"Free money to pay your bills," scream the ads plastered all over late night TV, radio stations, and the Internet. But don't believe it, the New York State Consumer Protection Board warned consumers on Wednesday.

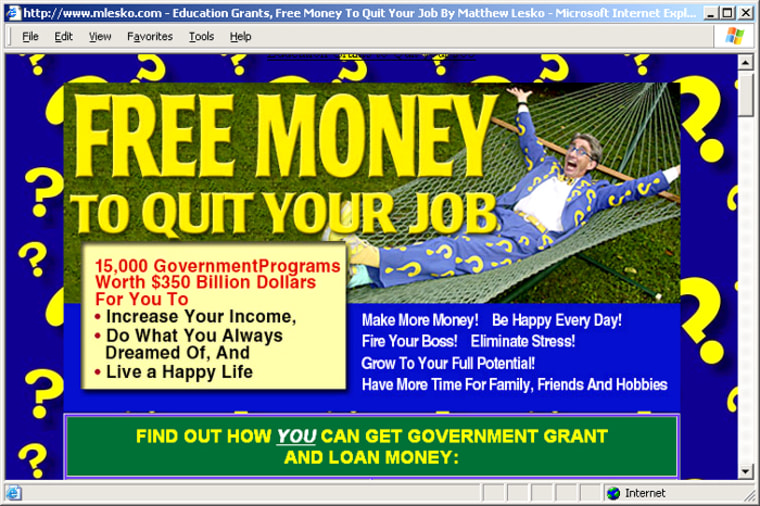

In the advertisements, self-proclaimed government grant guru Matthew Lesko makes aggressive pitches. Clad in a garish question-mark bedecked suit, in his trademark high-energy style, Lesko promises the inside scoop on little known grants and funding sources. He offers a chance at $350 billion worth of giveaways that could answer the prayers of those who are down on their luck — all in exchange for buying his most recent, $37.95 book

The promises are bold, such as "Why get out your checkbook when government sources will pay these bills?" and "I'll show you how to get the government to pay off your credit card bills and cover your basic living expenses."

But the claims are deceptive, says the New York State Consumer Protection Board, which issued a stern rebuke to the money man on Wednesday. In a report and press release issued by the Albany, N.Y. office, the agency says Lesko is exaggerating and taking advantage of downtrodden consumers.

Lesko: Traditional marketingLesko says he's just doing a public service by getting attention to government grant programs that would otherwise go unnoticed. Lesko says he's sold millions of books in the last twenty years, all focused on helping consumers get their fair share of available money. In a lengthy, seven-page response to questions posed by MSNBC.com, Lesko argues he is engaging in traditional marketing practices.

"This is primarily a result of trying to interest people in our products in the shortest amount of time," he says. "Every advertiser, news outlet and even politician frames their stories and information this manner."

He also says the consumer board has not received any complaints about his firm, and customers who aren't satisfied with his books are entitled to a refund, he said.

"This has been our policy for over 25 years. We do not want anyone unhappy with one of our products," he says.

The New York consumer agency says consumers who pay for such advice are almost always disappointed and that Lesko's multimillion dollar advertising campaign not only offers false hope, it has helped fuel an entire cottage industry of shaky government grant giveaway advice.

The agency wants Lesko and his Maryland-based firm, Information USA Inc., to tone it down.

"Lesko is now promoting a new book, 'Free Money to Pay Your Bills,' by claiming that the federal government has more than $350 billion in 'hidden money' that ordinary people can use to pay their credit-card bills and 'get out of debt.' That claim is simply not true," said Consumer Protection Board Chairperson and Executive Director Teresa A. Santiago. "We're mythbusters here. These are entitlement programs ... and the average person cannot apply for them."

Lesko's book isn't a scam, the office says. But advertising for the book includes "wild exaggerations," the agency says, adding that it is referring its research to the New York state attorney general's office.

"(Lesko is) profiting from the false notion that the government has billions of dollars available to help people pay their credit-card bills and other expenses," the agency says in its report. "This is due, in part, to the exaggerations and misleading claims spread by Matthew Lesko and the nationwide network of Lesko distributors."

Tall tales of free money

Most of the "hidden" $350 billion cited in the ads represents well-known public assistance programs like Medicaid and Medicare, for example, the agency says. The state group began investigating Lesko after receiving complaints about other grant offers, a spokesman said.

Among the inaccurate claims on Lesko's Web site found by the state board: that he is a columnist for the New York Times. The newspaper complained about this in November and asked that he remove the reference. Lesko once wrote a column distributed by the New York Times Syndicate, but stopped in 1994, the paper says. Lesko concedes the error, and says he's working to fix the Web site.

Examples of Lesko tall-tales, the agency says, include one story of a researcher who was given $500,000 to "travel the world," suggesting others can apply for similar offers. In reality, the researcher is a quantum physicist and professor at Georgetown University, who won a grant from the National Science Foundation. “Free car repairs” mentioned in the book actually involve automobile recalls, the agency says.

Lesko doesn't dispute either point, but says both stories are just examples of the kinds of funds that are available to U.S. citizens. Many other examples in the book demonstrate that "that there are plenty of programs available for all income categories and backgrounds," he says.

Lesko's book also points people to private assistance agencies, encouraging them to apply for grants there, even though many of the agencies don't give away money.

Mary Hoffman, executive director of the Small Business Development center at Adams State College in Colorado, says Lesko's book regularly sends about five money-seekers a week her way and she disappoints nearly all of them. While her agency gives free advice, it doesn't give away free money, as Lesko's book suggests.

"They're being sent on wild goose chases. ... A lot of our clients end up paying good money they can't afford for books like this," she said.

Grant advice a growing business

The Washington-area Better Business Bureau assigns an unsatisfactory rating to Lesko's company. The group has received 85 complaints about Lesko books in the past 36 months, according to president and CEO Ed Johnson. He wrote a warning to consumers about Lesko's sales pitches in 2002, which still appears on the agency's Web site.

"The way it's represented one would think obtaining the funds is a cinch," Johnson said. "The practical reality is it's not." Lesko said he didn't know about the complaints, or about the unsatisfactory rating.

The New York State Consumer Protection Board is calling attention to Lesko's books now because it says there is a growing wave of firms offering tips on obtaining government grants. Many charge hefty up-front fees and never help consumers, the agency says.

While Lesko isn't involved in such scams, his advertising helps fuel the perception that government grants are easy to obtain, the agency says. And Lesko sells customer lists to other grant-giveaway groups. In one case, a Lesko list buyer was accused of deceptive practices by federal authorities.

In July of 2003, the Federal Trade Commission settled deceptive practices charges against an Oregon firm, Grant Search Inc. and a related firm, Grant PAC. The FTC said that the defendants operated a "grant-matching business in which they falsely represented that consumers easily could obtain grants from charitable foundations for virtually any reason.”

Grant Search and Grant PAC purchased Lesko’s customer lists from the list broker Nextmark, according to Nextmark's Web site.

Lesko said it's a common business practice to sell or rent customer lists. He didn't know if Grant Search or Grant PAC had purchased his firm's list, but added "They might have and I would have to investigate this further. ... We would certainly not rent our list to anyone engaged in fraudulent activities."

Telemarketers enter the game

The sale of the lists concerns the New York agency because of a rise in fraudulent grant-related telemarketing calls.

Some go much farther than Lesko, calling consumers at home and announcing they are eligible for government grants -- but requiring them to pay $200 or more for access the money.

In a call monitored by a New York consumer board investigator, one such grant operator makes a hard sell.

“Every year the U.S. government used to give $20 million grants to its citizens and this year they have decided to give 1.5 trillion dollars as the grant amount," the caller told a potential buyer. "You are one among them who have qualified to receive it. So you are guaranteed to receive $8,000 and you can receive up to $25,000. Got it?”

After a lengthy sale pitch, the potential victim is asked to pay $257 for instructions on how to receive the money.

In part because of the outbreak of grant-related scams, the New York state consumer agency has asked Lesko to tone down his marketing. "Wearing a wild suit may be good marketing. But making wild, misleading claims about government grants is bad business," it says.

But Lesko says he's just trying to draw attention to a subject that's otherwise fairly mundane.

"I can understand that the information mentioned in our advertising may not apply to every single person who orders our book," he said. "I can understand that some people may misunderstand our mission. But I believe that our mission is to stay in business in order to educate the general public about programs available from government and non-profit organizations."