As tax day approaches, the question of what we all pay is on the minds of Americans everywhere.

But taxes are a lot more complicated than your annual 1040, and what you pay is about a lot more than what you earn: it’s also about what where you live.

In fact, those two factors together combine to create very different realities for high- and low-income taxpayers in different states across the country, according to data from the Institute on Taxation and Economic Policy.

For those with low incomes, the bottom 20% in each state, Delaware and the District of Columbia, offer the lowest effective tax rates.Both those jurisdictions have effective tax rates of less than 6% for low-income taxpayers.

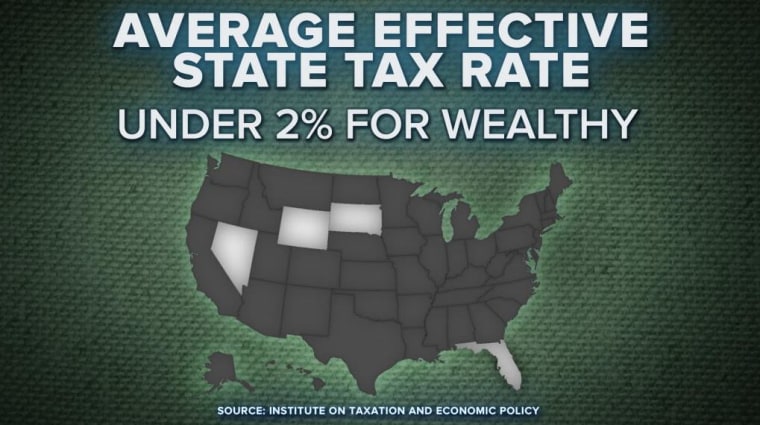

At the other end of the spectrum, the top 1% of earners, Wyoming, Nevada, South Dakota and Florida offer the lightest tax burden. In those states the top 1% has an effective tax burden of less than 2%.

Those numbers reveal a larger truth in the Institute’s tax data. Overall, the numbers show,low-income Americans have a higher effective tax rate than the wealthy.

Averaging out the effective state tax rates, the bottom 20% pays a tax rate of 10.9%, while the top 1% pays a rate of 5.4%. That’s more than twice as much for those on the bottom. Why is that? Because as much as people bemoan April 15, paying taxes isn’t a once-a-year thing. It is an all-the-time thing in most states – from registering your car to eating at your local burger joint. And some taxes hit low-income Americans harder than others, particularly sales taxes.

Rich or poor, everyone has to buy the basics – food, shelter, clothing. Those basics take up a much larger portion of a small paycheck than a big one and many of those purchases carry taxes.

But these figures also raise an interesting point about being rich or poor and the geography of taxation in the United States.

In recent years wealthy Americans have discussed moving to other states to avoid high tax rates.

Fox News host Sean Hannity threatened to move out of New York to avoid its taxes. Pro golfer Phil Mickelson has said similar things about California. And looking at these data there may be good reason for that. California and New York are the top two states for taxes on the top 1% of earners. Both states have effective tax rates of more than 8% for those wealthy Americans. The men could move to, say, Florida, where the effective tax rate for them would be only 1.9%.

These numbers, however, suggest that poor Americans actually stand to gain the most by moving.

The effective tax rate at the state level varies most for the bottom 20% of earners. The lowest rate, 5.5% in Delaware, is 11 points lower than the highest rate in Washington state, 16.8%.

For those in the top 1% of earners, the difference is only 7.5 points between the lowest, Wyoming at 1.2%, and the highest, California at 8.7%.

The irony, of course, is that even if the poor could gain more by moving, they are likely less able to do so. Relocating is an expensive proposition that’s more affordable for pro golfers and TV hosts than it is for, say, fast food workers.

One more point on the politics and geography of taxes: As you might expect, the great red/blue divide is apparent in these state taxation numbers as well.

States that voted for President Barack Obama in 2012 on average have higher effective tax rates for both low- and high-income earners, than those that voted for Republican Mitt Romney.