In the end, Phil Purcell had to give in.

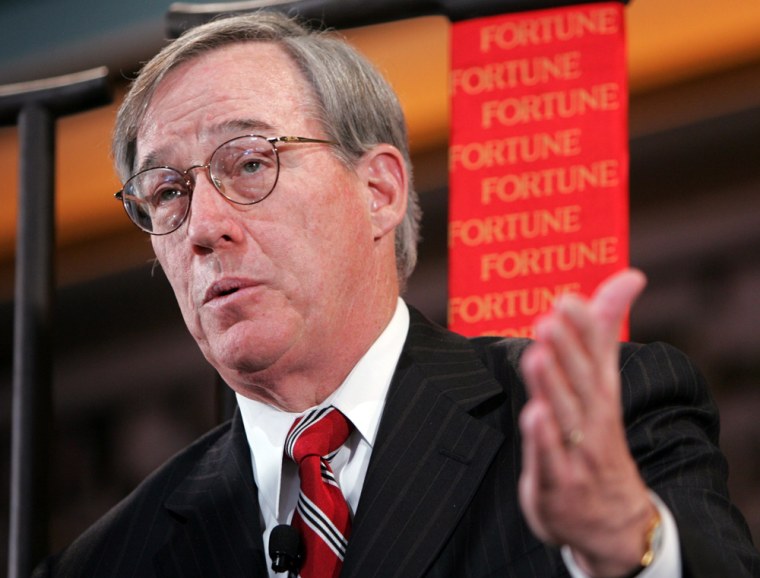

The Morgan Stanley chairman and CEO, who just months ago seemed to have a solid base of support at the venerable Wall Street firm, couldn’t hold on to his job amid a flood of defections by employees who, it turned out, had no faith in his management.

On Monday, Purcell announced plans to retire. It happened only three days after nine stock traders joined an exodus of top Morgan Stanley staffers that began last March and that included one of Wall Street’s biggest stars, investment banker Joseph Perella. It also included five of Morgan Stanley’s 14-member management committee.

Purcell admitted that calls for his ouster and the series of high-profile departures have hurt the firm. So, despite an April 30 vote of confidence from the Morgan Stanley board, Purcell said Monday he’d retire as soon as a successor can be found, but no later than the company’s annual shareholder meeting next March.

The resignations had led a group of dissident shareholders and former executives to publicly call for Purcell’s firing and a reorganization at Morgan Stanley. That, Purcell said, created a “sideshow” that distracted the company from its business goals.

“This morning’s announcement was very, very simple but hard,” Purcell, 61, told analysts in a conference call. “There’s been way too much attention being paid to acrimony and criticism, most of it directed at me. It’s not good for Morgan Stanley, and the best thing for me to do is, in fact, to retire.”

Investors who had sold Morgan Stanley shares as the turmoil increased were clearly relieved Monday and bid the stock higher.

Two sources close to the company, speaking on condition of anonymity, said Purcell’s departure was a joint decision by the CEO and Morgan Stanley’s board of directors. They said Friday’s resignations — from a division Purcell had highlighted as important to the firm’s future — were the deciding factor in his leaving.

The sources also told The Associated Press that Morgan Stanley board member Charles Knight, who will head the search for Purcell’s successor, told an employee meeting early Monday that popular former Morgan Stanley executive John Mack would not be considered for the job.

In addition, Knight told employees that none of the dissidents would be candidates, the sources said, nor would five former managing directors whose departures earlier this year triggered the succeeding wave of defections.

Knight’s statement removes some of the foremost candidates to replace Purcell. Given Purcell’s role as chairman of Morgan Stanley’s board and the board’s loyalty to him through the years, it was considered highly unlikely that anyone remotely aligned with his critics would get the top job.

If a transitional CEO is desired, a number of Wall Street veterans could receive consideration, including Citigroup chairman Sanford Weill, former Citi CEO John Reed, or former Treasury Secretary Robert Rubin. Otherwise, aside from those who already left Morgan Stanley and are not under consideration, few others combine the experience and vision to run the company.

Richard Bove, an analyst with Punk, Ziegel & Co., speculated that either of the two co-chief operating officers under Bear Stearns Cos. Inc. CEO James Cayne — Alan Schwartz or Warren Spector — could be a potential candidate, depending on which one succeeds Cayne. New York Stock Exchange CEO and former Goldman Sachs executive John Thain has also been mentioned.

Morgan Stanley would not comment on possible replacements. The company has retained Thomas Neff of the headhunting firm Spencer Stewart to search for qualified candidates.

Because of the issues still facing the company, Purcell’s successor is also unlikely to come from Morgan Stanley’s top ranks, which have been populated by Purcell loyalists — a strategy that prompted the wave of departures in the first place. Co-presidents Zoe Cruz and Stephen Crawford, appointed to their posts in late March over other longtime executives, may have problems holding on to their current jobs, let alone vying for the top spot.

“The board of directors’ decision to ask for Purcell’s retirement would seem to indicated that it wishes to put the recent management acrimony behind it,” Merrill Lynch analyst Guy Moszkowski wrote in a research note Monday, “and retaining figures very closely associated with Purcell seems unlikely to accomplish that goal.”

In the meantime, Purcell will have his hands full. Simultaneously with his retirement announcement, the company also warned that its earnings would fall sharply below Wall Street’s estimates. Like other Wall Street firms, Morgan Stanley said difficult market conditions in the March-May period would harm second-quarter earnings, which Morgan Stanley is scheduled to release June 22.

“This is a numbers business, and with this warning, Morgan Stanley has missed expectations three of the last four quarters,” Bove said. “Ultimately, you just can’t do that, no matter what else is going on.” Purcell said the company’s difficult quarter was not connected to its leadership and personnel issues.

While some have speculated that Purcell’s departure opens the door for a possible takeover, research notes issued by a number of analysts Monday said few other companies would have the resources to buy a firm the size of Morgan Stanley.

Upon his retirement, Purcell could walk away with up to $62.3 million in compensation, according to Morgan Stanley filings with the Securities and Exchange Commission. Of that, $48.1 million comes from Purcell’s stock and stock options, with another $14.24 million in retirement accounts and pensions.

Last year, Purcell earned $22,467,606 in total compensation, including stock option grants and stock sales, according to regulatory filings.