name sales were the poster child of dot-com excess -- with the most infamous being Business.com. ECompanies Venture Group, headed by former Disney executive Jake Weinbaum, paid $7.5 million for that domain name, but when the dot-com bubble burst, such prices began to appear downright silly. Today, Business.com is a shell of its former self, a simple text-based search engine run by a skeleton staff, a warning to would-be speculators.

"Prices at that time had no bearing on reality. Everyone just assumed they were going to be worth a fortune," said Ron Jackson, editor of Domain Name Journal.

What's in a name?

Domain sales began their comeback last fall, with a series of sites that sold for six figures, followed by the million-dollar sale of Men.com. Now, a tiny entrepreneurial Boston firm named Dealjam has turned its minimal investment in CreditCards.com into the biggest domain sale in years.

The formula this time around is different, however, Jackson said.

CreditCards.com is more than a domain name: it's a viable business. Before the sale, CreditCards.com was pulling in $30,000 or $40,000 a month in advertising an pay-for-conversion revenues, Jackson estimated.

"Typically, the numbers I hear for an ongoing business, they sell for 3 times annual revenue. So I don't think ($2.75 million) is a wild price. But it's certainly the highest one we've heard since the bubble," he said.

Dealjam president Andrew Miller said the credit card consumer research site has been profitable since the day he purchased it "for six figures" a little less than three years ago. His firm has a small staple of domains that it develops into full-fledged Internet businesses, then sells off to the highest bidder.

"We pick categories that are poised to succeed on the Internet," he said. "We are in a rapidly inclining market."

Jackson agreed, saying the Internet advertising rebound has had an immediate impact on the value of domain names. Simple pay-for-click sites, like Candy.com, now earn as much as $10 per user they send to an e-commerce site, Jackson said. And when a visitor to a site like CreditCards.com actually signs up for a new credit card, the bounty is as high as $50, he said.

"And I'm hearing those figures might jump another 50 percent this year," he said.

Miller said the recent uptick in the value of domain names was more grounded in reality than its predecessor. Legendary failures such as Wine.com had nothing to do with their domain names, he said. Instead, the firms making the purchase simply didn't have solid business models.

"In the pre-bubble deals, there were guys who threw money at a domain and didn't know what to do with it," he said. "There were a few high-profile deals where someone bought a name, then the company went belly up. It had nothing to do with the name."

Still, those high-profile failures will likely keep prices relatively reasonable this time around, Jackson said.

"The market is most definitely in a major rebound since last fall," he said. "But I haven't seen any really dumb deals in this new rebound that we're having."