Federal Reserve Chairman Alan Greenspan Thursday said some form of a consumption tax — such as a national sales tax — could spur greater economic growth, but he acknowledged that a hybrid approach might be more politically realistic.

Switching from an income tax to a consumption tax would generate huge opposition from Democrats, who argue that a greater burden would fall on the poor because they spend a far higher proportion of what they earn.

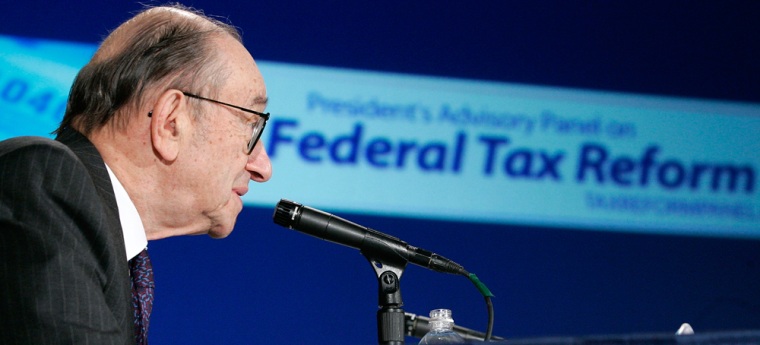

Acknowledging those concerns, Greenspan told the President’s Advisory Panel on Federal Tax Reform that policy-makers might want to consider a combination of an income- and consumption-based system.

“I would suspect that probably that may be the best route to go. In other words, don’t try for purity,” Greenspan said in response to a question from a panelist. “I would suspect that the opposition that would arise would probably make such a structure (a pure consumption tax) infeasible.”

Addressing concerns about increased surcharges on food and other necessities, Greenspan said policy-makers could design a consumption tax that would exclude some products.

In his prepared remarks to the panel, the Fed chief said that “a consumption tax would be best from the perspective of promoting economic growth” because it would encourage saving and the capital formation that the economy needs to expand and modernize.

“However, getting from the current tax system to a consumption tax raises a challenging set of transition issues,” he added.

Greenspan also said he supported tax incentives to encourage savings, largely because they affect the behavior of Americans saving for retirement.

“And that, especially in the context of the discussions we’ve all been having the last couple weeks relevant to retirement funding and the like, is clearly something which is desirable,” he said.

The Fed chief delivered his assessment to the panel a day after worrying aloud before a House committee about the buildup of budget deficits in recent years. The tax-reform panel is looking into ways to revamp the complex tax code, an important goal of President Bush.

Consumption taxes can take the form of national retail sales taxes or a value-added tax, imposed on the increased value of a good or service at each stage of manufacture and distribution and ultimately passed on to the consumer.

Bush’s advisers have spoken favorably of the economic benefits that could be achieved by moving from a system that taxes income to one that taxes consumption.

Democrats, on the other hand, are concerned about such a change. “I have a problem with the consumption tax because I believe it would be regressive,” said House Democratic leader Nancy Pelosi of California.

While Greenspan did not specify what types of transition problems would be faced in moving toward a consumption tax in his prepared remarks, he did tell the panel he is concerned about the issue of taxing capital investments under the consumption tax. “This is the issue that bedeviled the 1986 commission and ultimately led them to abandon the consumption tax idea,” he said.

Bush’s aides have pointed out that the current tax system is actually a combination of a system that taxes income and one that taxes consumption. They note the creation of individual retirement accounts and other tax-deferred savings accounts allows taxpayers to shelter some investment earnings from tax.

Greenspan told the panel members in his prepared comments that they will have to decide what type of system to use such as “a comprehensive income tax, a consumption tax or some combination of the two, as is done in many other countries.”

The tax panel is responsible for coming up with recommendations to make taxes fairer and simpler. In addition to revamping Social Security, Bush wants to overhaul the nation’s tax system — two centerpieces of his second-term economic agenda. Achieving both will be difficult politically and economically, especially against the backdrop of swollen budget deficits, analysts say.

Greenspan didn’t offer a specific approach for policy-makers to follow as they consider an overhaul of the tax code.

But he did say that changes should be aimed at making the tax code easier for Americans to navigate, be fair and should contain an element of predictability so that businesses and consumers alike can look into the future and have a good idea what their tax obligations are — allowing them to plan ahead.

“A simpler tax code would reduce the considerable resources devoted to complying with current tax laws, and the freed up resources could be used for more productive purposes,” Greenspan said.

The panelists later heard about one of the most complex and vexing parts of tax law — the alternative minimum tax.

Enacted in the 1960s after an outcry erupted when government officials determined 155 individuals paid no income tax, the levy aims to prevent wealthy people from sheltering their entire income from taxation. It has since grown into a second layer of taxation that creeps further toward the middle class each year.

Thomas Rinaldi, who runs a commercial kitchen installation business in Katonah, N.Y., submitted a statement about his experience with what he called the “stealth” tax.

“No matter how many times I ask my accountant to explain it to me, I still can’t figure out why I have to pay AMT even though I went to four years of college and minored in mathematics,” he said.

Leonard Burman, co-director of the Urban-Brookings Tax Policy Center, read some of the IRS instructions for computing the alternative minimum tax to the panel. “I have no idea what that means. That’s why I use TurboTax,” he said.