Some homeowners got rich quick, while others lost money during the turbulent real estate market in the 2000s, but a new study reveals that no matter when black first-time homebuyers purchased their homes, the majority of them lost money.

According to the study, “Is Timing Everything? Race, Homeownership and NetWorth in the Tumultuous 2000s,” released Wednesday in the journal Real Estate Economics, researchers found that race was a key factor in determining which low and moderate-income individuals who purchased their first homes from 2000-2009 made money.

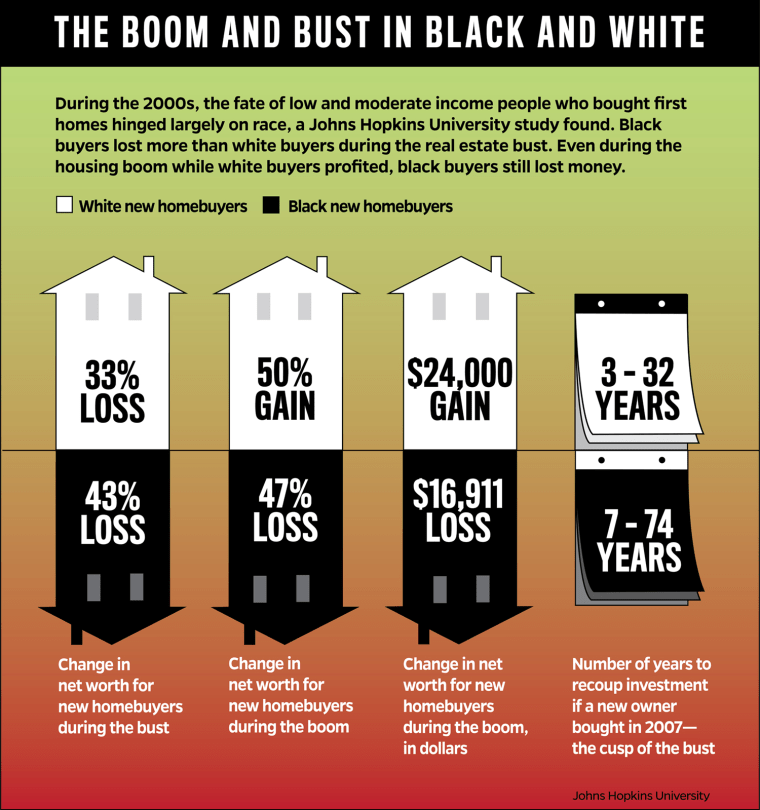

While some white homebuyers lost money during the Great Recession, from December 2007 to June 2009, black homebuyers lost significantly more. The study looked at families with a median income of about $106,000 or less and homebuyers who were aged 58 or younger.

Even during years when the economy boomed, the report indicated that black buyers experienced a 47 percent drop in their wealth, while white homebuyers boosted their wealth by 50 percent.

“This came to us as a great shock,” said study co-author Sandra J. Newman, a professor of policy studies at John Hopkins University. “All of the reports that we had been reading in the popular press and academic journals talked about homeowners in general, first time homebuyers in general and never distinguished homebuyers by their race. Lost in the story was the fact that black first-time homebuyers were losing money across the board and losing much more dramatically during the recession.”

The study built on previous research conducted on three Detroit neighborhoods and Prince George’s County, Maryland, for the book, “House of Debt,” by A. Mian and A. Sufi.

“If they were renting, they would not have lost all this equity in their homes. They could have set aside the money in a very low interest CD or hid it under the mattress.”

Newman and C. Scott Holupka, a senior research associate at John Hopkins, discovered that timing seemed to be the most important factor in whether white buyers made money on their homes. But timing meant nothing for black buyers.

Conversely, the neighborhoods they purchased in made the difference. Those neighborhoods tended to be predominately black where houses cost less, had lower appreciation values and declining homeownership rates.

“One of the lessons here is that the kind of neighborhood you purchase in, the location plays a very big role,” Newman said. “So you want to be sure that this is an appealing location that has a strong appreciation history. It’s much more risky to find a lower priced home in a lower appreciation neighborhood. If you’re not in the position to absorb that kind of risk, it’s much better to find a more stable neighborhood.”

RELATED: Welcome to Uniontown: Arrowhead Landfill Battle a Modern Civil Rights Struggle

Education levels and marital status also were strong factors in how the home purchase would impact black homeowner’s assets. Marital status and education didn’t impact white buyers at all.

Newman and Holupka analyzed data from the Panel Study of Income Dynamics and specifically looked at how buying a house impacted renters’ net worth of homebuyers at three different points during the decade—during the 2001 recession, when the market began increasing in 2003, at the peak of the 2005 boom, and the beginning of the Great Recession in 2007.

Home buying has long been touted as a way to increase wealth. The researchers said they also wanted to know if that was true. It still generally is for whites, the researchers said.

“What was shocking, what was surprising is that even during the supposedly good periods, black homeowners weren’t doing well,” Holupka said.

An estimated 40 percent of all homebuyers are first-time buyers, and more than 60 percent of those buyers fit into the low to moderate-income bracket.

The study also found that:

- During the Great Recession, between 2007 and 2009, the net worth for white homebuyers decreased 33 percent, while new black homebuyers lost 43 percent of their wealth.

- Between 2005 and 2007, during the real estate boom, white first-time buyers saw their net worth increase by 50 percent while new black homeowners lost 47 percent. That meant whites gained about $24,000; blacks lost $16,911.

Newman says this means that blacks would have been better off renting.

“If they were renting, they would not have lost all this equity in their homes,” she said. “They could have set aside the money in a very low interest CD or hid it under the mattress.”