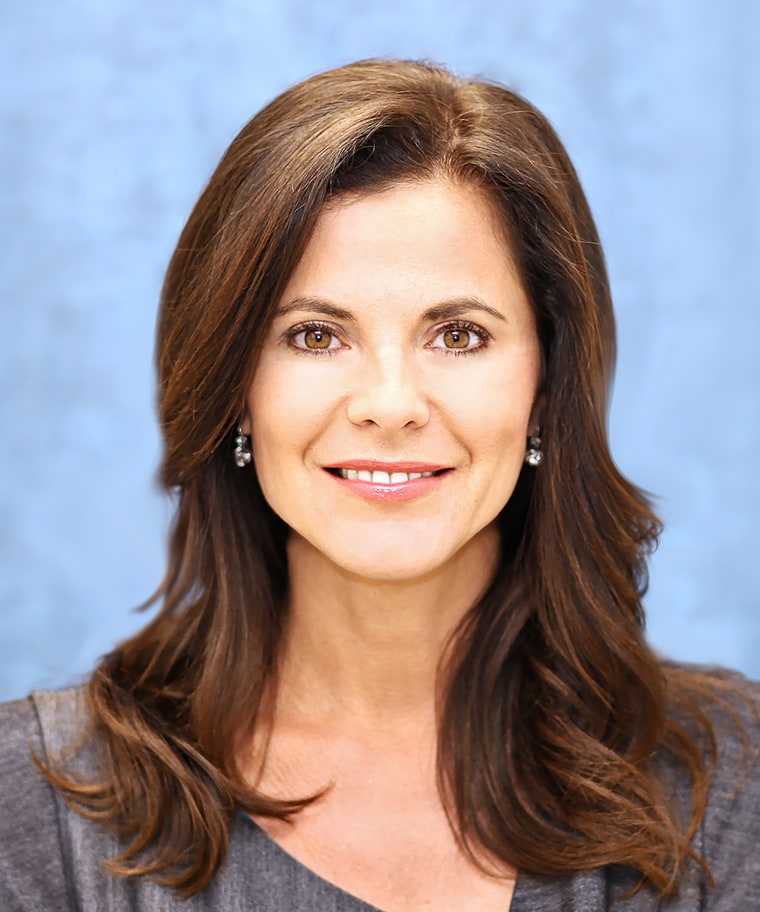

NAME: Patty Arvielo

AGE: 51

HERITAGE: Mexican-American

HOMETOWN: Grew up in Los Angeles area now in Corona Del Mar, CA

OCCUPATION/TITLE: President of New American Funding

Patty started in the mortgage industry at age 16 and eventually went on to transform New American Funding into a national mortgage lender and servicer that funds more than $900 million in home loans each month. Patty serves as the Corporate Board of Governors Chairman for the National Association of Hispanic Real Estate Professionals whose mission is to increase the rate of sustainable Hispanic home ownership by empowering the real estate professionals that serve the community.

In Spring of 2014, Patty spearheaded the Latino Focus Committee within her organization, with the mission of identifying and addressing challenges Latino consumers face in their pursuit of home ownership and to enhance the quality of their lending experience. Patty is also on the Diversity Committee for the Mortgage Bankers Association, serves as a member of the Fannie Mae Affordable Housing Advisory Council and resides on the Freddie Mac Community Lender Advisory Board.

How did you get into the mortgage industry?

Unfortunately, education wasn’t a big driver in my family. Neither of my parents got very far with their own educations and I really wasn’t raised with the dream of going to college, I was self-driven to find what I could do to make the most money at the time.

When I was 16 and still in school, I landed at Transunion and got this job working as a clerical data input clerk. Part of my job was to input mortgage credit reports, pull reports from all three bureaus and compile them in one report and type it up. I’d get calls from loan companies asking for status reports and then one day I asked the person who I talked to “How much does your job pay an hour?” So I started looking for a job at a mortgage company and at 18 I got on as a clerical loan opener and receptionist and I just climbed the opportunity ladder. I did every single job you can do in this business.

At 20, I was young, I chased the almighty dollar and every opportunity with the attitude: “I can do that — and even better than anyone else.”

What propelled me was an undying work ethic - I just valued it more than other people. It was “will over skill” — I always had the will and I was able to teach myself the business because there was no school for it back then and there still isn’t — it’s all on-the-job training.

What’s the best thing about working in the mortgage industry?

I’ve stayed rooted to this business – I’m in my 35th year as of this June – because though it’s an extremely stressful business, it’s also very rewarding. I help people achieve the American Dream and I got great satisfaction from this role at a very young age.

In 2007 when you uttered the words “mortgage banker” people would say: “Ugh! They caused the meltdown,” but that’s not true. I was never ashamed of my work and I’m very proud of the very high integrity of everything I do. At a young age I was serving the Latino community in homeownership achievement and when other business avenues dried up it was obvious that Latinos were still buying homes. I thought, “I speak pretty good Spanish!” And I put “Se habla español” on my business cards and started to call on Spanish-speaking realtors. It was one of my busiest times because where others were sitting on the sidelines, Latinos were looking for opportunities to fulfill their innate desire for a home.

Did you ever consider putting your career on hold to attend college?

I graduated high school and I don’t know that I was an excellent student. I excelled in debate team and was good in Spanish – I was good at what I wanted to be good at it – but it just wasn’t that big a deal to me in high school. Once, after I graduated, I walked on to a college campus and went to sign up but because at that point I was making so much money and had a new car and realized there was no way really to get through school and maintain my lifestyle, I went down the path of working.

You eventually transitioned from being an employee to being a business owner, what did you learn about yourself?

My husband, but boyfriend at the time had said, “You need to come work with me” and we ended up taking a company over. It was definitely an education, like in 2007-08 most mortgage businesses went down but we stayed intact. We kept our core group, we didn’t pay ourselves for year and a half, we hunkered down and held our breath tight until it started to grow.

RELATED: What I've Learned: Public Health Is Building Block for Latinos

It was a difficult mind-shift. I had always worked for the satisfaction of a paycheck and at age 39 to learn the whole risk-reward thing was incomprehensible. I was like, “What do you mean risk?”

Unfortunately I had never learned that – in our community we don’t risk, we have that instinctual fear of not succeeding and so we hold ourselves back, it’s a protection mode.

When I was 18 I remember I told my mom I wanted to enter a beauty pageant and she said, “Ay no! You’re going to embarrass the family!” Of course I did it anyway and won and went all the way to Miss California and my mom was my biggest fan and biggest cheerleader. But she told me that at first because she wanted to protect me from getting hurt or disappointed.

I hope our next generation is better about not needing a safety net. I hope my daughter lets her daughter fail because no one’s going to pat you on the back and say, “You’re going to be successful.” You have to do it on your own.

You mentor younger women and encourage Latinos and Latinas to follow their own dreams. What are your secrets to success?

I tell people what I did: I looked at other leaders who were better than me, like Sheryl Sandberg, I looked for mentors and women who made more money and were more successful than me. And I was not afraid to change mentors when I reached a new high point.

Also I tell people not to hold themselves back. You can exceed your limitations. The problem we have is a relative lack of role models, a lack of people to look up to. When you think about Silicon Valley you think about young white or Indian males but Latinos looking to get involved in technology are starving for leadership who can tell these stories about risk and reward.

So we, whatever our talent or career, have to show up and be role models. I am my mother’s American dream. I am the result of her coming to this country. It’s super important for Latinos to look at me and say, “I can be her, I didn’t go to college either.” And you can! That’s all I did – I looked at other people, saw how they were doing it and got to work.

It’s not always easy, there are multiple factors and a lot of it has to do with being women with multiple roles as mothers, wives and employees. Everybody’s question is: “Is there balance?” No, there’s not, that’s not the right word. You have to leave the guilt at the door. I make choices and are they always the right ones? No, but it’s the not doing that hurts us, it’s NOT the doing that hurts us. Failing is learning.

Esther J. Cepeda is a Chicago-based journalist and a nationally syndicated columnist for The Washington Post Writers Group. Follow her on Twitter, @estherjcepeda.